分析:是什么推动了黄金价格和美国股市的同步上涨?

黄金价格和美国股市的同步上涨有些不同寻常,因为传统上,黄金被视为一种“避险”资产,通常在经济不确定时期表现良好,而股票则更多与经济增长和风险偏好相关。分析师指出,有多个因素同时推动这两个市场上涨。

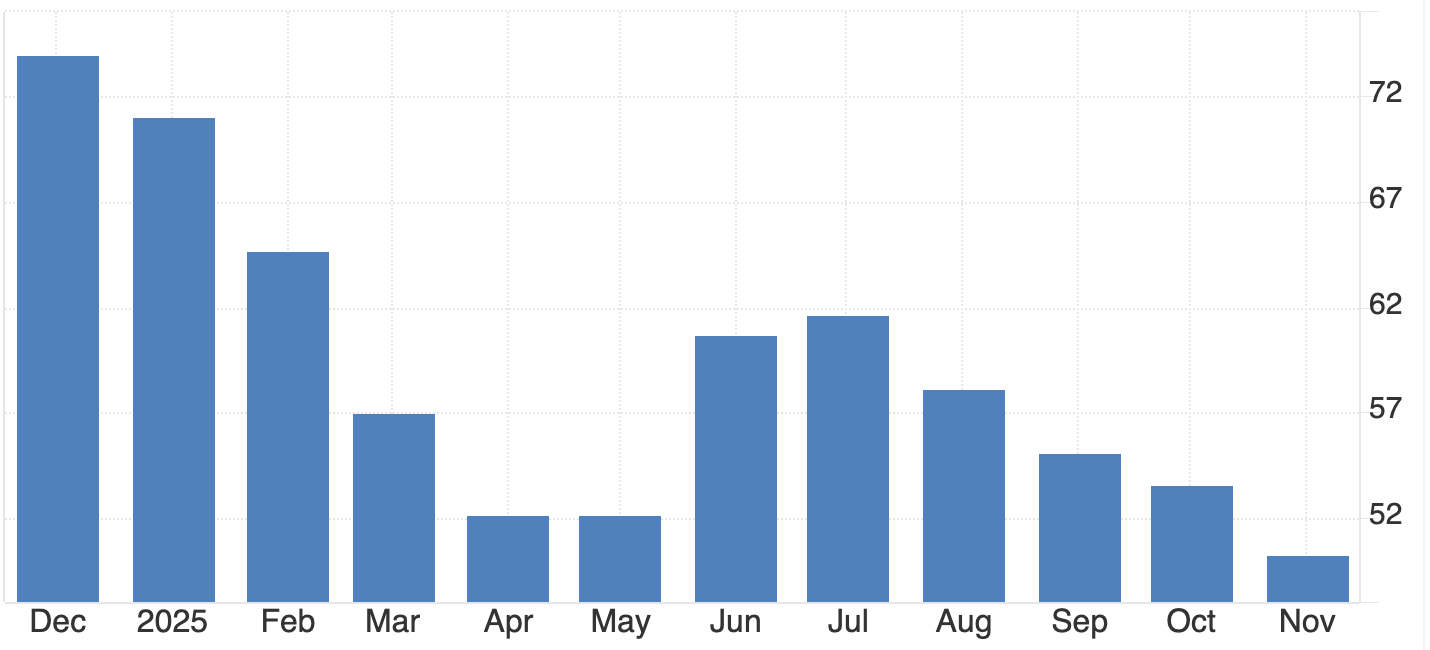

根据CME的FedWatch工具,交易员认为12月降息25个基点的概率为63%。这一单一叙事——更便宜的资金——推动了通常走势相反的资产上涨:黄金,经典的避险资产,以及股票,传统的风险资产。

两个市场都在依赖政策驱动的乐观情绪,而非经济实力。疲软的就业数据、低迷的消费者信心和财政压力迹象促使交易员预期货币政策将更温和,推动了一场流动性反弹,模糊了安全与投机的界限。

主要要点

- 黄金维持在每盎司4100美元以上,达到两周来的最高水平,交易员预期美联储将放松政策。

- 美国股市也在上涨,因较低的利率预期提升了未来盈利估值。

- 这波反弹反映的是流动性信心,而非增长——市场由央行驱动,而非基本面。

- 财政焦虑和美国国债收益率上升为黄金提供了第二层支撑。

- 印度和各国央行的强劲实物需求支撑了价格,超越了投机浪潮。

美联储降息预期推动黄金和美国股市

这次联合反弹源于明显的宏观转变。近期美国经济数据表明动能减弱——10月私人就业疲软,政府和零售岗位减少,消费者信心降至数月低点。市场将此解读为美联储将在12月转向降息的确认信号。

较低的利率同时影响市场两端:

- 对股票而言,降低了借贷成本,提高了企业盈利的现值。

- 对黄金而言,降低了持有无收益资产的机会成本。

结果是同步的上涨。投资者不再在安全与风险之间选择;他们同时买入两者,统一的预期是——宽松货币政策的回归。

对于使用Deriv MT5的交易员来说,这种跨资产动态创造了新的多元化机会,因为指数、大宗商品和金属的波动都响应同一政策脉动。

美国财政政策重新成为隐性驱动力

美国政府停摆及其暂时解决方案使财政稳定性成为焦点。参议院两党妥协重启政府——获得特朗普总统支持——缓解了短期市场压力,但提醒投资者美国的长期债务问题。

正如Saxo Bank的Ole Hansen所指出,“由财政焦虑而非经济实力推动的收益率上升,历来对投资金属有支持作用。”在此背景下,较高的债券收益率反映的是对债务可持续性的担忧,而非经济更强——强化了持有黄金作为财政不确定性对冲的理由。

政府机构的重新开放也将恢复官方经济数据的获取,为市场提供更大清晰度。然而,鉴于这些数据可能确认经济活动放缓,交易员认为这为美联储采取行动提供了更多理由。

黄金与股票:市场罕见的双重上涨

黄金和股票传统上走势相反。一个代表恐惧,另一个代表信心。然而,2025年的市场表现表明,两者现在都是流动性预期的体现。

当投资者预期货币宽松时,所有受益于廉价资金的资产都会上涨——从黄金到成长型科技股。这种相关性变化凸显了市场运作的结构性变化:政策预期已取代基本面成为主要价格驱动因素。

即使美元走强,黄金仍能上涨,进一步强化了这一转变。货币动态正被央行政策在全球资产定价中的主导地位所取代。

黄金需求为反弹增添深度

除了投机叙事,黄金上涨有强劲的现实支撑。实物需求依然强劲,尤其是在印度和各国央行:

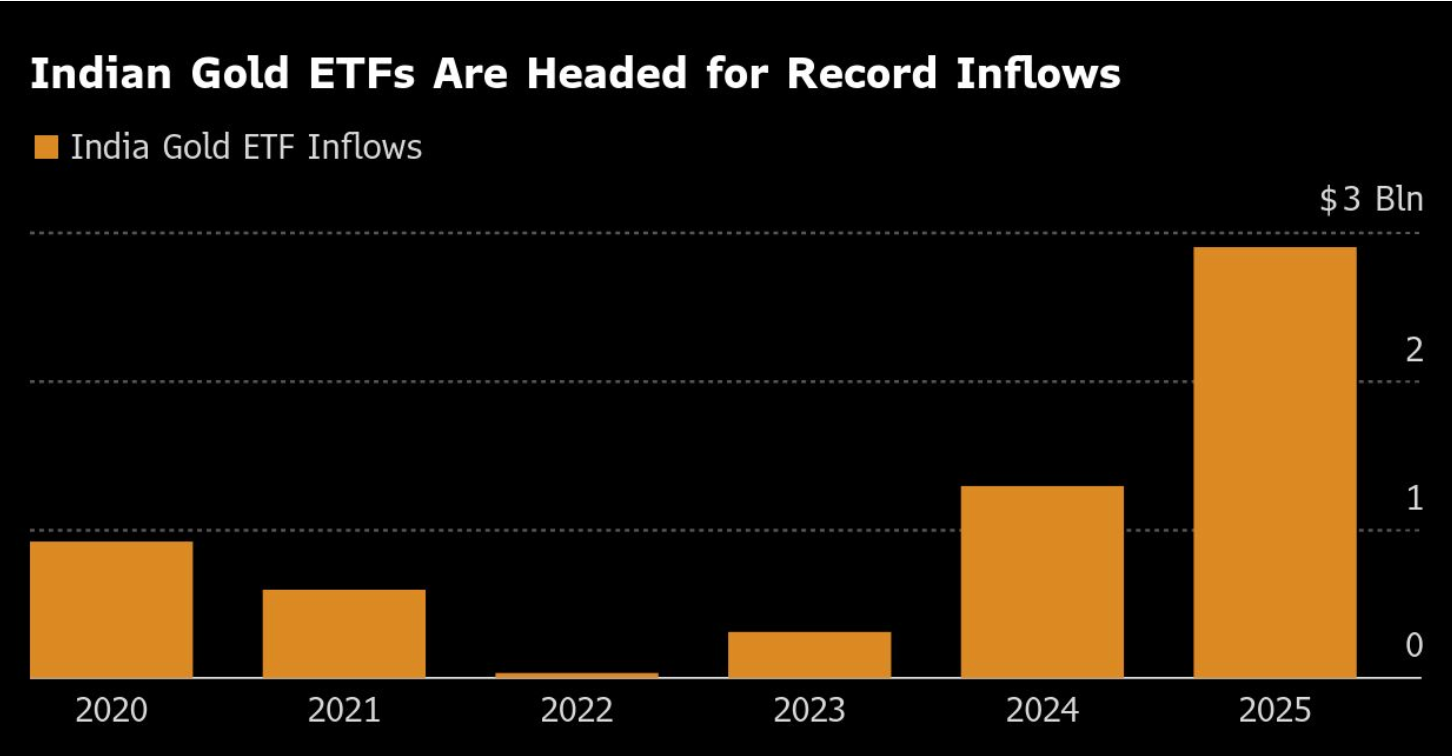

- 2025年前10个月,印度黄金ETF流入达到29亿美元——相当于26吨黄金,几乎与2020至2024年总和持平。

- 仅10月就有8.5亿美元新流入,继9月创纪录的9.42亿美元之后。

- 印度ETF总持有量现为83.5吨,价值超过110亿美元。

这一需求表明反弹并非纯粹投机,而是反映了全球对黄金作为长期价值储存手段的真实需求——对货币和财政不确定性的平衡。

黄金矿业公司反映投资者信心

黄金市场的企业端也反映了这一情绪。全球最大生产商之一Barrick Gold (ABX.TO)在报告调整后利润超预期后,将季度股息提高了25%,并扩大了5亿美元的股票回购计划。

- 平均实现黄金价格:每盎司3457美元,高于一年前的2494美元。

- 产量从943,000盎司降至829,000盎司,而全包维持成本略升至每盎司1538美元。

尽管面临运营挑战及因失去马里矿山而计提的10亿美元减值,Barrick向北美生产的战略转型显示出对黄金价格持续高位的信心。

然而,马里争端——包括员工被拘留和出口限制——凸显了全球黄金供应的地缘政治脆弱性,若未解决,可能进一步收紧市场。

市场背景:债务、收益率与政策悖论

今年黄金上涨超过50%,不仅仅是通胀担忧的反映。它是对财政脆弱性和市场对流动性依赖的回应。

国债收益率上升更多是对债务可持续性的警告,而非经济健康的信号。投资者购买黄金以对冲这些结构性风险,同时基于流动性将持续流入的假设推高股市。

这种同时寻求安全与风险的双重行为,是2025年市场心理的定义性悖论。

未来数月黄金与美国股市的情景

- 看涨突破

如果美联储12月降息并暗示进一步宽松,黄金可能迅速突破4200美元,受财政担忧和央行稳定需求支撑。

- 短期盘整

美联储采取谨慎或延迟立场,黄金可能在4050至4150美元间徘徊,股市则可能维持涨势,直到流动性预期减弱。

无论如何,关键结论是黄金和股票现在响应的是同一宏观经济驱动力——资金价格,而非对立的情绪力量。

黄金技术面洞察

黄金(XAU/USD)交易于4134美元左右,在关键水平间盘整——阻力位在4375美元,支撑位在3930美元。突破4375美元可能延续反弹,而跌破3930美元则可能引发新一轮抛售,目标3630美元。

RSI(81)显示强劲的看涨动能,但也提示超买,暗示可能出现短期盘整或回调。同时,MACD保持看涨交叉,确认持续买盘压力。

总体来看,黄金在3930美元以上偏多,但交易员应关注超买区附近动能的降温。您可以直接在Deriv MT5上监控这些水平,或使用Deriv交易计算器尝试保证金和风险设置,规划金属和指数的仓位。

黄金投资展望

- 短期交易者:在美联储12月决议前,4100至4200美元区间是关键关注范围。

- 中期投资者:财政压力、实际收益率波动和印度需求构成持续走强的核心驱动力。

投资组合经理:黄金与股票的相关性演变意味着它现在表现为一个对政策敏感的平行资产,而非纯粹的对冲工具。多元化策略应考虑这一结构性变化。

所引用的业绩数据不构成未来表现的保证。