Oil price prediction 2026: Rebound toward $65 or slide on weak demand?

Oil prices have fallen to their lowest levels in five months, and the balance of data as well as analysts, suggest that a meaningful rebound toward $65.00 per barrel is unlikely unless global demand recovers. Despite renewed political efforts to restrict Russian crude flows and strengthen sanctions, oversupply and soft consumption are driving a supply-heavy market. WTI crude currently trades near $58.00, while Brent sits around $62.00 - both struggling to find upward momentum as inventories swell and traders brace for weaker growth.

Key takeaways

- WTI trades near $58.00–$59.00 and Brent at $62.00, both at five-month lows.

- India’s pledge to halt Russian crude imports and U.S. pressure on China may tighten supply marginally.

- The U.K. sanctions new Russian oil assets and tankers, adding friction to global trade.

- OPEC+ output is rising as members unwind cuts, while U.S. shale continues record production.

- IEA forecasts a 3 million bpd surplus by 2026, the largest since 2020.

- Bank of America sees Brent averaging $64.00 in Q4 2025 and $56.00 in 2026, implying limited recovery potential.

- Technical support for WTI lies near $58.25, with resistance at $65.61–$70.00

Political pressure meets market inertia

After weeks of steady declines, oil prices saw a short-lived rebound in early Asian trading, supported by fresh geopolitical headlines. U.S. President Donald Trump announced that Indian Prime Minister Narendra Modi had agreed to halt Russian oil imports, marking a symbolic win in Washington’s campaign to curb Moscow’s energy revenues. Trump added that he would next seek to pressure China to reduce its imports - a move that, if successful, could restrict the flow of discounted Russian crude that has cushioned global supply.

Meanwhile, the U.K. unveiled new sanctions on Russia’s two largest oil firms, Lukoil and Rosneft, and 44 “shadow fleet” tankers suspected of helping Moscow evade G7 price caps. The measures include asset freezes, director bans, and restrictions on British services, making it more difficult for Russia to move crude via alternative shipping networks.

Despite these political developments, the market reaction has been modest. Traders remain sceptical that diplomacy alone can offset the mounting evidence of a supply glut. According to API data, U.S. inventories rose by 7.36 million barrels in the week ending 10 October, while gasoline inventories increased by nearly 3 million barrels. Distillate inventories, including diesel, fell by 4.79 million barrels, hinting at steady consumption in transport fuels but not enough to shift the broader trend.

OPEC+ production increases are overwhelming the market

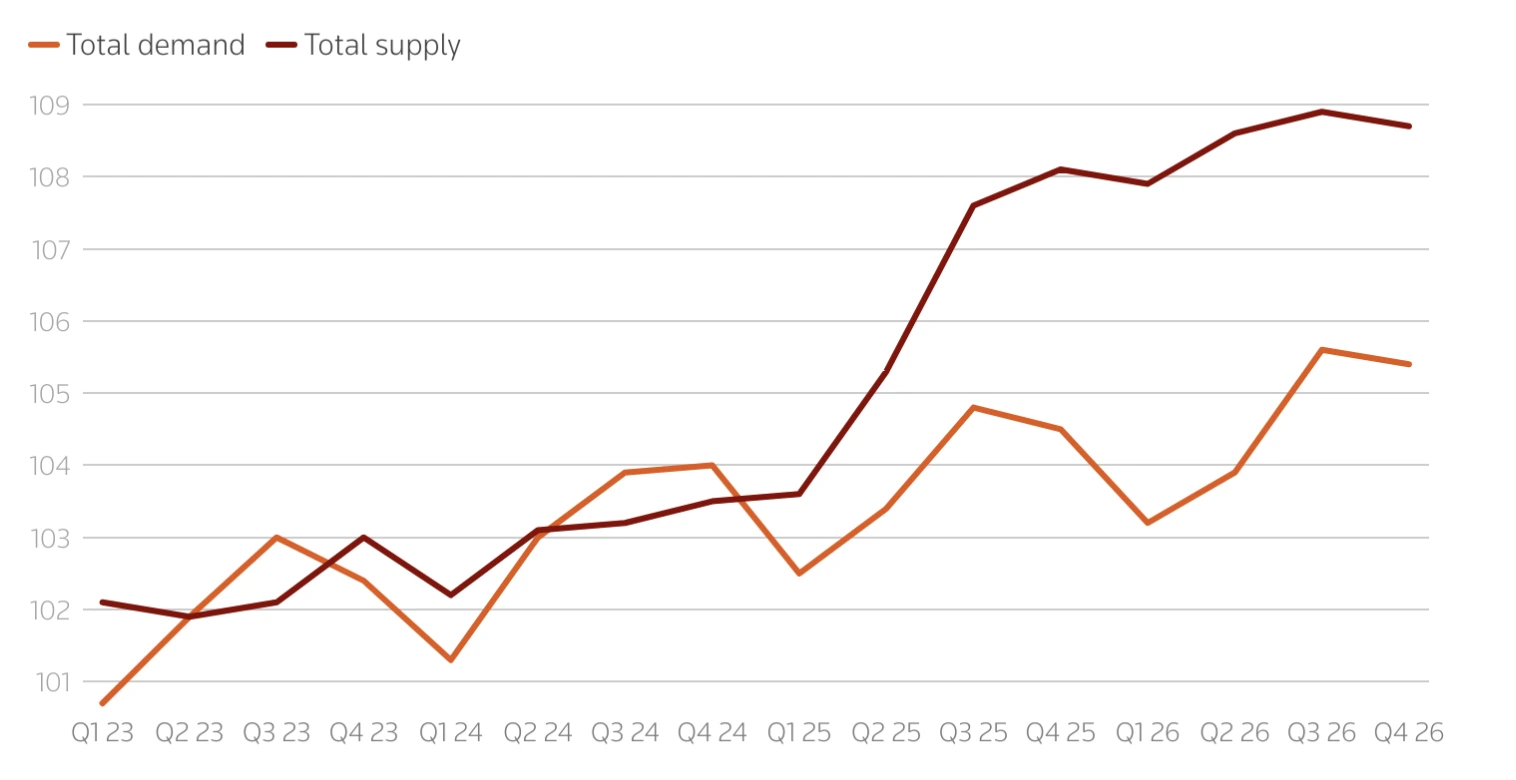

The International Energy Agency (IEA) revised its 2025 and 2026 oil supply forecasts higher, reflecting a faster unwinding of OPEC+ production cuts and robust growth from non-OPEC producers. Global supply is now expected to grow by 3 million bpd in 2025 and 2.4 million bpd in 2026, driven by two key forces:

- OPEC+ expansion: Saudi Arabia, Iraq, and the UAE have boosted output, collectively adding close to 400,000 barrels per day since September as they unwind earlier cuts.

- Non-OPEC surge: The United States, Brazil, Canada, and Guyana continue to scale production, with U.S. output at a record 13.58 million bpd. This record level has been achieved despite a significant reduction in active rigs, thanks to shale efficiency gains, longer laterals, and the completion of drilled-but-uncompleted (DUC) wells.

This aggressive production pace is pushing the market toward what the IEA calls a “persistent surplus.” Global inventories climbed to 7.9 billion barrels in August - the highest since 2021 - and the volume of “oil on water” surged by 102 million barrels in September as exports from the Middle East and the Americas grew.

The IEA says global oil demand growth is slowing

On the demand side, the IEA expects a much slower recovery. It forecasts oil demand growth of just 680,000 bpd in 2025 and 700,000 bpd in 2026, both about 20,000 bpd lower than its previous outlook. That’s less than half the growth rate projected by OPEC, which expects +1.29 million bpd next year.

The weakness is concentrated in major economies, where consumer confidence remains low, inflation has eroded spending power, and industrial output is softening. In China, deflationary pressures and a protracted property market slump continue to weigh on energy consumption. The renewed U.S.–China trade tensions, including higher tariffs and port fees, risk further depressing manufacturing activity and freight demand.

The IEA’s conservative stance contrasts sharply with OPEC’s optimism. While OPEC sees emerging markets sustaining transport fuel demand, the IEA expects the shift toward renewables and efficiency improvements to slow overall consumption. As a result, the agency’s models now project a significant surplus by mid-decade unless supply curbs intensify.

OPEC oil production forecast: The 2026 glut warning

The IEA’s October Oil Market Report warned that global oil supply could exceed demand by almost 4 million bpd in 2026 - a glut larger than the pandemic-era oversupply that sent prices below $40.00 in 2020. That scenario is underpinned by continued OPEC+ expansion, strong non-OPEC output, and sluggish industrial recovery in key markets.

Brent’s recent drop below $66.00 and WTI’s slide to $58.00 reflect investor concern that the market may not absorb the rising supply even with record refining runs. Refineries are processing around 85.6 million bpd, but most analysts agree that this level of throughput is unsustainable if global inventories continue to rise.

If the projected surplus materialises, Brent could test the $50.00–$55.00 range, while WTI may stabilise around $55–$60 unless production slows or demand surprises on the upside.

Geopolitical factors could slow the fall

Political risk remains a key variable that could temporarily support prices. Sanctions on Russia and Iran continue to constrain output from two of the world’s largest exporters. China’s strategic stockpiling of crude for energy security has also absorbed surplus barrels earlier this year, softening the downside momentum. Additionally, the Trump administration’s diplomatic campaign to pressure India, China, and Japan to reduce Russian imports could, over time, tighten the market if those commitments translate into actual trade restrictions.

However, the market has seen similar announcements before, and traders are waiting for tangible evidence of supply tightening. Bank of America expects short-term volatility around these developments but maintains a base case for Brent at sub $50 if Chinese demand continues to soften or if Washington escalates its tariffs on Beijing.

Oil price technical insight

From a technical standpoint, WTI crude is testing a significant support level around $58.25. A sustained move below this threshold could open the path toward $55.00–$57.00, while a rebound could target $65.61 and then $70.00, provided that buy-side momentum returns. Current trading volumes suggest that sellers still dominate, but if geopolitical headlines trigger renewed buying, short-term recoveries remain possible.

The potential rebound narrative is supported by prices touching the lower Bollinger band - hinting at oversold conditions. RSI pointing up towards the midline also suggests building buy momentum.

Trading oil price volatility with Deriv

Oil price swings create opportunities for traders seeking to capture short-term volatility or hedge longer-term exposure. On Deriv MT5, you can trade WTI and Brent CFDs with access to advanced charting tools, flexible leverage, and custom indicators to track price momentum and support/resistance levels.

During periods of heightened uncertainty - such as rising OPEC+ supply or U.S. inventory surges - traders can manage exposure with stop-loss and take-profit features available on Deriv MT5. To plan positions more precisely, use Deriv’s trading calculator to estimate margin, pip value, and potential returns before entering the market.

For more insights on commodities like oil, explore our commodity trading guide.

Investment implications

The market suggests heightened downside risk over the medium term for investors. If political headlines or new sanctions trigger brief rallies, short-term tactical buying near $61.00- $62.00 support may offer opportunities. However, the broader outlook remains bearish, with prices likely capped below $70.00–$75.00

Low-cost producers and U.S. shale operators are positioned to withstand lower prices thanks to efficiency gains, while offshore and high-cost projects may face margin compression. Refining companies could remain relatively insulated, benefiting from cheaper feedstock and strong throughput volumes, even in a lower price environment.

Disclaimer:

The performance figures quoted are not a guarantee of future performance.