Gold price prediction 2025 points to a potential supercycle

Yes - gold’s surge toward $4,000 an ounce shows signs of a structural uptrend rather than a short-lived spike, according to analysts. With 39 record highs in 2025 and futures now within 1% of $3,900/oz, the conditions point to the early stages of a potential supercycle: a dovish Federal Reserve pivot, weakening US dollar, and strong safe-haven inflows.

Gold, a precious commodity prized for its scarcity, durability, and historic role as a store of wealth, has always attracted investors in times of uncertainty. Yet the speed of the rally and speculative fervour around events like Zinjin Gold’s blockbuster IPO raise the possibility that markets are chasing momentum rather than fundamentals. The evidence suggests gold is moving toward supercycle territory, but whether $4,000 marks the beginning of that trend or the peak of mania will depend on what unfolds in the months ahead.

Key takeaways

- Gold has risen to nearly $3,900/oz in 2025, logging 39 all-time highs and putting $4,000 in sight.

- Federal Reserve rate cuts and dovish commentary are a major tailwind for non-yielding assets like gold.

- The US dollar is losing its appeal as a safe store of value amid debt concerns and broad devaluation.

- Safe-haven flows are strong, but investor enthusiasm also risks tipping into speculative excess.

- Zinjin Gold’s IPO surge (+60%) underscores investor demand spilling into gold-linked equities.

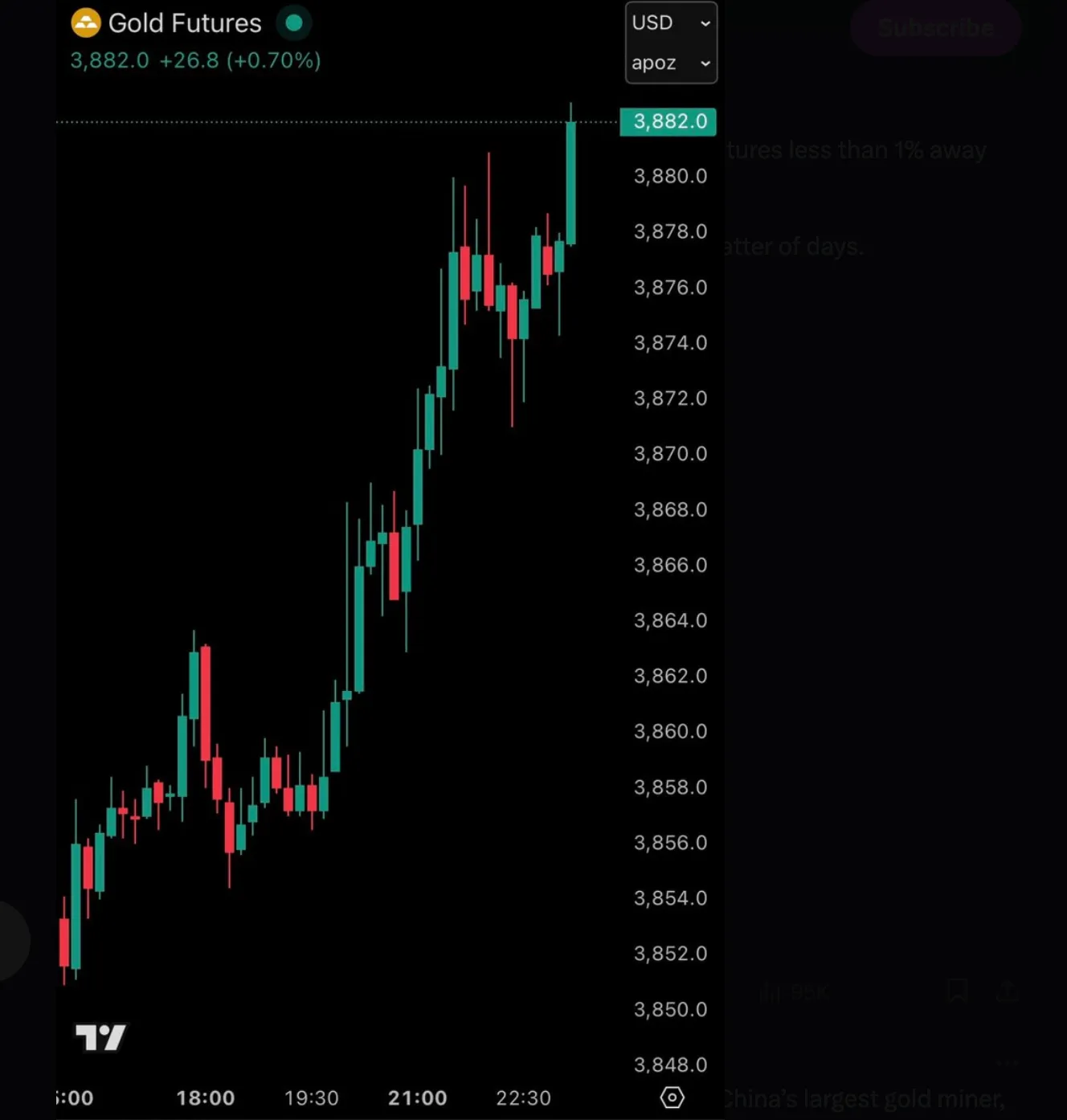

Gold’s record-breaking run

As Gold prices made history, futures rose to less than 1% away from $3,900/oz per ounce.

This performance makes 2025 one of the strongest years for precious metals in decades, with both gold and silver delivering standout returns. While equities remain resilient, gold’s momentum has outpaced most asset classes, leaving traders to debate whether the $4,000 mark is inevitable before year-end. For traders, commodity CFDs offer a way to capture these moves without owning the physical asset.

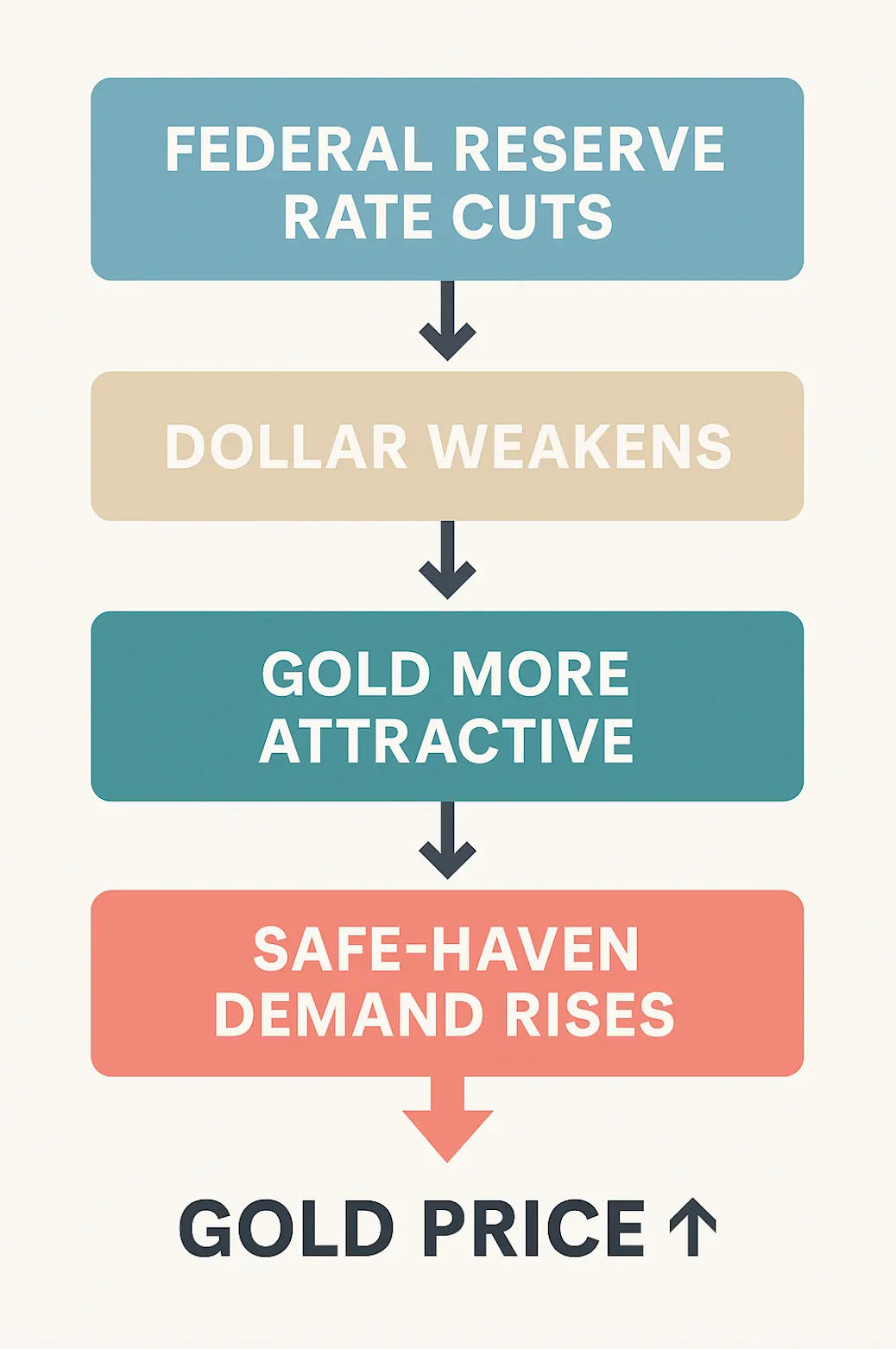

Federal Reserve impact on Gold prices

The Federal Reserve’s pivot towards a more dovish stance has provided strong support for gold. Despite hawkish positioning earlier in 2025, policymakers have now reduced the funds rate and signalled that further cuts are possible in the two remaining meetings of the year.

Lower rates reduce the opportunity cost of holding non-yielding assets, making gold more attractive and reinforcing the case for a potential gold supercycle. Markets are increasingly pricing in a sustained easing cycle that could underpin gold demand well into 2026.

The dollar devaluation effect

Gold’s rally is closely tied to a weakening US dollar. The Dollar Index (DXY) has slipped to around 97.87, down roughly 0.08% today.

But beyond exchange rate movements, investor concern over US sovereign debt has eroded trust in the dollar as a long-term store of value. This shift is significant: while gold has always had an inverse correlation with USD, the scale of devaluation in 2025 is pushing capital into gold more aggressively than in previous cycles - one of the key dynamics underpinning talk of a gold supercycle.

How key forces interact with gold prices

Gold safe-haven investment in 2025

Investor demand for safe-haven assets has intensified. While the S&P 500, Dow Jones, and Nasdaq have posted gains, political uncertainty - particularly around the threat of a US government shutdown - has strengthened gold’s appeal.

The potential delay of employment data from the Bureau of Labor Statistics adds another layer of risk, given the Fed’s reliance on data for policy decisions. In contrast, traditional safe havens such as the dollar and yen are underperforming, leaving gold, silver, and the Swiss franc as strong alternatives.

Mania or Gold supercycle?

The combination of record prices, investor enthusiasm, and blockbuster events like Zinjin Gold’s IPO (+60% on debut) suggests a market driven not only by fundamentals but also by momentum.

For some analysts, this is a hallmark of a gold supercycle - a prolonged structural uptrend in precious metals, underpinned by macroeconomic shifts. For others, the speed of gold’s ascent raises concerns about speculative excess. Whether $4,000 marks a stepping stone to a multi-year bull market or a near-term peak will depend on the Fed’s trajectory, global confidence in fiat currencies, and the durability of safe-haven demand.

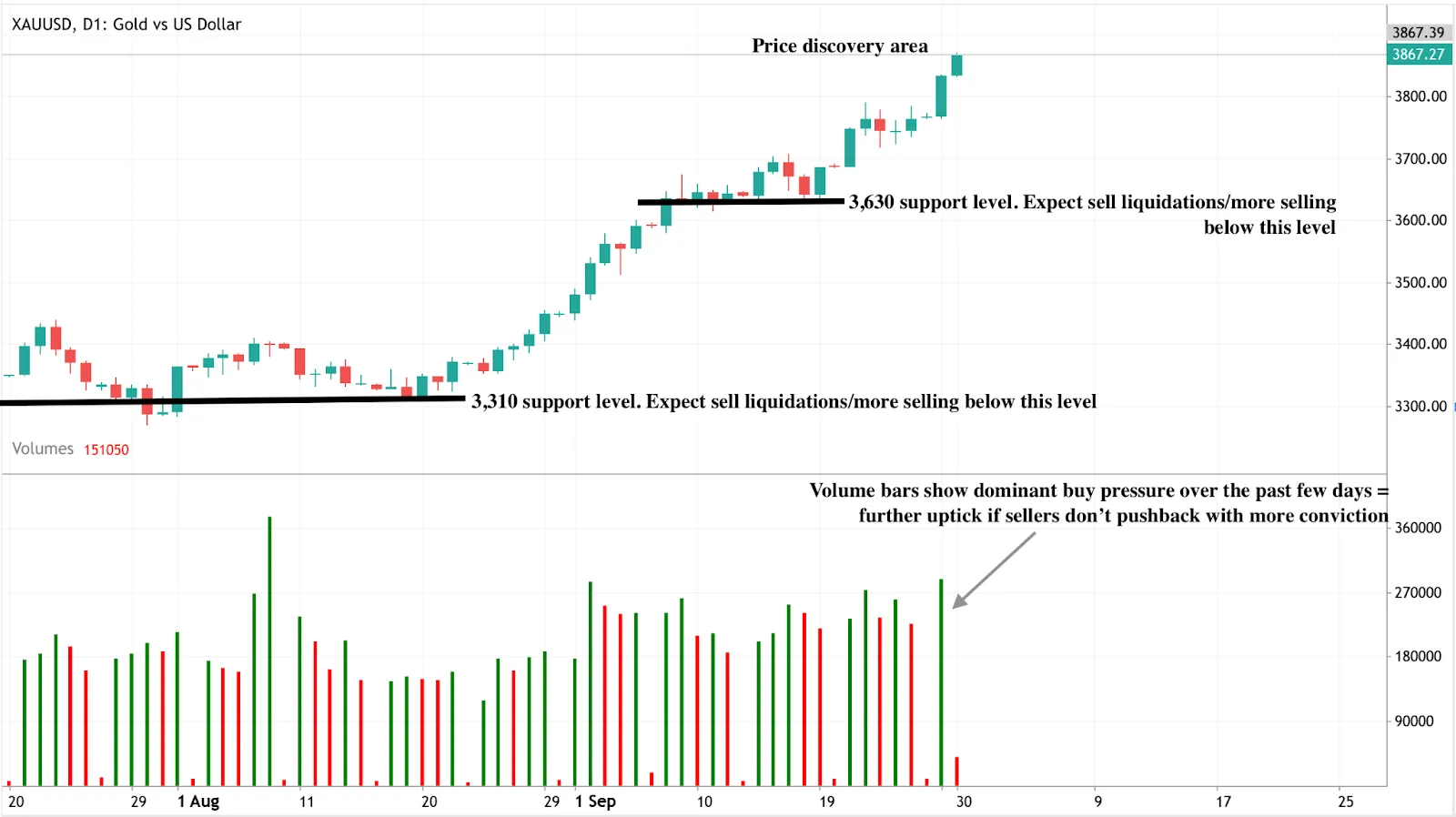

Gold price forecast: Technical insight

At the time of writing, Gold’s momentum is showing no signs of slowing. Volume bars support this bullish sentiment, with sellers not pushing back with enough conviction. If bulls keep pushing, prices could breach a historic $4,000. Conversely, if sellers regain momentum, we could see a significant retreat towards the $3,630 support level. A price crash will likely be held at the $3,310 support level.

Investment implications

For traders and investors, gold’s rally presents both opportunity and risk. Short-term strategies may benefit from momentum trading towards the $4,000 level, particularly in times of heightened political tension. Medium-term positions should consider the risk of overextension: if gold fails to break $4,000 convincingly, consolidation or correction is likely. Longer-term allocation hinges on whether the supercycle thesis proves correct. In that case, gold could remain one of the top-performing assets well into the second half of the decade.

How to trade Gold on Deriv: Step-by-step

Gold’s rally is full of opportunity - but turning analysis into action requires structure. Here’s how traders can approach gold on Deriv platforms:

1. Set up gold trading on Deriv MT5

- Log in to your Deriv account and select Deriv MT5 (DMT5).

- Open a CFD account (Synthetic, Financial, or Financial STP, depending on your trading preference).

- Search for XAUUSD (Gold vs US Dollar) in the market watch list and add it to your symbols.

- Start analysing the live chart with built-in technical tools.

2. Strategy ideas for different price scenarios

- Breakout trade: If gold convincingly breaches $4,000, momentum trading techniques can ride the move higher, with tight stop-loss orders to protect against reversals.

- Range trading: If gold stalls between $3,630 (support) and current levels, using oscillators (RSI, Stochastics) can be beneficial for entering trades near support and exiting near resistance.

- Pullback entry: If prices retreat toward $3,310, this could be a potential entry point for longer-term bullish positions, provided fundamentals (Fed cuts, weak dollar) remain intact.

3. Risk management for volatile gold markets

- Stop-loss orders below support levels (e.g., $3,630 or $3,310) can help manage downside risk.

- Use position sizing: Traders commonly expose only 1–2% of their account per trade to account for gold’s volatility.

- Diversify: Balancing gold with other assets like indices, forex, or silver CFDs on Deriv MT5 can help manage overall portfolio risk.

- Track news flow: Fed announcements, U.S. debt news, and political risk events can influence gold prices, making it useful to monitor these developments.

4. Next steps

Ready to trade? Explore gold CFDs on Deriv and put these strategies into practice with a demo account before committing real capital.

Disclaimer:

The performance figures quoted are not a guarantee of future performance.