Precious metals 2026 outlook: After a historic rally, can prices hold?

%20(1).png)

Precious metals closed 2025 at levels that forced markets to reassess long-held assumptions. Data showed that silver surged more than 150% over the year, its strongest performance since 1979, briefly breaking above $80 an ounce. Gold climbed roughly 65%, also marking its best annual gain in decades, while platinum pushed to a 17-year high after an abrupt re-pricing of supply and demand dynamics.

Such moves rarely fade quietly. As 2026 begins, investors are no longer asking whether precious metals are supported, but whether prices can remain elevated once volatility, tighter trading conditions, and shifting macro signals settle in. The outlook now hinges on rates, real-world demand, and how much excess the market has already burned off.

What could drive precious metals in 2026?

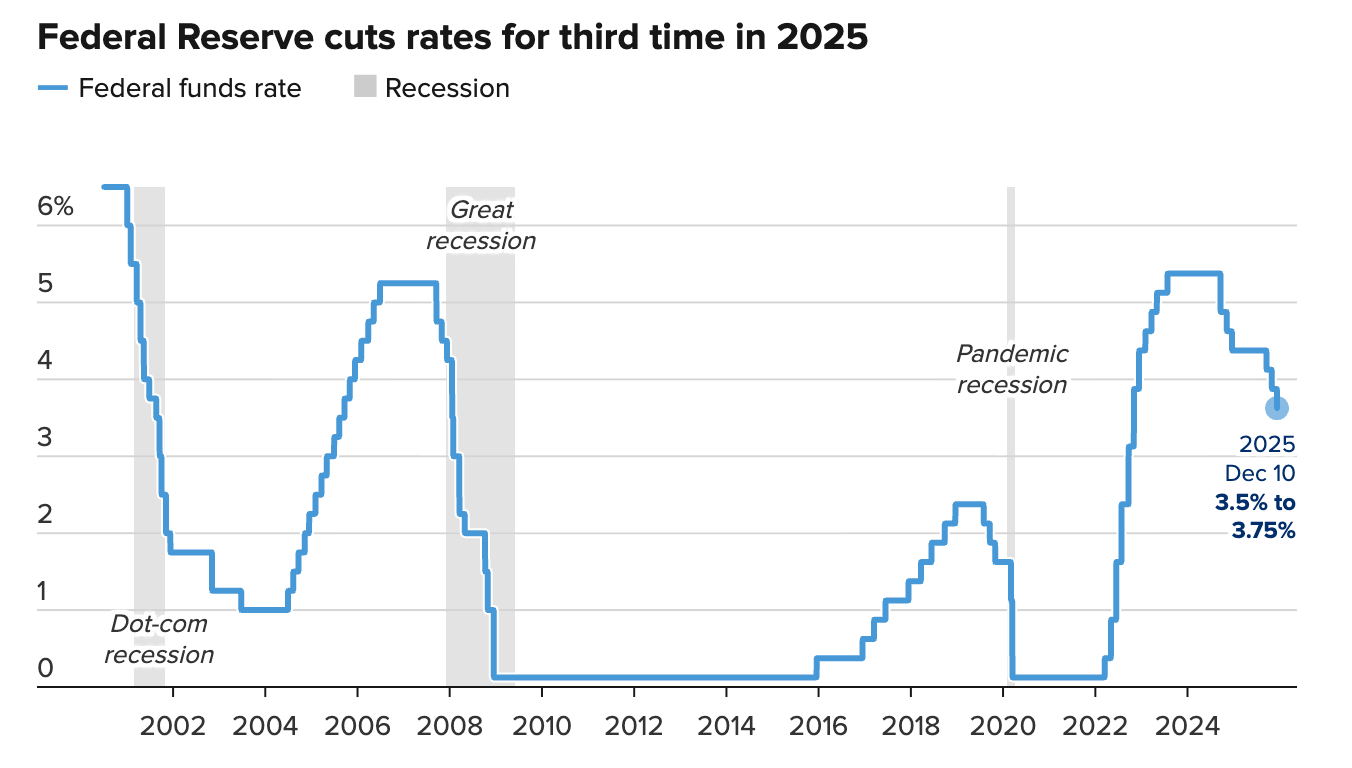

The most important force shaping the 2026 outlook is monetary policy, according to analysts. Expectations for further US interest rate cuts have lowered the opportunity cost of holding non-yielding assets, providing a powerful tailwind for gold and silver.

The Federal Reserve cut rates by 25 basis points in December, bringing the target range to 3.50%–3.75%.

Meeting minutes showed that most officials remain open to additional easing if inflation continues to cool.

Market watchers noted that silver has responded with outsized volatility because it sits at the intersection of finance and industry. Alongside safe-haven flows, demand from solar manufacturing, electronics, and electric vehicles has tightened an already constrained market. Years of supply deficits and shrinking inventories have made silver unusually sensitive to shifts in investment positioning, helping explain why its rally became both explosive and unstable as liquidity thinned toward year-end.

Why it matters

The stakes extend beyond price charts. Silver’s role as both a financial hedge and an industrial input means sharp swings ripple into manufacturing costs, investment strategies, and inflation expectations. Bank of America raised its 2026 silver forecast to $65 an ounce, citing persistent supply shortfalls even as it warned that high prices could cool demand at the margin.

Gold’s influence is broader but steadier. Its rally has been reinforced by geopolitical stress, including ongoing tensions in the Middle East and uncertainty surrounding US foreign policy. Analysts note that gold’s appeal in late 2025 was less about speculative excess and more about capital preservation in an environment where policy clarity remains elusive.

Impact on markets, industry and investors

Volatility has already reshaped behaviour. CME Group’s decision to raise margin requirements for precious metals futures triggered forced deleveraging, particularly in silver, which fell sharply from near $86 to the low-$70s in a matter of days. These moves acted as a mechanical reset rather than a signal of collapsing fundamentals, reducing leverage in a market that had become heavily crowded.

Investment flows remain robust despite the turbulence. Silver exchange-traded funds recorded exceptional inflows in 2025, outperforming gold ETFs and many equity benchmarks. Platinum has followed a similar path, with UBS lifting price projections after tighter supply conditions collided with renewed investment interest, amplified by reduced output from South Africa’s mining sector.

Expert outlook

Forecasts for 2026 highlight the uncertainty ahead. A Reuters poll of 39 analysts projects silver averaging around $50 an ounce next year, while Bank of America’s $65 target reflects confidence that structural deficits will continue to support prices. Both sit well below the highs reached during the 2025 rally, underscoring how difficult it is for fundamentals to justify momentum-driven peaks.

Platinum and palladium face a more nuanced path. UBS warns that if platinum remains significantly more expensive, demand from autocatalysts could shift back towards palladium, particularly as the adoption of electric vehicles progresses more slowly than initially expected. Across the precious metals complex, interest rates, physical availability, and policy decisions will determine whether 2025 marks a climax or a higher base.

Key takeaway

Precious metals enter 2026 after one of the strongest rallies in decades, driven by falling rate expectations, constrained supply, and geopolitical risk. Silver’s surge has raised both opportunities and risks, while gold remains the market’s anchor, and platinum reflects changing industrial realities. Whether prices can hold will depend on how quickly rate cuts materialise, how industrial demand evolves, and whether supply tightness persists once speculative excess has fully unwound.

Silver technical insights

Silver remains in a broader bullish structure but is currently consolidating after a sharp rally, with price pulling back modestly from recent highs. The move has eased pressure from momentum indicators rather than signalling a trend reversal.

RSI has cooled and is now sitting just above the midline, suggesting momentum has reset into a more neutral zone while underlying demand remains intact. Bollinger Bands, which expanded aggressively during the rally, are beginning to stabilise, pointing to a pause in volatility rather than renewed downside pressure.

As long as silver holds above the US$57 support level, the uptrend remains structurally sound. A break below this zone would expose deeper downside towards US$50 and US$46.93, while renewed upside momentum would likely emerge if buyers regain control above recent highs.

The performance figures quoted are not a guarantee of future performance.