Bitcoin slides as analysts warn the worst may not be over

Bitcoin’s latest decline has unsettled markets already on edge. After slipping to around $64,000 last week, the world’s largest cryptocurrency is now more than 40% below its October peak, erasing much of the optimism that defined late 2025. What initially looked like a routine pullback is beginning to resemble something more structural.

Veteran traders, technical analysts, and policymakers are now converging around a troubling idea: Bitcoin may not have found its true bottom yet. With forecasts clustering between $50,000 and $42,000, the market is shifting from short-term noise to a deeper reassessment of risk and liquidity.

What’s driving Bitcoin’s slide?

The selloff has been driven less by a single shock and more by the slow deflation of expectations. Bitcoin’s run toward six figures last year rested on ETF inflows, improving regulatory sentiment, and hopes that institutional demand would provide a permanent price floor. That narrative weakened once Bitcoin failed to hold above key psychological levels, triggering mechanical selling and leveraged liquidations.

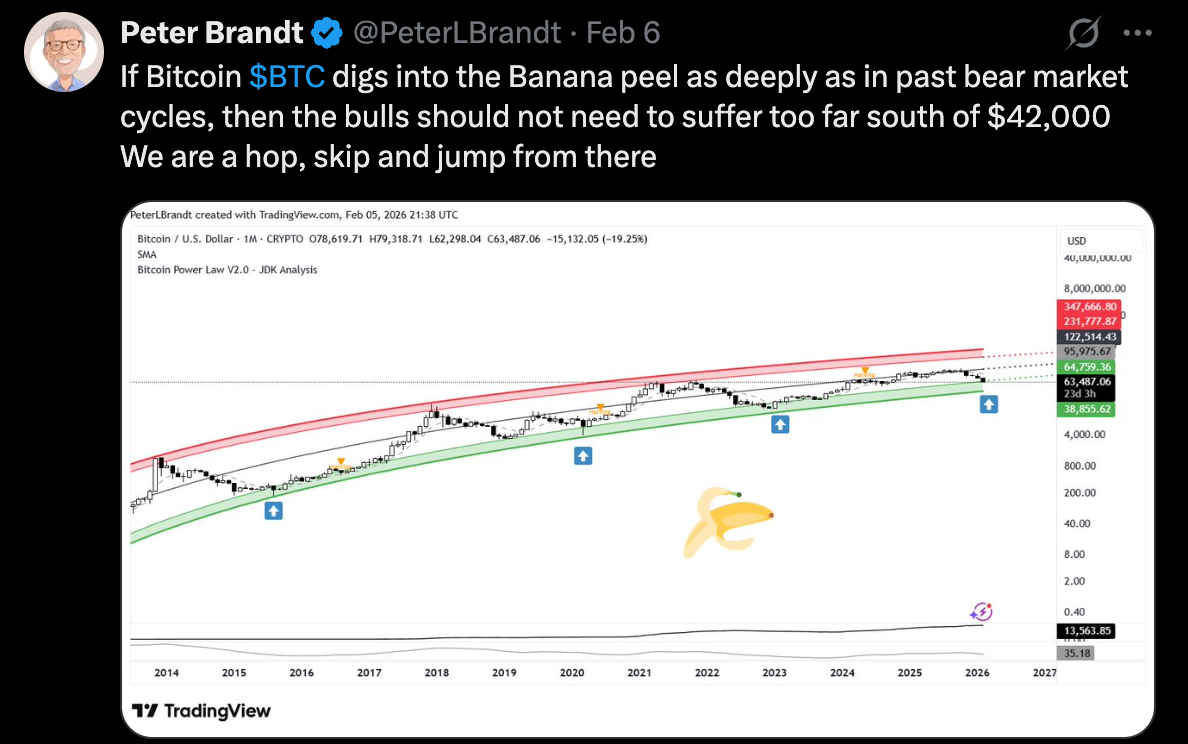

Veteran chartist Peter Brandt added fuel to the debate after describing the recent decline as a “banana peel” move - a sudden slip that caught traders off balance.

In a post on X, Brandt suggested Bitcoin’s true cycle low could be closer to $42,000, arguing that only a deeper retracement would reset sentiment and positioning. Rather than calming nerves, the call intensified downside anxiety.

Liquidity conditions have also tightened. Bitcoin briefly fell to $60,033 last week, its lowest level since October 2024, sparking the sharpest volatility spike since the collapse of FTX in 2022. Funding rates flipped negative as traders rushed to hedge or short, reinforcing the bearish momentum.

Why it matters

Bitcoin’s decline matters because the market has changed. Crypto is no longer a fringe asset dominated by retail traders. Hedge funds, trading desks, and exchange-traded products now amplify both gains and losses, making breakdowns faster and more forceful.

One analyst now in focus is KillaXBT, whose Bitcoin roadmap from mid-2025 accurately mapped the market top above $100,000. His resurfaced analysis suggests Bitcoin is currently stuck in a distribution phase, where larger players sell into rallies rather than accumulate. According to the model, a final capitulation toward the $50,000 area may be required before a durable base forms.

That view is reinforced by sentiment indicators. Measures such as Crypto Fear and Greed have fallen to multi-year lows, often a prerequisite for a bottom, but historically only after sellers are fully exhausted.

Impact on crypto markets and investors

The broader crypto market has felt the strain. Altcoins have largely underperformed Bitcoin, with many suffering sharper drawdowns as risk appetite evaporates. Stellar (XLM), for instance, dropped more than 16% over the past week before stabilising near $0.16, showing tentative signs of relative resilience.

Investor behaviour is also shifting. Rather than chasing rebounds in large-cap tokens, speculative capital is rotating into smaller, narrative-driven projects, particularly those linked to artificial intelligence. This pattern mirrors previous late-cycle phases, where traders seek asymmetric upside while limiting direct exposure to Bitcoin’s volatility.

For longer-term holders, the implications are more strategic. Without the formation of a macro base - a prolonged period where price stabilises - further declines could reshape portfolio allocations, ETF flows, and institutional risk models well into the year.

Expert outlook

Policy signals are adding another layer of uncertainty. Federal Reserve Governor Christopher Waller recently noted that the post-election optimism that lifted crypto markets may be fading, as mainstream financial firms reassess exposure and manage risk more tightly.

From a market perspective, analysts agree that structure now matters more than sentiment. A sustained break below $60,000 would increase the probability of a move toward $50,000 or even $42,000. Conversely, a decisive reclaim of the $70,000 region would challenge the bearish thesis and suggest that institutional demand is returning.

Until clarity emerges, volatility remains the dominant signal. Bitcoin’s next move is likely to be shaped less by headlines and more by whether the price can stabilise without narrative support.

Bitcoin technical outlook

Bitcoin has moved lower within its recent structure, with price declining from the upper range and stabilising near the lower portion of the chart around the $69,000 area. Bollinger Bands remain expanded, indicating elevated volatility following the recent downside acceleration, even as price trades back inside the bands.

Momentum indicators show subdued conditions: the RSI is flat and below the midline, suggesting weakened momentum following the earlier decline rather than renewed directional strength. Trend strength appears moderate, with ADX readings indicating a trend but without strong directional dominance.

Structurally, price remains below the previously defined zones around $78,000, $90,000, and $96,000, highlighting a market environment characterised by consolidation following a sharp repricing rather than active price discovery.

Key takeaway

Bitcoin’s slide has exposed how fragile last year’s optimism really was. With analysts warning that the true bottom may still lie ahead, the market faces a critical test of structure and conviction. Whether this phase marks a final wash-out or the start of a deeper reset will depend on liquidity, institutional behaviour, and Bitcoin’s ability to form a stable base. The next few weeks could define the remainder of the cycle.

The performance figures quoted are not a guarantee of future performance.