新手指南:CFD 交易的應做與不應做事項

CFD(差價合約)交易讓您無需持有標的資產,即可對金融市場的價格波動進行投機。這是一種靈活且具高潛力的參與全球市場方式——從外匯到合成指數——但風險較高。對新手來說,起初可能感覺複雜,因此建立堅實的基礎至關重要。本指南將帶您了解 CFD 交易的關鍵應做與不應做事項,幫助您做出明智且有紀律的決策,同時有效管理風險。

快速摘要

- CFD 交易允許您在不持有資產的情況下交易價格波動。

- 選擇受監管的經紀商是邁向更高安全性與透明度的重要步驟。

- 槓桿、情緒及隔夜持倉必須謹慎管理。

- Deriv 提供透過 Deriv MT5 和 Deriv cTrader 進行的 CFD 交易。

什麼造就可靠的 CFD 交易平台?

您的經紀商是您進入市場的入口。務必確認其為完全受監管,且所有牌照均為有效且可查證。監管透明度有助於營造更值得信賴且資訊充分的交易環境。

在 Deriv,監管資訊公開可隨時查驗。您可以在兩個平台上交易 CFD:

- Deriv MT5 — 一站式多資產交易解決方案。

- Deriv cTrader — 為重視超高速執行、進階圖表及市場深度工具的交易者打造。

兩者均支持涵蓋 外匯、股票與指數、商品、加密貨幣、ETF 及合成指數 的 CFD,為交易者提供多元機會於同一生態系統中。

新手如何安全練習 CFD 交易?

金融市場不斷演變,新手必須先了解關鍵概念,如 保證金、槓桿、點差 及 停損。

Deriv 模擬帳戶 提供 10,000 美元虛擬資金,非常適合在無財務風險的實時環境中測試 CFD 策略。您可以嘗試不同訂單類型,觀察價格波動如何影響潛在盈虧,並在實盤交易前建立信心。

持續學習至關重要。關注官方 Deriv 部落格更新、網路研討會及交易社群討論。即使是經驗豐富的交易者,也會定期回顧基礎知識,以適應市場與監管的變化。

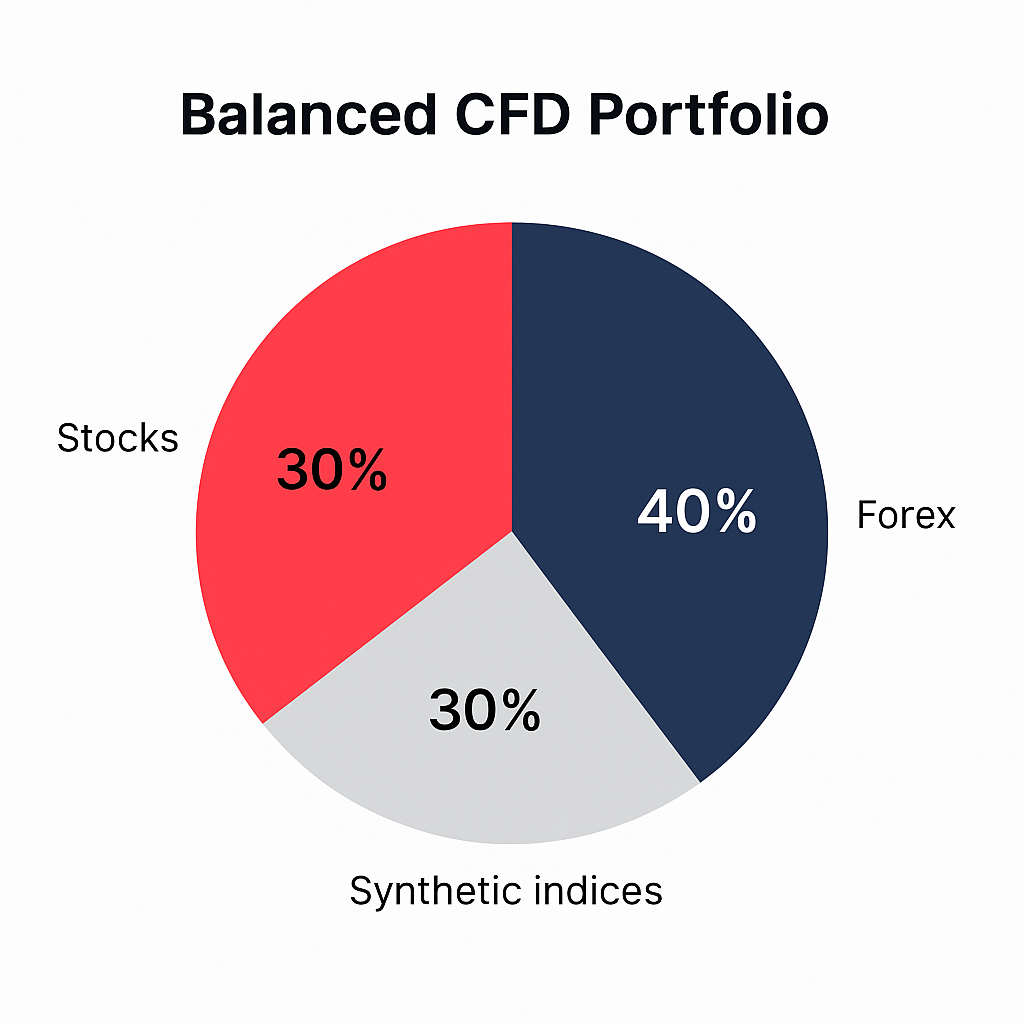

如何分散您的 CFD 投資組合?

CFD 交易讓您接觸多個市場,但分散投資必須有策略。均衡的投資組合能分散風險,同時不會削弱重點。

從 兩到三種互補資產類別 開始。例如,結合外匯貨幣對、股票指數與合成指數。

Deriv 獨家提供的合成指數全天候 24/7 運作,不受現實世界事件影響,為交易者提供持續的市場接入。

分散投資無法保證獲利,但有助於控制曝險並維持績效。

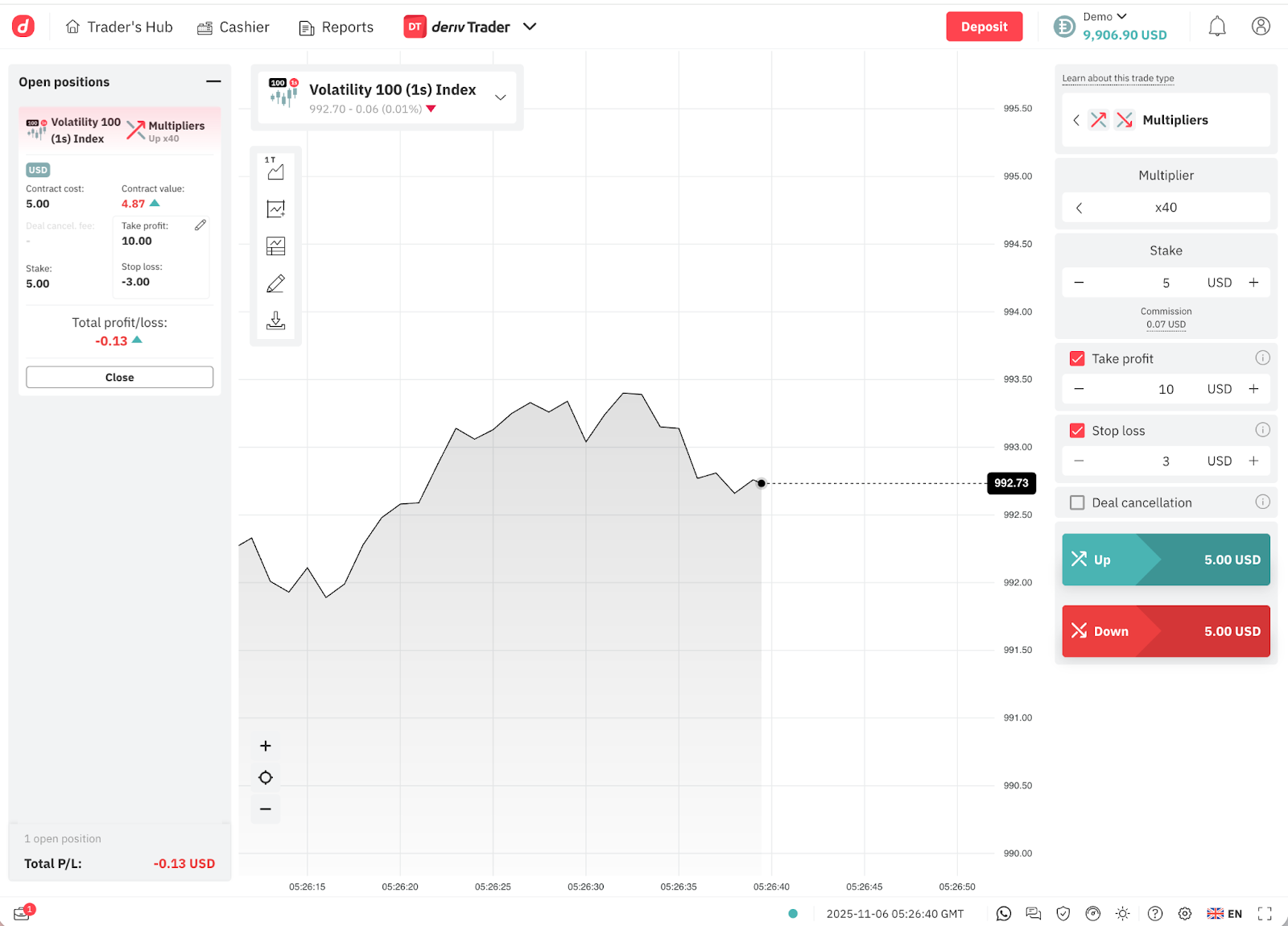

應該使用哪些風險管理工具?

槓桿能放大潛在利潤與損失,因此適當的風險管理至關重要。每筆交易都應使用內建工具,如 停損 和 獲利了結:

停損 會在損失達到您預設的限度時自動平倉。

獲利了結 則會在達到目標價格時自動鎖定潛在收益。

Deriv 平台清楚顯示這些功能,幫助您主動管理風險。

「槓桿是一把雙刃劍。它能同時放大利潤與損失。交易者切勿在單筆交易中冒險超過資金的百分之一至百分之二。」

此外,交易前請計算您的 風險報酬比。1:3 比例(風險 100 美元以目標 300 美元)有助於在雄心與謹慎間取得平衡。

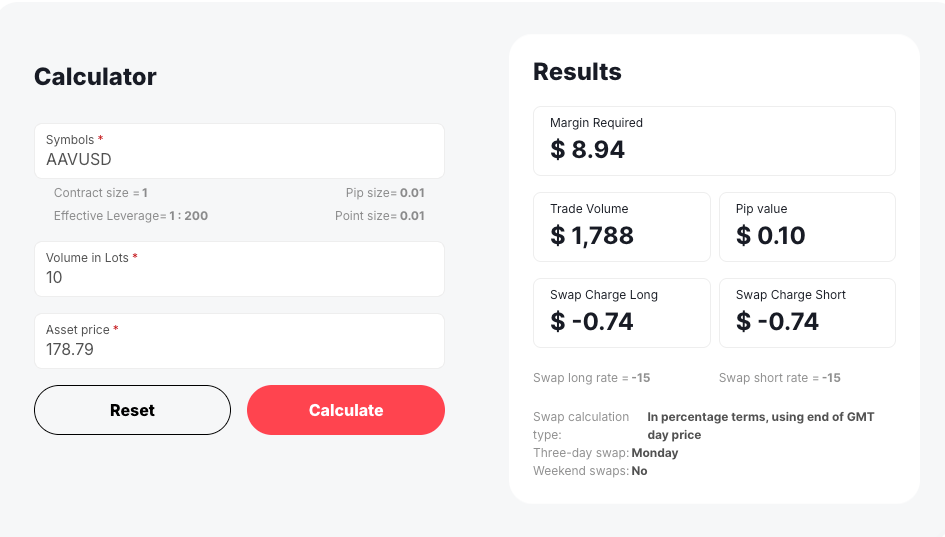

使用 Deriv 的保證金計算器,在交易前估算曝險。

為何檢視交易績效很重要?

保持 交易日誌 是持續進步的最有效習慣之一。記錄每筆交易的理由、情緒狀態與結果。隨著時間推移,您將發現揭示優勢與弱點的模式。

所有 Deriv 平台均提供可下載的交易歷史與績效指標,讓檢視變得簡單且具可行性。定期分析有助於優化進場點、改善時機並對策略負責。

交易 CFD 時應避免的常見錯誤

1. 不要過度使用槓桿

槓桿讓您以較少資金操作較大倉位,但高槓桿同時增加損失風險。

開倉前請自問:「如果市場逆向,我的帳戶能否輕鬆承擔整個倉位?」

若不能,請降低槓桿或選擇較小的交易。

Deriv 的 保證金計算器 和 風險指標 可協助避免過度曝險。

Deriv 高級市場分析師 Seeyan Padinjaraveettil 表示:

「CFD 交易的持續獲利來自學習,而非運氣。每月追蹤績效的交易者更有可能有效調整風險。」

2. 不要讓情緒控制交易

情緒化交易容易導致過度反應,尤其是在虧損後。

避免報復性交易或對資產產生情感依附。

設定預先風險限額,並在波動時期適時休息,以防衝動決策。

3. 不要忽視隔夜及隱藏成本

隔夜持有的 CFD 可能產生 交換費或展期費,這些費用可能侵蝕微薄的潛在利潤。

持倉前請檢視每筆交易的潛在成本。Deriv 平台透明顯示 交換利率,方便您有效規劃。

4. 不要忽略基本面因素

即使偏好技術交易,了解基本面能讓您對市場有更清晰的認識。

經濟數據、利率決策及企業盈餘均會影響 CFD 價格。

利用 Deriv 的經濟日曆監控全球重要事件。

5. 不要無計劃交易

每筆 CFD 持倉都應遵循明確結構:

- 進場理由 — 您為何進行該交易。

- 獲利目標 — 成功時的出場點。

- 停損限額 — 您可承受的最大損失。

遵循明確系統可減少情緒錯誤,並隨時間產生可衡量的成果。

結語

CFD 交易以靈活與精準開啟全球市場大門,但持久成功依賴於 教育、紀律與風險意識。

透過應用這些應做與不應做事項,您將建立穩固基礎,實現持續且明智的交易。

Deriv 提供 安全且先進的平台:Deriv MT5 與 Deriv cTrader,並提供免費模擬帳戶及交易工具,支持您的成長。

無論是在模擬帳戶練習或實盤交易,請記住:學習、管理風險並保持策略性。

免責聲明:

Deriv X 不對居住於歐盟的客戶開放。