Commodity prices: What drives them and how to trade

.png)

Commodity prices move mainly due to real-world supply and demand factors such as weather, geopolitics, inventories, energy costs, currency movements, policy shifts, and technology changes. They also react to speculative forces including sentiment, liquidity, positioning, and technical patterns. Understanding how these factors interact helps traders choose the right instruments: CFDs or options, and the most suitable Deriv platform to express their market views effectively.

Quick summary

- Fundamentals set direction, speculation amplifies moves.

- The Structural, Seasonal, and Shock regime lens helps identify conditions.

- CFDs suit flexible positions; options suit defined-risk, time-boxed views.

- Recent developments such as gold’s highs, cocoa’s spike, OPEC+ unwind, and shipping disruptions, continue to shape market setups.

- A two-minute pre-trade checklist ensures discipline.

How do commodity market forces shape prices?

Commodity charts reveal an ongoing tug-of-war between fundamentals and speculation. Fundamentals set the trend direction, while speculative flows often dictate how quickly prices move. A strong long-term supply deficit may push a market higher over months, yet a single unexpected headline can still cause sharp intraday reversals.

Commodity markets also react strongly to how quickly new information spreads. In fast-moving environments—such as energy outages, crop condition updates, or surprise macro announcements—prices may temporarily overshoot their fundamental value as traders rebalance exposure. This may create short-term swings that traders should approach with caution. On Deriv, the ability to reduce size, scale in gradually, or switch to defined-risk options helps traders manage their exposure more deliberately.

Shivank Shankar, Marketing Paid Acquisition Specialist at Deriv, adds:

“In commodities, long-term direction comes from fundamentals, but short-term movement comes from surprise.”

In addition, correlations between commodities and other asset classes can shift unexpectedly. For example, industrial metals may decouple from equity trends during periods of policy uncertainty, while energy markets may respond more closely to shipping or weather-related disruptions. Understanding these shifting relationships helps traders avoid outdated assumptions and maintain flexibility in their strategy.

What drives supply and demand shifts in commodities?

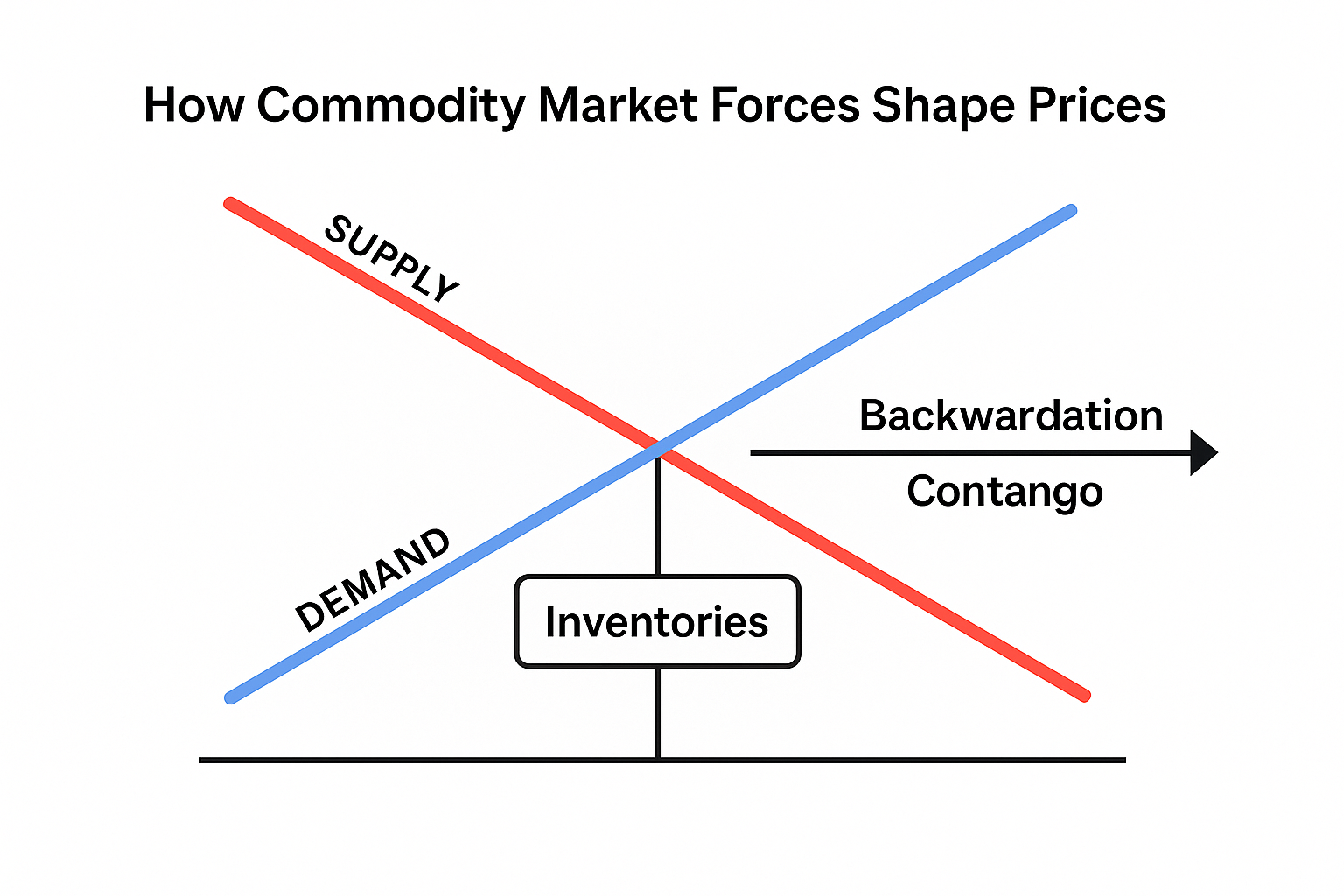

Supply, demand, and inventories form the core of commodity pricing. When demand outpaces supply, inventories fall, and near-term prices often rise faster than later prices (backwardation); when supply exceeds demand, inventories build and forward prices tend to sit above spot (contango).

Weather and climate: Weather remains one of the biggest short-term market movers. Droughts, heat waves, floods, and storms all affect agricultural yields and energy demand. If unusual weather persists, it can shift from a short-term pattern into a structural trend.

Geopolitics and logistics: Shipping routes act as key arteries for commodity flows. Disruptions such as those in the Red Sea or Panama Canal increase transport costs, delay deliveries, and tighten regional supply. These effects ripple into futures curves and spot spreads.

Macro and USD effects: Because commodities are largely priced in USD, a stronger dollar often weighs on prices for non-dollar buyers. At the same time, growth expectations, changes in inflation, and interest rate outlooks reshape demand for industrial metals and transport fuels. On Deriv, CFDs allow traders to adjust positions dynamically when macro data causes sudden sentiment shifts.

Policy and technology: Regulations, tariffs, emissions rules, and extraction innovations all move cost curves. For metals and energy markets, technological upgrades such as improved drilling methods or refining processes, can lower production costs and reshape global competitiveness.

Table - Regime lens for commodity trading

Beyond these core drivers, long-term investment cycles also shape supply. Many commodities, particularly metals and energy, require years of capital expenditure before production capacity changes meaningfully. When investment stalls—because of low prices, tighter financing conditions, or regulatory hurdles—future supply can fall short even when current inventories look stable. This mismatch often leads to structural price uptrends.

On the demand side, consumption patterns evolve as industries modernise. Electric vehicles, renewable energy infrastructure, and data centres have increased demand for copper, lithium, and other specialised materials. Traders who track these transitions early often build stronger directional theses.

How can traders use market regimes to build commodity strategies?

- Structural regime: Multi-quarter themes driven by long-term supply-demand mismatches or policy shifts. For instance, electrification and renewable infrastructure continue to increase demand for copper and other metals.

- Seasonal regime: Calendar patterns such as planting and harvest periods, heating and cooling cycles, and predictable shifts in demand. Climate patterns like El Niño often create seasonal imbalances.

- Shock regime: One-off catalysts such as sanctions, unexpected supply outages, or weather events. Cocoa’s surge, triggered by production losses, is a recent example of a shock that evolved into a new structural base.

Deriv Trading Education Lead elaborates:

“Identifying the regime correctly often matters more than picking the perfect entry.”

These regimes guide choices around holding periods, risk budgets, and the suitability of CFDs versus options.

Successful application of the regime framework requires consistency. Many traders misclassify markets by focusing too heavily on short-term candles instead of the underlying drivers. A structural market with slow pullbacks may appear range-bound on lower timeframes, while a shock regime may look like a sustainable trend if viewed too narrowly.

Keeping a simple regime log—structural, seasonal, or shock—helps avoid overreacting to noise. Deriv’s charting tools across Deriv MT5, Deriv cTrader, and Deriv Trader make it straightforward to compare timeframes and validate whether the current behaviour matches the intended regime.

How can I trade commodities on Deriv using CFDs and options?

CFDs (Deriv MT5 and Deriv cTrader): Flexible tools that let traders scale positions, add or cut size, and trail stops behind trends. They work best in structural or seasonal markets where trends evolve gradually.

Options (Deriv Trader and SmartTrader): Structured for defined-risk outcomes. They are especially useful in shock regimes or when traders want to express short-term, time-boxed views.

Syed Mustafa Imam, Data Engineering specialist at Deriv, explains:

“Defined-risk structures can help beginners understand their maximum possible loss upfront, though trading still carries significant risk.”

Rule of thumb: Some traders prefer options when they want the potential loss to be limited to the stake and the trade to run for a set duration, while CFDs may suit those who want more flexibility to adjust positions as conditions change.

When should I use CFDs vs options in commodity trading?

- CFDs: Suitable when traders want path flexibility. They allow partial closes, trailing stops, and trade adjustments during volatile sessions.

- Options: The stake defines the maximum loss, making them appropriate for event-heavy periods or markets prone to sharp reversals. Rise/Fall and Touch/No Touch contracts help express directional or level-based ideas.

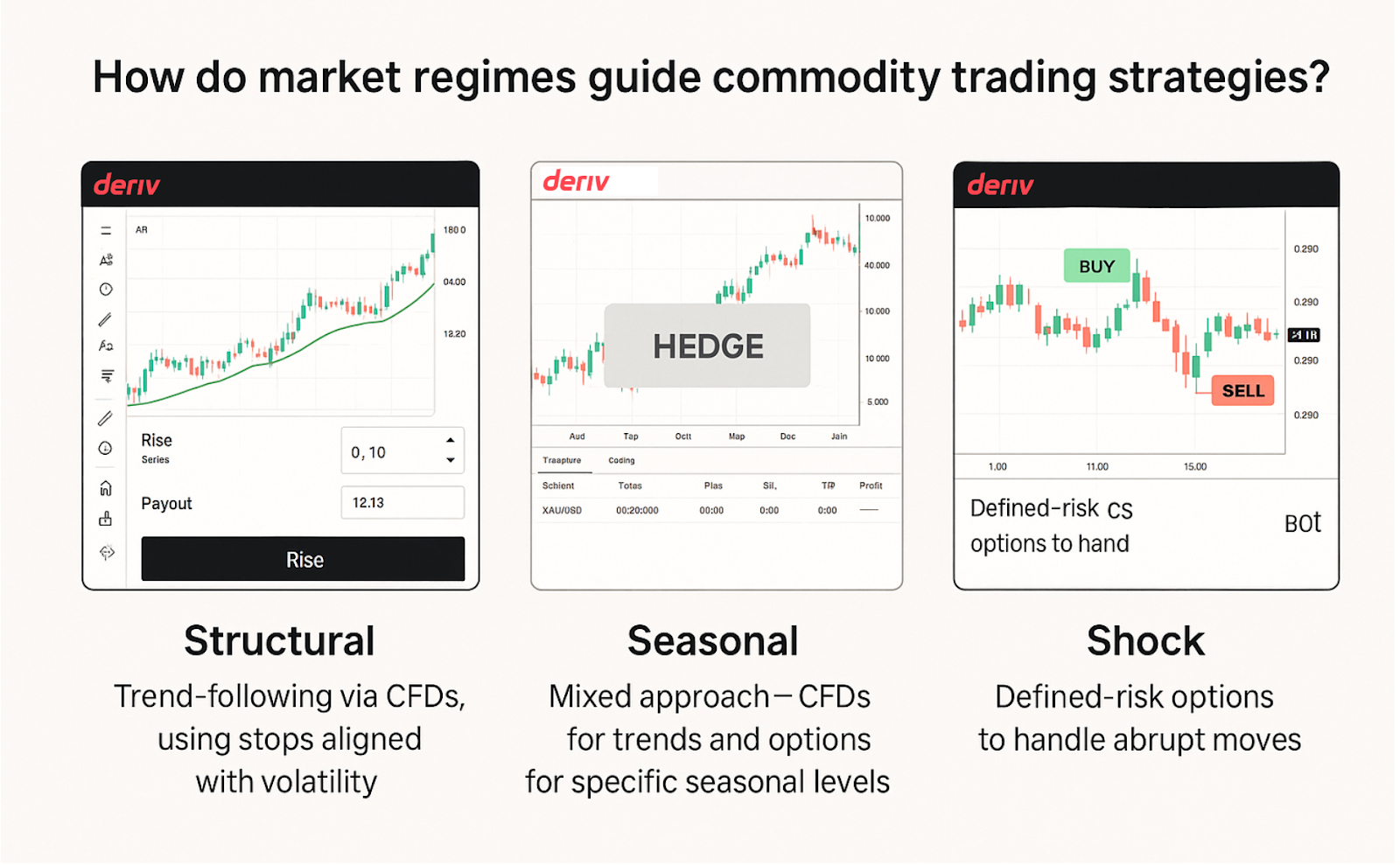

How do market regimes guide commodity trading strategies?

Market regimes determine whether a trader should prioritise trend-following, level-based options, or range plays.

- Structural: Trend-following via CFDs, using stops aligned with volatility.

- Seasonal: Mixed approach—CFDs for trends and options for specific seasonal levels.

- Shock: Defined-risk options to handle abrupt moves.

What Deriv examples show these strategies in practice?

- Example 1: Deriv Trader trend-following

Some traders use Deriv Trader to express time-limited market views with predefined parameters, without needing to manage the position continuously.

- Example 2: Deriv Trader short-horizon decisions

Short-horizon trades are sometimes used to practise translating a market view into a clear, time-bound decision, while keeping the stake amount limited.

- Example 3: Deriv MT5 event hedge

Other traders prefer platforms like Deriv MT5 or Deriv cTrader when they want to actively monitor a position and adjust exposure as new information emerges.

- Example 4: Deriv Bot discipline

Automation tools can be used to apply pre-set conditions consistently, which may support discipline and reduce ad hoc decision changes.

These examples highlight how traders can turn broad concepts into rule-based actions. Consistency matters more than complexity. A beginner does not need a complicated system, only a process that can be repeated without emotional interference. For instance, a trader may commit to trading only during higher-liquidity sessions, or to avoiding entries five minutes before scheduled economic releases.

Deriv’s platforms support these habits with features such as trade limits, predefined stop-loss levels, and automated workflows in Deriv Bot. By combining a structured approach with modest position sizes, traders can observe how different markets behave while managing their exposure, though losses remain possible at all times.

How do current commodity developments shape trading strategies now?

- Gold: Safe-haven flows and shifting rate expectations maintain a structural bid.

- Cocoa: Supply constraints continue to support elevated price levels.

- Oil: Gradual adjustments in OPEC+ output may continue creating event-driven volatility.

- Shipping: Disruptions to global routes keep freight costs elevated, affecting energy and agricultural delivery times.

How can traders turn a market view into a Deriv trade?

- Identify the current regime.

- Choose the appropriate instrument (CFDs or options).

- Express the thesis with level-based, drift-based, or range-based structures.

- Set up risk parameters and position sizing.

- Confirm no near-term events contradict the idea.

Aisha Rahman, Senior Market Strategy at Deriv, explains:

“A clear invalidation point is what separates a thesis from a guess.”

What pre-trade checklist should I follow?

- Define the regime.

- State the invalidation fact.

- Choose between time-fixed or flexible management.

- Set your stop or maximum loss.

- Note any relevant economic releases or logistical issues.

How can I practise commodity trading safely on a Deriv demo account?

Start with one market: gold, oil, or volatility indices. Practise by applying the regime lens, set clear invalidation levels, and track outcomes. The Deriv demo mirrors live market conditions, allowing traders to test strategies without using real funds.

When you can summarise your last five trades clearly, you may feel more prepared to consider trading with real funds, provided you understand the risks involved.

Disclaimer:

This content is not intended for EU residents.

The information contained in this blog article is for educational purposes only and is not intended as financial or investment advice.

Trading conditions, products, and platforms may differ depending on your country of residence.