Intel stock price surges 55%: Can political backing fuel a breakout above $40?

Intel’s rally has momentum behind it, but whether it can sustain above $40 depends on execution rather than politics. The surge to $37 - a 55% rebound in just six weeks - has been fuelled by U.S. government backing, multi-billion-dollar investments from Nvidia and SoftBank, and speculation about new partnerships, including talks with AMD. These drivers make a test of $40 likely in the short term. But without evidence that Intel can close the gap with AMD and TSMC or turn its foundry profitable, the rally risks pausing once the optimism fades.

Key takeaways

- Intel stock up 55% since early September, its sharpest rally in 18 months, closing at $37.30 on Thursday.

- Trump’s 6-week-old investment up 80%, while the U.S. government’s 10% stake has grown from $8.9 billion to $16 billion.

- Nvidia ($5B), SoftBank, and Apple interest add institutional weight behind the recovery story.

- AMD talks raise the possibility of Intel producing chips for its longtime rival - a major shift in the semiconductor landscape.

- CEO Lip Bu-Tan took over after Intel’s worst year in history (-60% in 2024) and sweeping layoffs.

- Analysts remain divided: Citi calls Intel a “sell,” arguing the foundry business is a drag, even as investors believe in a turnaround.

Intel government investment boosts confidence

Intel’s rally is tied directly to political and industrial support. In August, the Trump administration negotiated a 10% equity stake in Intel, acquiring 433.3 million shares at $20.47 each for $8.9 billion. At $37, that stake is now valued at nearly $16 billion.

The government equity purchase was funded by CHIPS and Science Act grants originally allocated under Biden, underscoring bipartisan recognition that semiconductors are a matter of national security. Intel has already received $2.2 billion from CHIPS grants, with $5.7 billion more coming, plus $3.2 billion from a separate program.

For Washington, Intel’s survival and resurgence are not just market issues - they’re about reshoring production and reducing reliance on Taiwan’s TSMC amid escalating U.S. - China tensions. That political dimension gives Intel a safety net most companies lack.

Intel-Nvidia deal and other private-sector endorsements add fuel

The surge is also being driven by heavyweight private investors:

- Nvidia invested $5 billion in September, tying Intel CPUs with Nvidia GPUs in future data centres and PCs. The move bolsters Intel’s relevance in AI and computing infrastructure.

- SoftBank became an equity investor earlier in 2025, providing capital diversification and balance sheet strength.

- Apple is reportedly considering partnerships, with speculation that future product ecosystems could involve Intel manufacturing.

These developments have helped restore optimism in a company that, just a year ago, had been written off after years of falling behind AMD and TSMC, mass layoffs, and consideration of selling off its foundry arm.

Still, some analysts have downplayed Nvidia’s investment. With $67 billion in cash, the $5 billion commitment is small for Nvidia, and it doesn’t necessarily solve Intel’s performance gap in processors or AI chips.

Intel-AMD partnership: Potential impact

One of the most intriguing catalysts for Intel’s rally has been reports that Intel and AMD are in preliminary talks to make AMD a foundry client.

Such a deal would be historic - two arch-rivals cooperating. For Intel, it could validate its foundry model, helping to monetise a long-unprofitable division. For AMD, it would diversify production away from TSMC, whose dominance in advanced node manufacturing has left the industry exposed to geopolitical risks in Taiwan.

Yet, these talks are at an early stage. Questions remain over how much of AMD’s production could shift, and whether AMD would invest directly into Intel as part of the deal. For now, the story is more sentiment driver than earnings catalyst.

A leadership reset after Intel’s worst year

Intel’s turnaround effort is unfolding under new leadership. Lip Bu-Tan became CEO in December after Pat Gelsinger's departure. His appointment followed Intel’s worst fiscal year on record in 2024, when shares lost 60% of their value amid supply chain disruptions, stiff competition, and strategic missteps.

The company has experienced major layoffs, asset reviews, and internal restructuring. That painful reset, combined with government and institutional capital, has positioned Intel for a potential rebound - but it also sets a high bar for execution.

Sceptics highlight ongoing risks

Despite the rally, sceptics caution that Intel’s fundamentals haven’t yet caught up with its price:

- Citi analyst Christopher Danely downgraded Intel to “sell.” He argued Nvidia’s $5 billion “is no big deal” and won’t materially shift Intel’s competitive position.

- Intel remains behind AMD in CPUs and behind Nvidia in AI chips.

- Intel's foundry business is still losing money, and continuing down that path could keep it stuck in a cycle of underperformance.

- Some analysts suggest Intel could unlock more value by exiting foundry operations altogether.

This bear case underscores the tension: Intel is today valued based on hope, politics, and partnerships rather than proven execution.

Market impact and price scenarios

Momentum suggests Intel could push through $40.00 in the near term. Government backing, institutional investment, and the AMD narrative provide strong fuel for short-term traders.

But sustainability depends on Intel’s ability to:

- Demonstrate progress in AI and data centre products.

- Translate government and private support into profitability.

- Close the performance gap with AMD and TSMC in advanced chip manufacturing.

Without this, the rally risks stalling or reversing once optimism fades.

Intel stock forecast insights

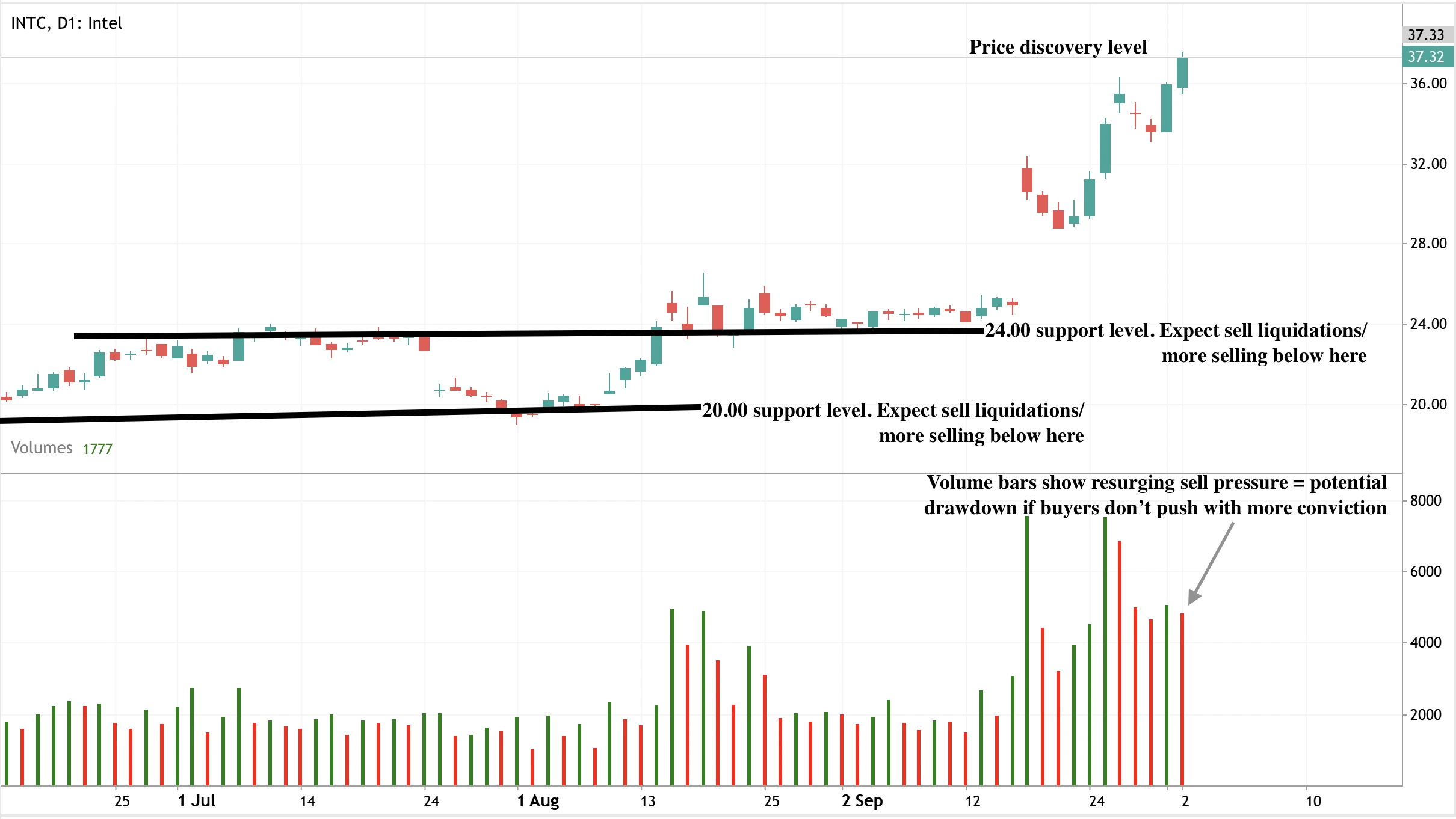

At the time of writing, the daily chart shows a clear bullish bias, hinting at a potential further uptick. However, the volume bars reveal a resurgence in selling pressure, suggesting that upside momentum could be capped. If sellers dominate, prices could tumble toward the $24.00 support level, with deeper support seen at the $20.00 price level.

Traders looking to analyse these setups in real time can use Deriv MT5, which offers advanced charting and indicators for momentum-driven markets like Intel.

Trading Intel’s momentum on Deriv platforms

For traders, Intel’s current volatility presents opportunities across Deriv platforms:

- Deriv MT5 CFDs: Speculate on Intel’s short-term price moves with leverage, enabling both long (bullish continuation above $40.00) and short (reversal from resistance) strategies. Tight stop-loss placement is key given the stock’s sharp swings.

- Multipliers: Intel’s momentum makes multipliers attractive for those looking to capture quick moves around breakout levels without committing to full CFD exposure. A breakout above $40.00 could be a natural entry trigger for short-term multiplier trades.

- Risk management: Given Intel’s political ties and speculation-driven rally, volatility spikes are likely. Using Deriv’s built-in risk tools - such as stop-loss and take-profit settings - is essential for disciplined positioning. Traders can also calculate position sizes and risk/reward ratios with Deriv’s trading calculator to manage exposure effectively.

Investment implications

Intel represents a momentum-driven turnaround. The political and institutional support is unmatched in the semiconductor industry, giving it short-term resilience. A breakout above $40.00 looks possible, especially if AMD talks advance or further partnerships are announced.

However, the risks are elevated in the medium term. Intel must deliver on its promises in AI and foundry manufacturing or risk slipping back behind AMD and TSMC. For investors, this is a high-risk, high-reward trade: bullish in the short run but dependent on execution for lasting gains.

Related reading: explore our recent analysis on Gold’s breakout potential and Oil price volatility for more insights into trading commodities and tech-driven momentum markets.

Disclaimer:

The performance figures quoted are not a guarantee of future performance.