Leverage on Deriv for Synthetic Indices explained

Many traders struggle with finding the right leverage balance: too little restricts opportunities, too much increases risk. Deriv’s Synthetic Indices help address this problem by offering tailored, instrument-specific leverage that adjusts to volatility. The result? Traders on Deriv MT5 and Deriv Trader can take advantage of precise exposure control without unnecessary risk. This article explains how Deriv’s leverage model works, how it compares to other brokers, and what traders can do to use it responsibly..

Quick summary

- Deriv provides symbol-specific leverage across its platforms, helping traders manage capital efficiently.

- The April 2024 Deriv MT5 update boosted leverage on most indices but tightened it for Jump 100 to stabilise volatility.

- The model aligns with global transparency trends, using data-driven margin logic and built-in safety features.

- Smart use of leverage, combined with good position sizing and stop-losses, can drive sustainable results.

Here’s how Deriv’s leverage structure stands out in today’s trading landscape.

How does Deriv lead today in synthetic-index leverage?

Deriv has spent over two decades refining its synthetic-index model. Indices like Volatility 75, Crash 500, Boom 1000, and Step Index are powered by audited random number engines that mimic real-market behaviour without outside influence.

Leverage on Deriv isn’t uniform. It’s tailored per instrument:

- Higher leverage on steady indices (Volatility 25, 50)

- Moderate leverage on mid-volatility markets (Crash/Boom)

- Lower leverage on jump-heavy assets (Jump indices)

According to Deriv’s Q1 2025 data:

- 68% of traders use less than 1:500

- 24% trade between 1:500 and 1:1000

- Only 8% exceed 1:1000

“Leverage is not a power tool. It’s a precision instrument. Traders who stay under a 1:500 leverage tend to grow their equity more steadily. It’s not about size. It’s discipline.” - Wafaa Elashry, Senior Product Analyst at Deriv.

In short, Deriv’s flexible leverage structure gives traders precise control without compromising safety.

Table 1 – Comparison of Deriv and global brokers

How does Deriv's leverage compare globally?

Most brokers are restricted to a 1:30 leverage ratio in the EU/UK and a 1:100 leverage ratio in Australia.

Deriv, operating under its Derived account model, allows leverage to vary by symbol. It offers flexibility aligned with each index’s volatility.

“Our flexibility comes with constant monitoring. Each index is continuously reviewed to keep leverage safe and proportional.” - Syed Mustafa Imam, Data Engineering specialist

Deriv MT5 and Deriv Trader each apply this logic in real-time, showing traders the exact margin requirements before placing orders.

How does Deriv MT5 leverage work across different synthetic index types?

A Volatility 100 Index at 1:1000 requires just 10 USD margin for a 10,000 USD position. That’s a 0.1% margin requirement.

A Jump 100 Index at 1:250 needs a 40 USD margin for the same exposure, or a 0.4% margin, reflecting higher volatility.

“Margin efficiency keeps you in the game. Plan margin ahead so volatility doesn’t force liquidation.” - Prince Coching, Senior Trading Specialist

Table 2 – Leverage ranges by synthetic index type

In short, Deriv’s leverage-to-margin ratios are engineered to align with each index’s volatility, ensuring stability and opportunity coexist.

How can you maange leverage risks when trading synthetic indices on Deriv?

Leverage amplifies both potential profit and loss, so control matters. Deriv’s safety features help, but smart habits are the key to longevity.

In-platform safeguards

- Stop-out triggers: Auto-close positions if equity falls below ~50%.

- Negative balance protection: Losses never exceed deposits.

- Margin call alerts: Warnings before critical levels.

Deriv data (Q1 2025)

- Average margin level before stop-out: 68%

- Stop-loss use: 82% of traders

- Median drawdown for over-leveraged accounts: 23%

Best practices

- Keep margin level > 300%.

- Limit leverage to ≤ 1:500 for long trades.

- Avoid correlated high-leverage positions (e.g., Vol 75 + Boom 1000).

“Risk isn’t just leverage. It’s attention. Those who track margin and diversify last longer.” - Felicia Tanwijaya, Risk Analytics specialist

Deriv MT5 and Deriv Trader all display live margin data, making it easy for traders to stay within safe limits.

In short, Deriv’s ecosystem combines automation with awareness — the best mix for risk management.

How do margin requirements and exporsure levels work on Deriv?

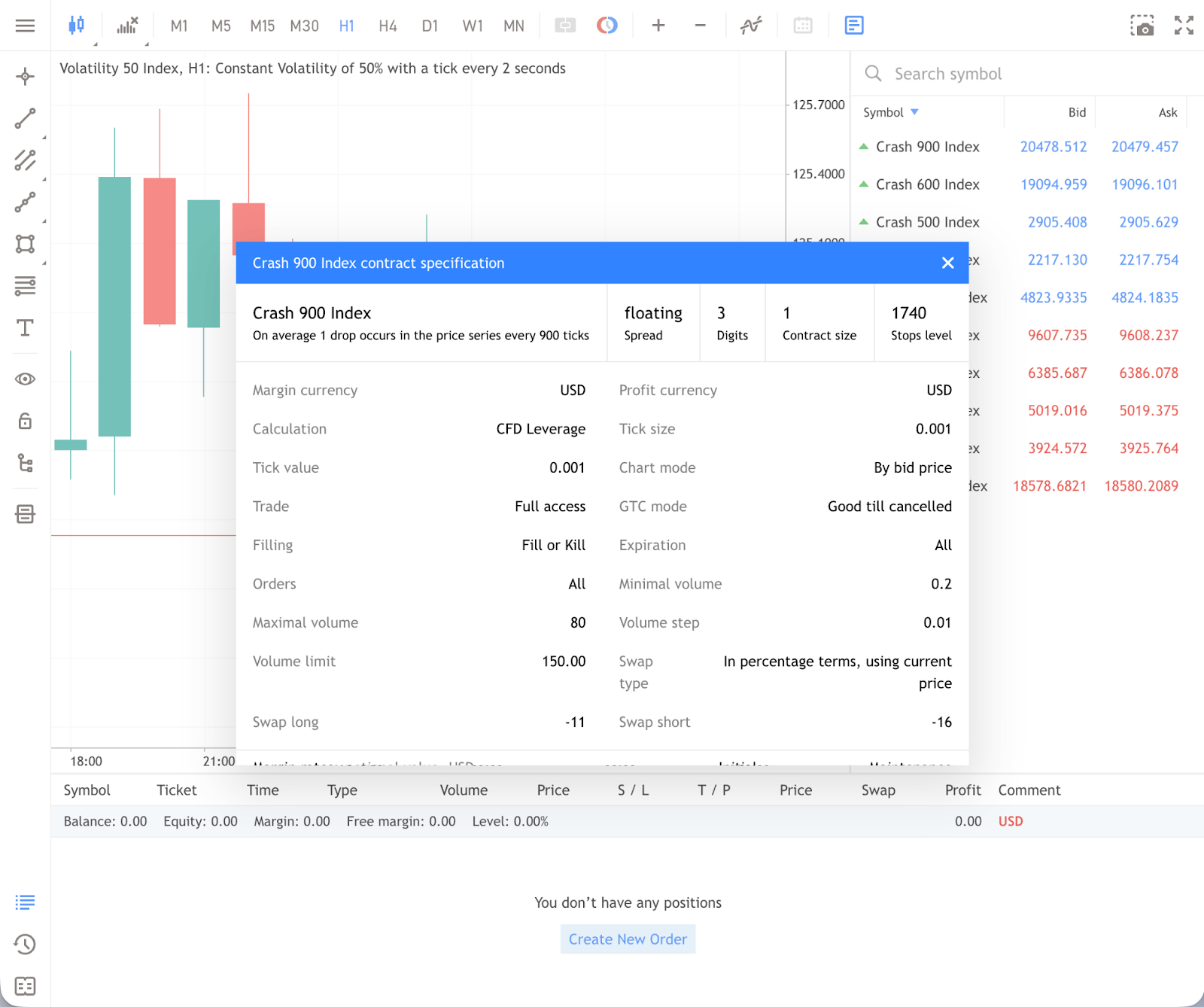

On Deriv MT5

- Market Watch → Specification shows contract size, margin %, and stop-out.

- Order Window displays required margin before execution.

- Terminal → Trade tab shows live margin levels and alerts.

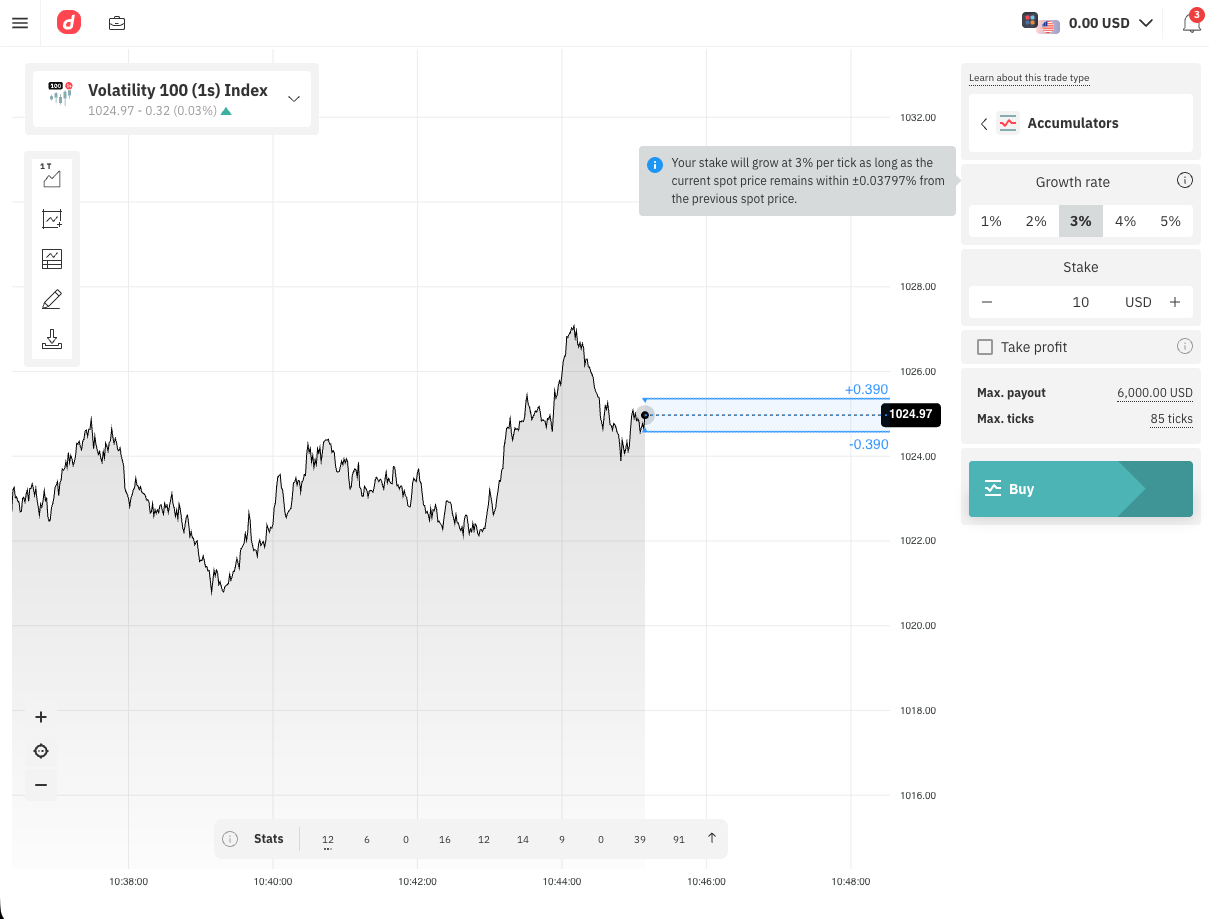

On Deriv Trader

- Tap (ℹ️) beside a contract to view leverage and payout details.

- Demo accounts mirror real specs—ideal for practice.

Table 3 – Practical margin calculation examples

What can traders learn from these simulated case studies?

Case 1: Balanced use

- Lena, Southeast Asia – Vol 50, 1:2500 leverage, 1:3 risk–reward, stop-loss always on.

- Result: +18% in 3 months, minimal drawdown.

Case 2: Over-leverage

- Ray, Latin America – Boom 1000, 1:600, no stop-loss, 3 positions.

- Result: Auto stop-out at 65% margin; –25% equity in one session.

Case 3: Smart diversification

- Aisha, Middle East – Vol 10, 75 & Step Index at 1:500 each, 1% risk per trade.

- Result: Consistent monthly growth, low drawdown.

In short, disciplined margin management leads to consistent long-term performance.

What's next for Deriv's leverage system in 2025–2026?

As part of Deriv’s 2025–2026 roadmap, the company is refining its leverage engine to match modern market dynamics and risk calibration standards.

Coming updates:

- Dynamic tiers: Leverage adjusts automatically by trade volume and volatility.

- Real-time margin dashboards: Exposure heatmaps by index family.

- AI-based prompts: Warn when portfolio leverage exceeds safe limits.

- New indices: “Macro Volatility” and “Energy Volatility” (in testing).

“Leverage will become adaptive,” predicts Priyanka Shrivastava, Product Owner. “Ratios will reflect each trader’s history and risk profile.”

Disclaimer:

The information contained in this blog article is for educational purposes only and is not intended as financial or investment advice.

This information is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information.

Deriv MT5’s availability may depend on your country of residence.

Trading is risky.

Derived and Swap-Free accounts on the MT5 platform are unavailable to clients residing in the EU.

Trading conditions, products, and platforms may differ depending on your country of residence. For more information, visit deriv.com