Japanese yen forecast: Recovery in sight or is economic pressure here to stay?

The Japanese Yen (JPY) trimmed some of its recent losses during Friday's London trading session, offering temporary relief after a sharp decline earlier in the week. The yen had faced significant pressure following comments from Japan’s new Prime Minister, Shigeru Ishiba, and Bank of Japan (BoJ) Governor Kazuo Ueda, both of whom signaled a cautious approach to monetary policy. Despite this recovery, the broader outlook for the yen remains clouded, with economic headwinds and subdued expectations for interest rate hikes likely to continue influencing the currency's performance.

Yen outlook: Interest rate uncertainty and economic priorities

Prime Minister Ishiba’s stance on Japan’s interest rates has been pivotal in shaping the recent movements of the yen. Earlier this week, Ishiba stated, "I do not believe that we are in an environment that would require us to raise interest rates further," reinforcing the view that Japan is not yet ready for tighter monetary policy. This statement, combined with Governor Ueda’s cautious approach, has dampened market expectations of any imminent interest rate hikes by the BoJ, adding to the yen’s weakness against major currencies like the U.S. dollar.

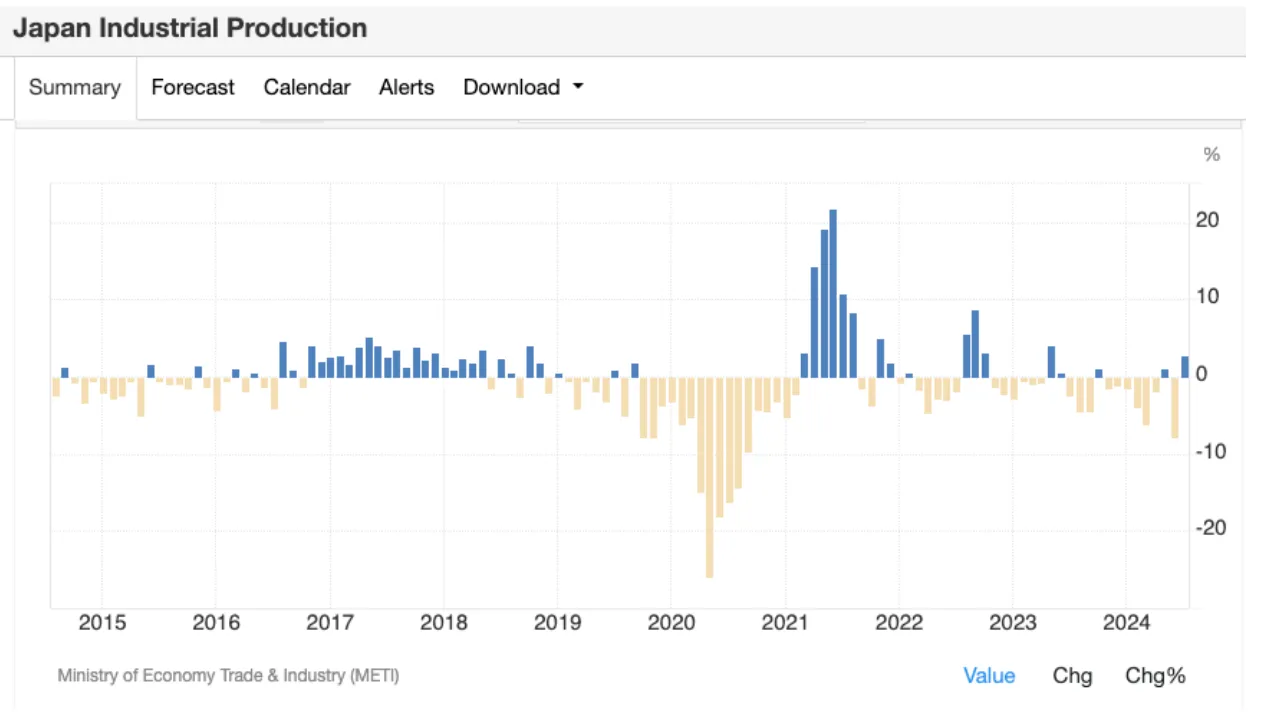

Before assessing the potential impact of monetary tightening and the yen's future outlook, it's essential to examine how a weaker yen affects the broader economy. Over the past few years, the yen has depreciated due to the growing interest rate differential between the U.S. and Japan. Despite efforts by the Japanese government since 2020 to encourage companies in China to relocate back to Japan and Southeast Asia, industrial production has not experienced a significant rebound.

While Japan’s real GDP has increased in yen terms, its GDP in U.S. dollars has declined, suggesting that much of the growth is a result of the weaker yen rather than underlying economic strength. This highlights the reliance of Japan's economy on currency-driven growth, which may complicate any future decisions to tighten monetary policy.

Japan’s ongoing struggle with deflation and the government's focus on economic growth continue to play a significant role in monetary policy decisions. Overcoming deflation remains Japan’s top priority, and both Prime Minister Ishiba and the BoJ are committed to maintaining an accommodative policy stance until this goal is achieved. The BoJ’s 2% inflation target, while still in place, has proven difficult to reach, and any move towards tightening monetary policy is likely to be delayed until more concrete signs of economic recovery emerge.

Will the yen get stronger?

While the yen's performance in the near term may be influenced by global factors like U.S. dollar strength and economic data releases, the longer-term outlook remains uncertain. With the BoJ maintaining its ultra-loose monetary policy and showing little inclination to raise interest rates, the yen could face sustained downward pressure in the months ahead.

Moreover, the broader economic landscape in Japan, including rising costs and the potential for increased government spending, suggests that the yen may continue to struggle in the absence of stronger inflationary pressures. Prime Minister Ishiba has pledged to introduce an economic package aimed at easing the impact of rising costs on households, but the effect of such measures on the yen’s value remains to be seen.

The upcoming supplementary budget and Japan’s fiscal strategy will be crucial in shaping both the yen's trajectory and market sentiment. While some analysts believe that the yen could recover if the BoJ signals a shift in policy or if inflation accelerates beyond expectations, the current environment suggests a more cautious outlook.

Technical outlook: USD to yen forecast

At the time of writing the pair trades at around 146.61, with bullish momentum evident on the daily chart. However, the RSI retreating towards 60, with price close to the upper boundary of the bollinger band, hints at overbought conditions.

Buyers could struggle to breach the upper boundary of the bollinger band, potentially being stopped at 146.72, with a further up potentially being stopped at the 100-day moving average. On the downside, sellers could be held at the 145.22 price level, with a further move down likely to hold 144 psychological levels.

As for now, you can get involved and speculate on the trajectory of this pair with a Deriv MT5 account. It offers a list of technical indicators that can be employed to analyse prices. Log in now to take advantage of the indicators, or sign up for a free demo account. The demo account comes with virtual funds so you can practise analysing trends risk-free.

Disclaimer:

The information contained within this blog article is for educational purposes only and is not intended as financial or investment advice.

This information is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information.

The performance figures quoted refer to the past, and past performance is not a guarantee of future performance or a reliable guide to future performance.

We recommend you do your own research before making any trading decisions.