Ethereum price prediction 2025: Analysts project $12,000 target despite headwinds

Ethereum price prediction 2025 has become a key market focus as the token holds near the $4,000 support level. ETH faces immediate headwinds from a negative shift in the Ethereum funding rate and $79.36 million in ETF outflows. Despite these pressures, analysts led by Tom Lee of Fundstrat and BitMine argue that Ethereum remains on track for a rally toward $12,000–$15,000 in 2025 as institutional adoption and BitMine Ethereum holdings strengthen its long-term case.

Key takeaways

- Ethereum price steadies near the $4,000 support level

- Funding rates flipped negative twice this week, pointing to rising short positions.

- Ethereum ETF outflows reached $79.36 million in the past 24 hours.

- BitMine Ethereum holdings expanded with 264,000 ETH added last week, bringing total to 2.15 million.

- Tom Lee projects ETH at $10,000–$12,000 by year-end 2025, with potential upside to $15,000.

Ethereum funding rates go negative

Ethereum funding rates dropped to -0.0013 this week, marking the second negative reading in five days.

An Ethereum funding rate negative reading occurs when perpetual futures trade below spot, with short traders paying long traders to hold positions. This underscores a bearish tilt in the derivatives market, where traders are positioning for further declines.

Ethereum ETF flows raise caution

The short-term pressure is reinforced by flows in institutional investment vehicles. According to SoSoValue, Ethereum ETF outflows totalled $79.36 million in just 24 hours. This highlights reduced institutional risk appetite and suggests that funds are trimming exposure after months of inflows. While ETF flows can fluctuate, they remain an important gauge of institutional sentiment toward ETH.

BitMine Ethereum holdings and institutional adoption

Despite near-term headwinds, BitMine Ethereum holdings are reshaping Ethereum’s institutional narrative. BitMine Immersion Technologies has rapidly accumulated 2.4 million ETH, making it the world’s largest Ethereum treasury. The company’s market cap has surged from $37.6 million in June to $9.45 billion by September 2025.

Tom Lee, BitMine’s co-founder and Fundstrat Chairman, describes Ethereum as a “neutral chain” that appeals to Wall Street and Washington. He argues that Ethereum’s decentralisation makes it the natural infrastructure for tokenisation, financial systems, and digital identity.

Beyond corporates, the trend is spreading. Singapore’s DBS Bank recently launched tokenised structured notes on Ethereum, while policymakers in the US under the Trump administration have begun referencing Ethereum as part of broader digital economy strategies.

The case for a super cycle

Lee forecasts Ethereum will climb to $10,000–$12,000 by the end of 2025, with potential upside to $15,000 if adoption accelerates. He places this within a broader 10–15 year Ethereum super cycle driven by:

- Institutional adoption through ETFs and treasuries.

- Governmental alignment with pro-crypto policies.

- AI and automation use cases, with Ethereum as the infrastructure layer.

- Correlation with Bitcoin’s projected $200,000–$250,000 surge.

This long-term view contrasts with short-term pessimism reflected in ETF outflows and negative funding rates, suggesting that volatility may simply be part of Ethereum’s transition into a financial infrastructure asset.

ETH price forecast and technical analysis

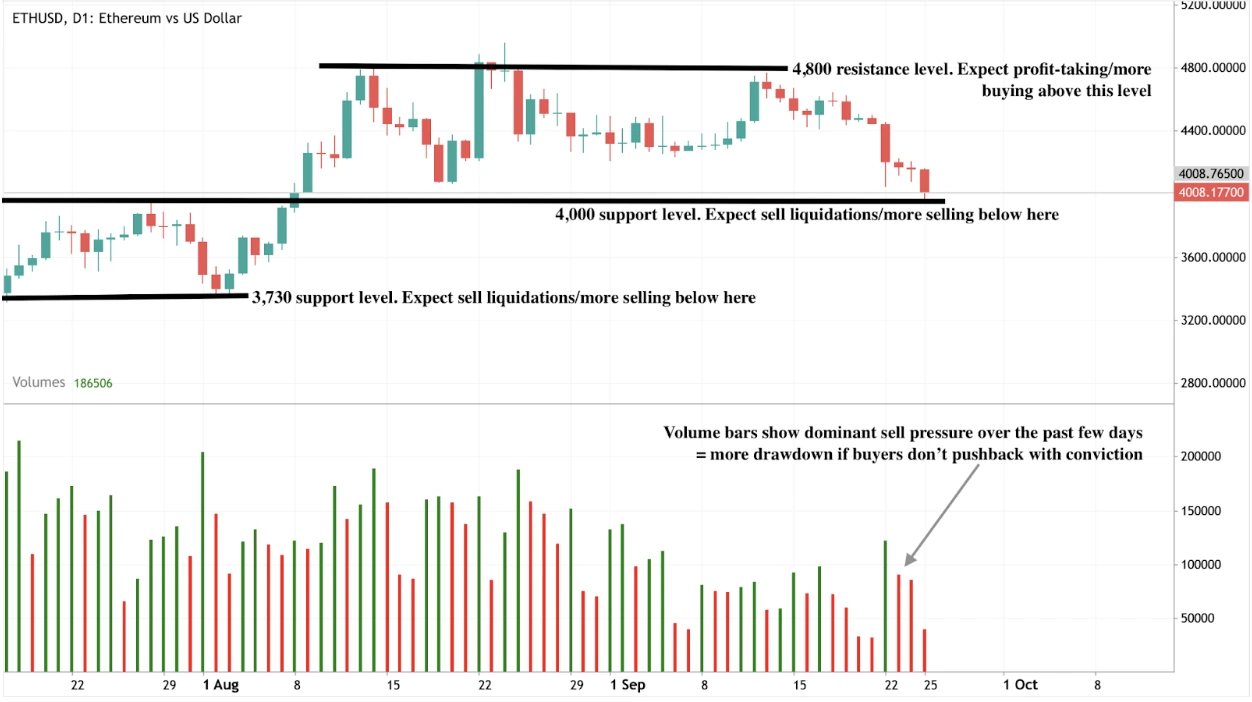

At the time of writing, Ethereum is hovering around the $4,000 support level. The ETH price forecast points to two scenarios:

- Bearish: If sellers maintain dominance, ETH could retest support at $4,000, with further drawdown toward $3,730.

- Bullish: A significant bounce could push ETH higher, with resistance at $4,800.

Volume indicators show sellers remain dominant for now, but buyers defending $4,000 could set the stage for a rebound.

Ethereum future price predictions comparison

ETH price forecast: Investment outlook

Ethereum faces a split between bearish short-term signals and bullish long-term drivers. Negative funding and ETF outflows create caution for traders, while institutional treasuries, adoption trends, and Ethereum’s neutrality narrative underpin its longer-term potential.

For traders, the $4,000 support is the key level to watch. For long-term investors, Ethereum’s role in treasuries, tokenisation, and financial infrastructure suggests that it is building toward a super cycle with targets above $10,000 in 2025.

Trade the next movements of ETH with a Deriv MT5 account today.

Disclaimer:

The performance figures quoted are not a guarantee of future performance.