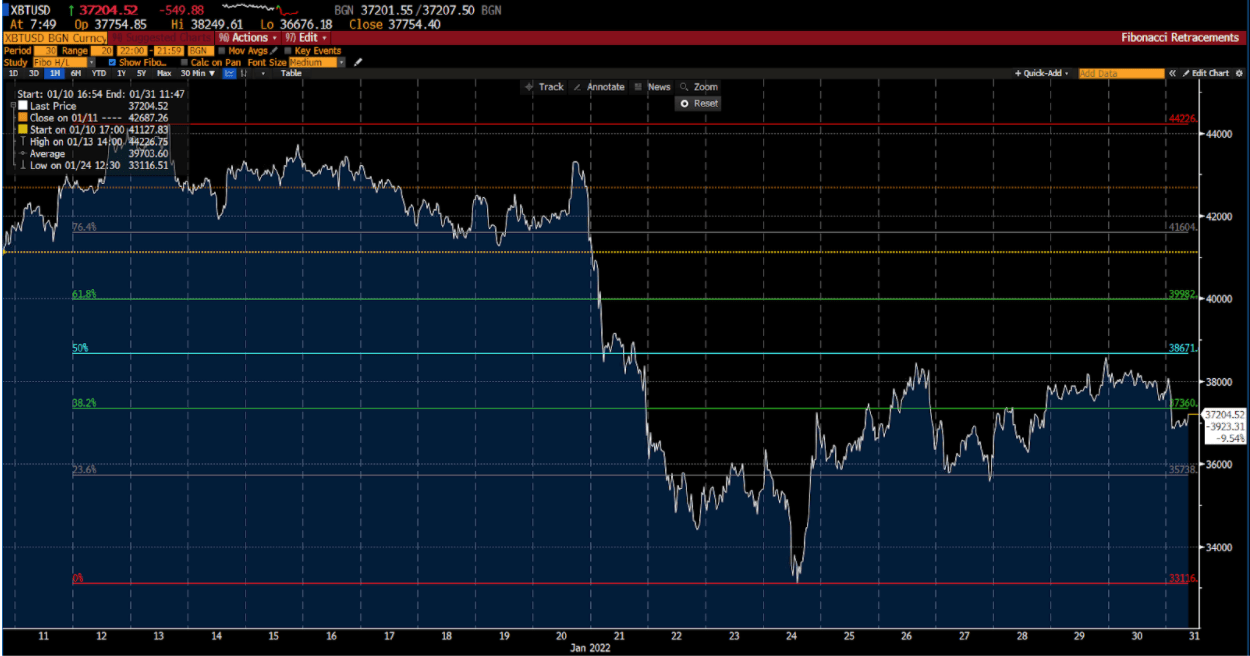

Forex

Source: Bloomberg Click to view full size

Last week, the US dollar extended its winning streak, posting the most significant weekly gain in roughly 7 months. For the first time since July 2020, the Dollar Index (DXY) surpassed $97 by more than 1.7% as the Federal Reserve announced it would raise rates faster in the months ahead. Technically speaking, the monthly chart shows multiple support levels of 200 and 100 SMAs around $96.6 and $97.1, respectively, and a 50 SMA resistance level at around $97.2.

How did the other pairs react?

- The EUR/USD pair was trading near $1.11 and slumped to its weakest level since May 2020 after the Federal Reserve confirmed its hawkish view.

- GBP/USD was barely around $1.3400 due to mixed US data and the endorsement of the rate hikes made by the Federal Reserve. Additionally, political uncertainty surrounding Prime Minister Boris Johnson has also weighed on the British Pound.

- USD/JPY had an upward bias before it slid ahead of the weekend due to the US 10-year Treasury yield fall by 8 basis points from 1.85% to 1.77%. As of the weekend, it is currently trading around ¥115.22. As for the Japanese data, the core inflation rate stood at -0.7% – more than twice December’s (-0.3%).

- On Friday, the GBP/JPY pair traded within a narrow range of ¥154.00 – ¥155.00ish, staying just above the low it reached earlier in the week. The pair started the week nearly 0.75% down but now trades in the ¥154.2 area with roughly 0.15% weekly gains.

This week’s focus will be the upcoming Non-farm Payroll (Jan) and Unemployment Rate (Jan) scheduled for Friday, 4 February 2022. The report is expected to show that 238k new jobs were created in the month, whereas the unemployment rate should remain at around 3.9%.

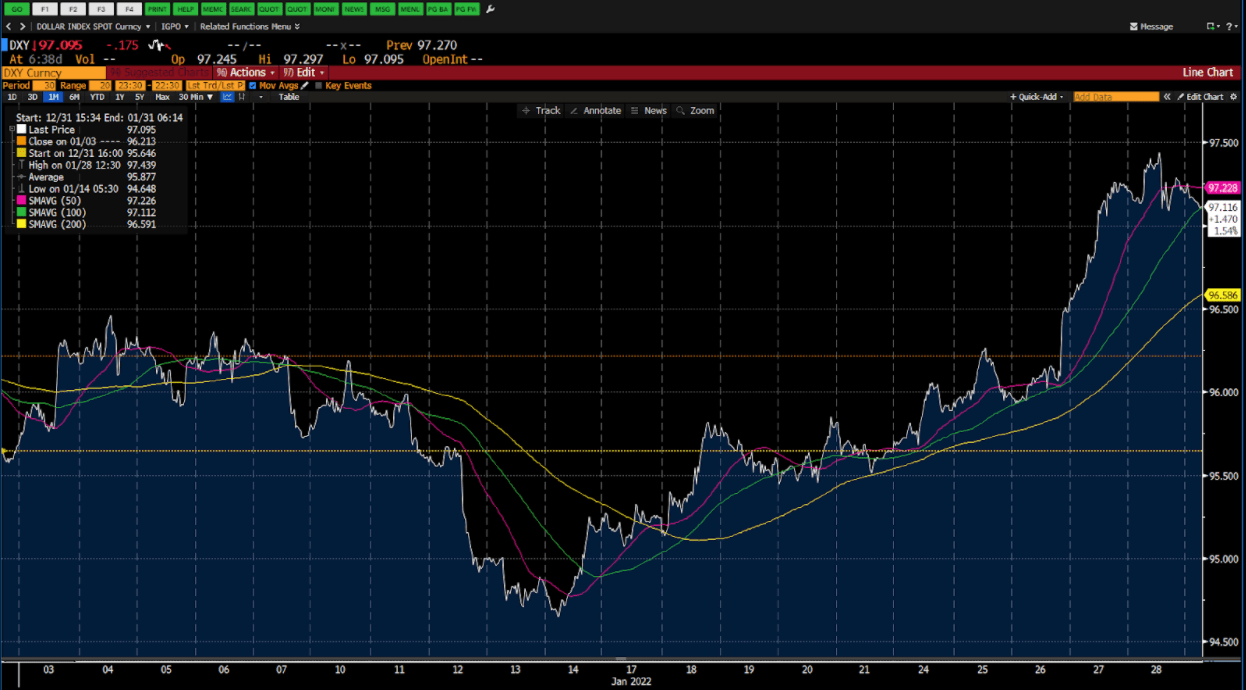

Commodities

Source: Bloomberg Click to view full size

Within 3 days, gold lost all of its gains since the start of the year, as the US Federal Reserve affirmed its hawkish stance. On Wednesday, 26 January 2022, the Fed announced that its policy settings would remain unchanged and that the quantitative easing program would end as scheduled in early March. However, during the Federal Open Market Committee press conference, Chairman Jerome Powell’s comments on the policy outlook sparked a rally in the USD and sent XAU/USD down sharply.

Although the XAU/USD pair reached its highest level since November on Wednesday, 26 January 2022, at $1,853, it lost more than 3% from that level to end the week below $1,800. As far as technical analysis is concerned, gold is trading below the 50% retracement level near $1796.93. The metal’s next support level will be near the 38.2% retracement level at around $1780.27.

Meanwhile, silver had its worst week of the year, dropping for 6 consecutive days, closing at approximately $22.39. Overall, silver accumulated losses of around 7.90% for the week – its highest since November 2021.

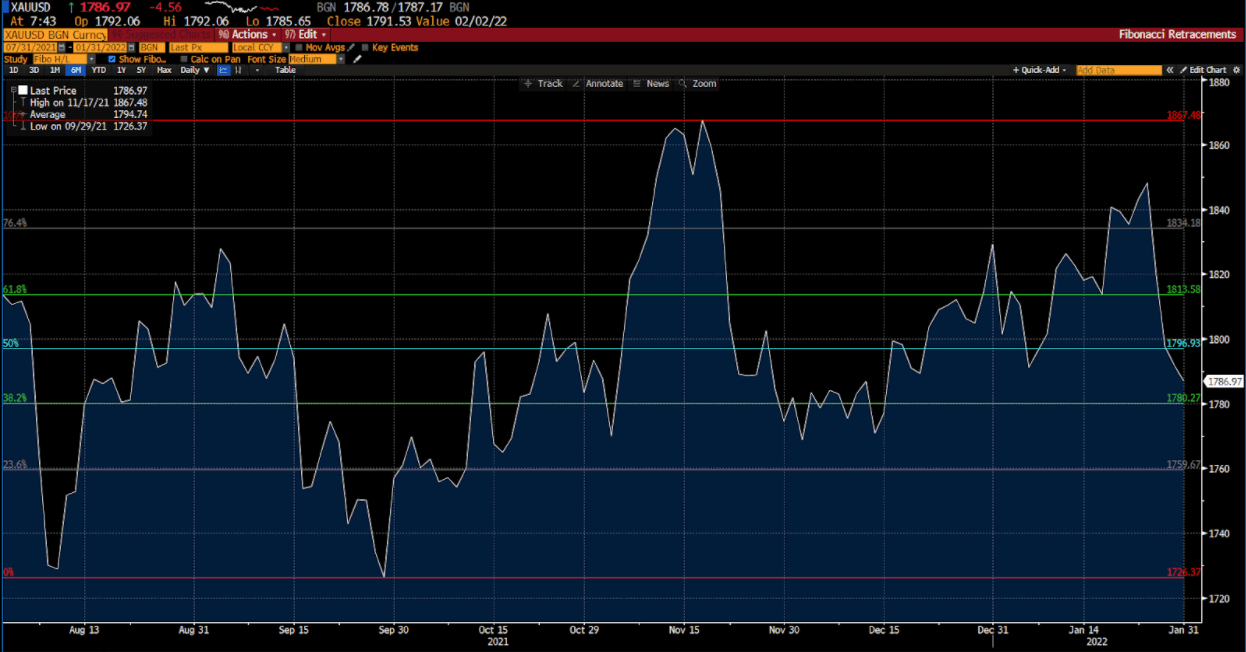

Cryptocurrencies

Source: Bloomberg Click to view full size

The cryptocurrency market plunged, with Bitcoin trading under $38,000. Compared to its all-time high of $69,000 hit in November, Bitcoin has fallen by nearly 20% since the start of 2022.

In recent weeks, the prices of cryptocurrencies have been under severe pressure. Traders have been worried about the ripple effect of expected Federal Reserve interest rate increases that have caused digital tokens and stocks to fall together since the beginning of the year. Last week, the Fed held interest rates near zero, aiming to increase rates to combat inflation.

Furthermore, on Thursday, 27 January 2022, the US Securities and Exchange Commission denied a proposal to list and trade shares of Fidelity’s Wise Origin Bitcoin Trust. When making its decision, the SEC cited trader protection and public interest concerns. Since last year, traders have been able to buy shares of an ETF that tracks Bitcoin futures contracts. However, a spot Bitcoin ETF would track the price of Bitcoin rather than the price of Bitcoin futures, and the SEC isn’t quite ready for that yet.

Currently, Bitcoin is trading at $37,200, right under its 38.2% retracement level of $37,400. If it breaches this level, the new resistance at 50% retracement level will be $38,700.

Meanwhile, Ethereum’s has been in a slump since its price dropped below $3,000 on 20 January 2022. Currently, the price is trading at $2,500, but on Monday, 24 January 2022, it fell below $2,200 – its lowest level since July 2021.

On the other hand, Dogecoin (DOGE) has climbed to ninth place by market capitalisation even though its price has slid more than 4% in the past 24 hours. The top meme cryptocurrency has managed to topple the embattled Terra (LUNA) token, which is down by another 10% amid a brutal sell-off.

US Indices

|

Name of the index |

Friday’s close |

Net Change |

Net Change (%) |

|

Dow Jones Industrial (US 30) |

34,725.47 |

360.97 |

+1.05% |

|

Nasdaq (US Tech 100) |

14,454.61 |

-54.97 |

-0.38% |

|

S&P 500 (US 500) |

4,431.85 |

+21.72 |

+0.49% |

Source: Bloomberg

On Friday, 28 January 2022, equity markets surged to reverse previous mid-week losses as traders witnessed another volatile week. The Dow Jones Industrial Average gained 1.05%, while the S&P 500 index ended a three-week losing streak by gaining 0.49%. However, the Nasdaq 100 ended with barely a change of -0.38% for the week.

Based on Thursday’s closing prices, the S&P 500 was on track to post a weekly loss of about 1.90%. As January comes to a close, the S&P 500 is paced for its worst monthly performance since March 2020, trading down by 7%. Furthermore, the Dow Jones could also witness its worst month since October 2020.

The latest economic data was the focus on Friday, 28 January 2022. In December, the Personal Consumption Expenditures (PCE) index rose by 5.8% year-over-year – the highest level since 1982. Out of this 5.8%, the core PCE, which excludes more volatile food and energy prices, rose at a 4.9% annual rate. Over the past month, all 3 major indices have fallen as traders consider the consequences of the Federal Reserve’s more hawkish monetary policy tilt. With traders digesting the Federal Reserve’s pivot to tighter policy, the CBOE Volatility Index, used as the market’s fear gauge, shot up to a yearly high of above 30.

In addition to this, Apple (AAPL) posted record earnings and better-than-expected profits, tech stocks led Friday’s rally. Meanwhile, Microsoft (MSFT) surpassed earnings expectations by posting revenues of $51.73bn versus forecasts of $50.88bn.

Fed Chairman Jerome Powell stated earlier this week that interest rates would be raised in March above near-zero levels. However, other questions remain unanswered, such as how quickly the Fed aims to raise interest rates and when it will begin reducing its $9 trillion balance sheet and tightening financial conditions.

Trade the financial markets with options and multipliers on DTrader or CFDs on Deriv X Financial account and Deriv MT5 Financial and Financial STP accounts.

Disclaimer:

Options trading, and the Deriv X platform, are not available for clients residing within the European Union or the United Kingdom.

Cryptocurrency trading is not available for clients residing within the United Kingdom.