Forex

Source: Bloomberg. Click to see full size

The weekly recovery of the US dollar failed to advance further north of the $99.00 mark over the weekend. Over the past few days, the US dollar index’s (DXY) volatility was moderate, with prices attempting to consolidate around the $98.75 area. Concerns surrounding the geopolitical landscape are expected to keep propping up the demand for the US dollar, along with prospects of extra tightening by the Fed.

The 1-month chart above shows that the asset is currently trading over its support level at the 76.4% retracement level of $98.65, followed by a second support level at the 61.8% retracement level of $98.30 level. Since the start of March, the asset has held an upward trend and is trading under its resistance level at the $99.30 level.

How did other pairs react?

The ramping up of hawkish Fed comments continues to apply downward pressure on the EUR/USD, which was clinging to the $1.1000 level on Friday, 25 March 2022.

The British pound rebounded from its intraday losses but failed to reclaim the $1.3200 mark, due to factors like a risk-on market mood, Fed hawkishness, and the Bank of England’s rate hike being perceived as a dovish increase. Technically speaking, on Friday, 25 March 2022, GBP/USD was trading at the $1.3180 level.

The USD/JPY pair has remained one of the top performers for traders and has been rallying after surpassing the level of ¥120.00 in the past few days. The Bank of Japan (BoJ) provided a bullish signal on Friday, 25 March 2022 and refrained from stepping into the markets to control the continuous rise in yields. In fact, even after the yield on the 10-year Japanese government bond (JGB) rose, the BoJ continued to buy an unlimited amount of bonds. Elevated US Treasury bond yields also attracted some USD dip-buying and further contributed to limiting the downside for the USD/JPY pair.

This week brings many high-impact US economic reports, including the February Personal Consumption Expenditure (PCE) data and the latest NFP figures. In light of the packed calendar, volatility is likely to pick up, setting the stage for large moves in the DXY index and financial markets in general.

Commodities

Source: Bloomberg. Click to see full size

In the first half of the week, gold fluctuated above $1,920 within a relatively tight range but regained its momentum after crossing $1,950 on Thursday, 24 March 2022. Although the yellow metal struggled to maintain its bullish momentum due to the surge in US Treasury bond yields and FOMC policymakers indicating an aggressive policy tightening, it increased by around 1.16% on a weekly basis.

Traders are getting increasingly anxious about the global economic consequences of a prolonged Russia-Ukraine conflict. Moreover, an increase in international tensions could aid the yellow metal in limiting its losses and vice versa.

As seen in the chart above, the recovery from sub-$1,900 levels paused around a resistance marked by the 38.2% retracement levels. A following drop below the 23.6% retracement level around the $1,941 mark may have altered the bias in favour of pessimistic traders, implying that more losses are likely. On the flip side, if gold finds its momentum, the next resistance level could again be 38.2% retracement near the $1,966 mark and accelerate towards the next resistance level at 50% retracement around the $1,986 mark.

On the other hand, oil prices rose amid supply concerns as Houthi rebels attacked Saudi Arabia’s energy assets and Russia maintained its military offensive in Ukraine. Oil ended at around $113 a barrel on Friday, 25 March 2022. Oil prices have also increased since global demand has outpaced crude production as economies recover from coronavirus.

Additionally, during a meeting with US President Joe Biden last week, EU members were split on whether or not to boycott Russian oil and gas. However, they failed to agree on a ban, and while refusing to agree to it may bring temporary relief, it does not alter the trend of rising demand and decreasing supply.

Cryptocurrencies

Source: Bloomberg. Click to see full size

While the entire crypto market pumped higher, Bitcoin and Ethereum in particular spiked on Sunday, 27 March 2022, pushing through their recent price resistance levels. Bitcoin was up by 14% in the past week, and Ethereum was up by 15%. However, on Sunday, Bitcoin was trading above the $44,600 level, whereas Ethereum topped the $3,100 mark.

Several factors have contributed to the increase in the crypto space:

- The S&P 500 has risen for a week straight, and Bitcoin’s correlation with stocks is at a 17-month high.

- Bitcoin balances on exchanges are also at their lowest in more than 3 years, signalling increased demand and an interest in moving Bitcoin off exchanges via cold storage methods like hardware wallets.

- Ukraine officially legalised cryptocurrencies and continued accepting donations (more than $100 million to date) in Bitcoin, Ethereum, Polkadot, and Dogecoin.

One of the best performing cryptocurrencies on the market was Terra (LUNA) which gained worldwide acclaim in light of its highly impressive price hike in the last 30 days. As a result, its management has announced plans to soon add nearly $10 billion worth of Bitcoin to its project’s reserves. They believe this action would create a new monetary era for the global Bitcoin standard.

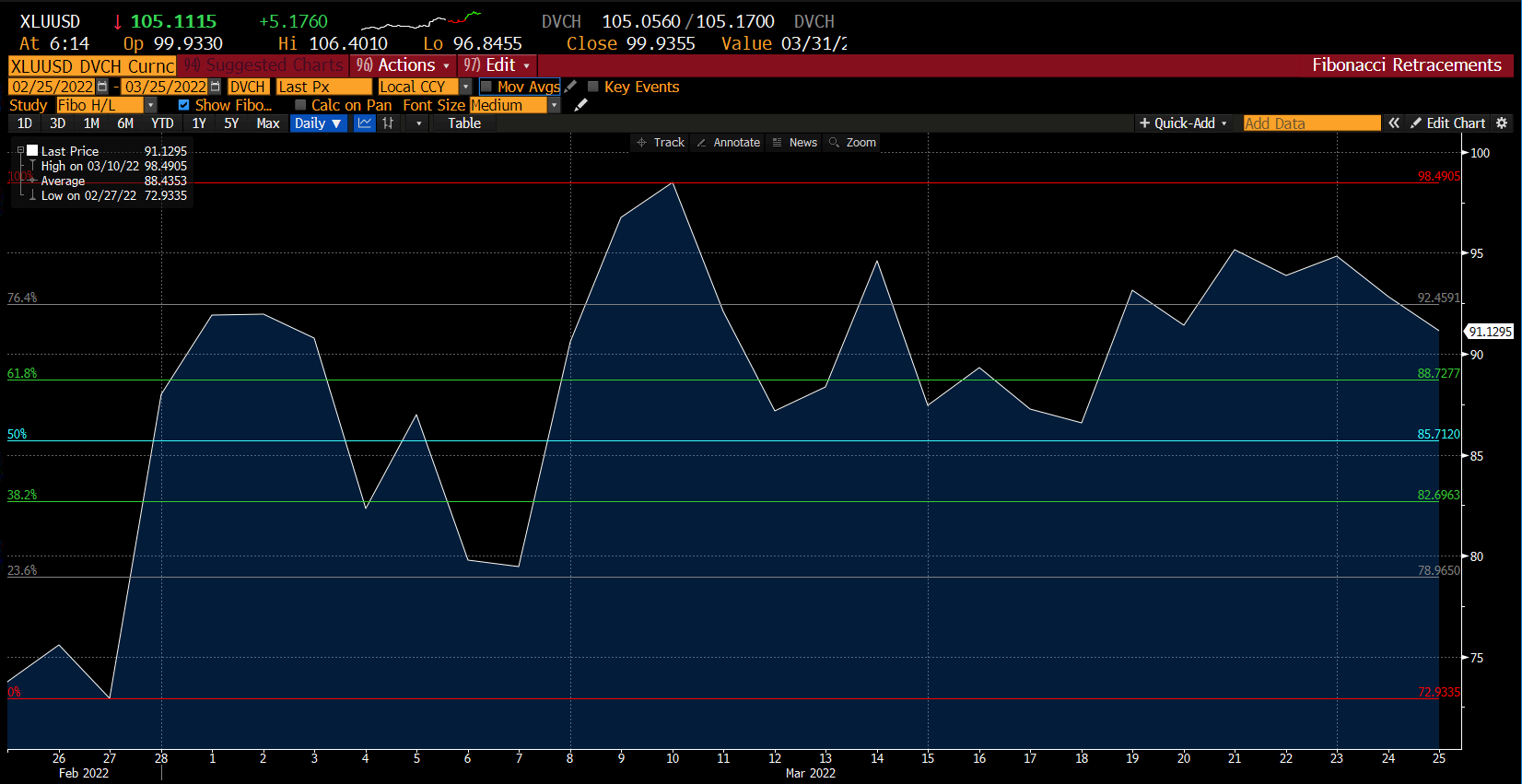

The chart above represents the upward trend in its prices since the beginning of March. The asset ended the week trading right in between its resistance at the 76.4% level of $92.50 and its support at the 61.9% level at $88.70.

Altcoins have been a preferred pick over the past week, but none more than Cardano (ADA). This Ethereum competitor had a rough go of it when it introduced smart contracts in 2021; the founder Charles Hoskinson said earlier this week that he was wrong about how quickly the network would accrue decentralised apps (dapps). That slow adoption stunted ADA in the initial months of 2022. However, things are now turning around, and today, the network hosts hundreds of dapps and millions of native NFTs.

The UK government will soon reveal plans to regulate the cryptocurrency market, focusing on a fast-growing type of token known as stablecoins. Stablecoins have seen exponential growth in terms of usage over the past few years, in tandem with rising interest in cryptocurrencies more broadly.

US Indices

|

Name of the index |

Friday’s close |

*Net Change |

*Net Change (%) |

|

Dow Jones Industrial (Wall Street 30) |

34,861.24 |

308.25 |

0.89% |

|

Nasdaq (US Tech 100) |

14,754.31 |

378.22 |

2.63% |

|

S&P 500 (US 500) |

4,543.06 |

81.88 |

1.84% |

Source: Bloomberg

*Net change and net change % are based on the weekly closing price change from Monday to Friday.

The S&P 500 and NASDAQ 100 both gained 1.84% and 2.63% last week, respectively, while the Dow gained 0.89%. Despite falling far short of the previous week’s surge, the results marked the second positive week in a row for stocks amid growing expectations of steep interest-rate increases ahead.

Concerns about the Federal Reserve’s increasingly hawkish stance weighed on equity sentiment early in the week, prompting a bond market sell-off. The sharp year-to-date decline in bond prices accelerated, sending the 10-year US Treasury bond yield to levels not seen since May 2019. The 10-year yield jumped to 2.49% on Friday, 25 March 2022, after finishing the previous week at 2.15%.

Additionally, the housing industry in the United States received some bad news ahead of the often bustling spring home-buying season, as pending house sales fell for the fourth month in a row, according to a study released on Friday, 25 March 2022. Compared to the previous month, pending sales declined by 4.1% in February – a drop that coincided with the recent climb in mortgage rates.

The monthly labour market update will be released this week in the United States and reveal whether the strong growth seen in February continued into March. February’s report showed that the economy added 678,000 jobs, the highest in seven months, and the unemployment rate dropped to 3.8%.

Trade the financial markets with options and multipliers on DTrader or CFDs on Deriv X Financial account and Deriv MT5 Financial and Financial STP accounts.

Disclaimer:

Options trading, DXY, and the Deriv X platform are not available for clients residing within the European Union or the United Kingdom.

Cryptocurrencies are not available to clients residing in the UK.