Forex

Source: Bloomberg. Click to see full size

The US Dollar Index (DXY) managed to regain some buying interest and moved beyond the $98.00 hurdle at the end of the week. After a four-day losing streak, it began to attract some bids around $97.73. But renewed fears of an escalation in geopolitical tensions between Russia and Ukraine brought a minor pause in the demand for risk-perceived assets, eventually resulting in a minor pullback for the DXY. Despite that, the Greenback remains around 1.5% higher for March. On the technical side, it is currently at around $98.79, well-settled above the moving average based on the six-month chart. Even though there is a bit of a fluctuation in the spikes due to the mentioned reasons above, it maintains its uptrend for now.

How did other pairs react?

After a strong week, the Euro suffered from some profit-taking, causing EUR/USD to fall back to the mid – $1.10s. Due to speculation of the start of the European Central Bank’s hiking cycle by the end of the year, the European currency faced some selling bias at the end of the week and faded from its recent uptick in the $1.1140 region.

GBP/USD erased some of its earlier weekly losses after the Bank of England (BoE’s) increased borrowing costs. It is worth noting that this was the third time the BoE consecutively raised their benchmark rates by a quarter to the percent.

The USD/JPY pair extended its steady intraday climb to a fresh multi-year peak – around ¥119.10 – ¥119.20, gaining ground on the last day of the week. The Bank of Japan stuck to its dovish stance and left its policy-setting unchanged at the end of the March meeting. This, in turn, weighed on the Japanese yen and pushed the pair higher amid a pickup in the US dollar demand.

Commodities

Source: Bloomberg. Click to see full size

At the beginning of last week, hopes for a diplomatic solution to the Russia-Ukraine conflict allowed risk flows to dominate financial markets, making it difficult for gold to find demand. Furthermore, on Wednesday, 16 March 2022, the US Federal Reserve announced that it would raise the policy rate by 25 basis points (bps). According to the revised Summary of Projections, policymakers expect 6 more rate hikes by the end of the year. The market’s initial reaction to the Fed’s hawkish rate outlook forced gold to go below the $1,900 mark.

However, there was a negative shift in risk sentiment in the second half of the week. This change aided gold’s recovery as both Russia and Ukraine officials denied reports that they were getting closer to a peace agreement.

As seen in the monthly chart above, gold is currently trading at around $1,925.75, close to its moving average. The 14-day RSI is just below the 50 level mark at about 49.93, suggesting further selling may be likely. If this momentum persists, it may have an expected bearish market trend.

Since late February, gold’s reaction to changes in risk sentiment has been fairly straightforward. If this week’s developments indicate a further conflict escalation, gold should rally and begin regaining last week’s losses. On the other hand, if markets remain optimistic about a cease-fire, the precious metal may face renewed selling pressure.

On the other hand, Oil prices found a floor above $100 per barrel on Friday, 18 March 2022, following a week of volatile trading. Since there’s no easy replacement for Russian barrels in sight, the market is already characterised by tight supply.

The rise in oil prices and other commodities exported by Russia has also fueled inflation fears as governments seek to stimulate growth in the aftermath of the pandemic. The Federal Reserve raised interest rates last week and signalled further increases to match the pace of the rise in prices.

However, the recent surge in COVID-19 cases and the fact that closures in China are in place now may threaten the oil demand. Lastly, with nuclear proliferation talks making little progress, the possibility of Iran supplying additional barrels has also contributed to the volatility in the oil prices.

Cryptocurrencies

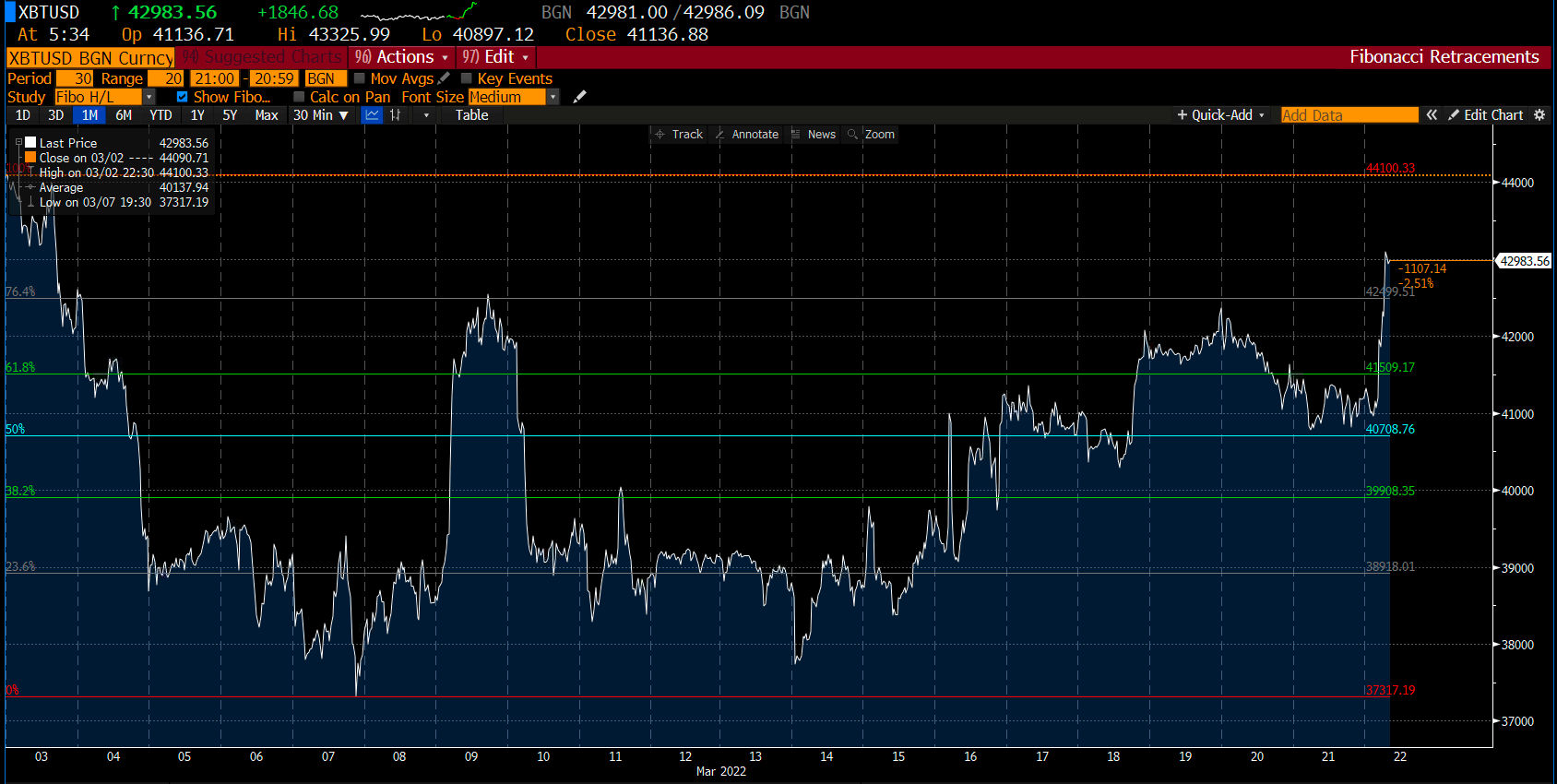

Source: Bloomberg. Click to see full size

The US Federal Reserve’s long-awaited announcement of interest rate hikes kept Bitcoin’s price above $40,000. For the first time in 3 years, Fed Chair Jerome Powell announced plans to raise interest rates by 25 basis points. After weeks of low volatility, Bitcoin’s price experienced a surge, skyrocketing by $3,000 in one day.

Technically, at the start of the week, Bitcoin was trading close to the 23.6% retracement level at around $38,900, followed by an uptrend and then range-bound between 50% and 61.8% retracement levels. As per the monthly chart above, it went above the 61.8% retracement level for a brief time. However, it reverted to range-bound until it breached the major resistance level at 61.8% around the $41,500 mark and hit the next resistance level at 76.4% around the $42,500 mark. At the time of writing, Bitcoin is trading around the $42,983.56 mark.

Despite a soaring US dollar, declining Bitcoin mining, and falling NFT interest, Bitcoin is still impressively hovering around $40,000.

Several leading cryptocurrencies rallied more than 10% in the last week, with Ethereum, Solana, Cardano, and Avalanche posting some of the highest gains.

By market capitalisation, Avalanche had the most significant growth last week among the top 20 cryptocurrencies. Avalanche shot up by almost 30% to hit the $90 mark. While it’s 37.5% off its former all-time high of $146.22, set 4 months ago, this is by far the biggest rise for a leading cryptocurrency in the last 7 days.

Both Solana and Cardano, 2 other smart contract giants, rose by more than 11% and 12%, respectively.

US Indices

|

Name of the index |

Friday’s close |

*Net Change |

*Net Change (%) |

|

Dow Jones Industrial (Wall Street 30) |

34,754.93 |

1,809.69 |

5.49% |

|

Nasdaq (US Tech 100) |

14,420.08 |

1,373.44 |

10.53% |

|

S&P 500 (US 500) |

4,463.12 |

290.01 |

6.95% |

Source: Bloomberg

*Net change and net change % are based on the weekly closing price change from Monday to Friday.

The major US market indices gained by around 5.50% to 10.50% last week, regaining all ground lost in the previous two weeks. Multiple factors supported the market, including falling oil prices, news that Russia avoided defaulting on its sovereign debt and the outcome of the Federal Reserve’s monetary policy meeting. While tensions in Ukraine continued, market sentiment was sustained this week by ongoing talks to end the conflict. Gains were widespread across the major indices, with the Nasdaq 100 leading the way.

On the other hand, the government bond prices fell in a rising-rate environment with high inflation, sending sharply higher yields for the second week in a row. The 10-year US Treasury bond yield rose to around 2.15% on Friday, 18 March 2022, the highest level in nearly 3 years.

The Federal Reserve of the United States raised interest rates for the first time since 2018, following market expectations to raise its benchmark lending rate by a quarter percentage point to a range of 0.25% to 0.50%. Policymakers have indicated that they intend to raise interest rates at each of their 6 remaining policy meetings through the end of 2022.

Trade the financial markets with options and multipliers on DTrader or CFDs on Deriv X Financial account and Deriv MT5 Financial and Financial STP accounts.

Disclaimer:

Options trading, DXY, and the Deriv X platform are not available for clients residing within the European Union or the United Kingdom.

Cryptocurrencies are not available to clients residing in the UK.