Forex

Source: Bloomberg. Click to see full size

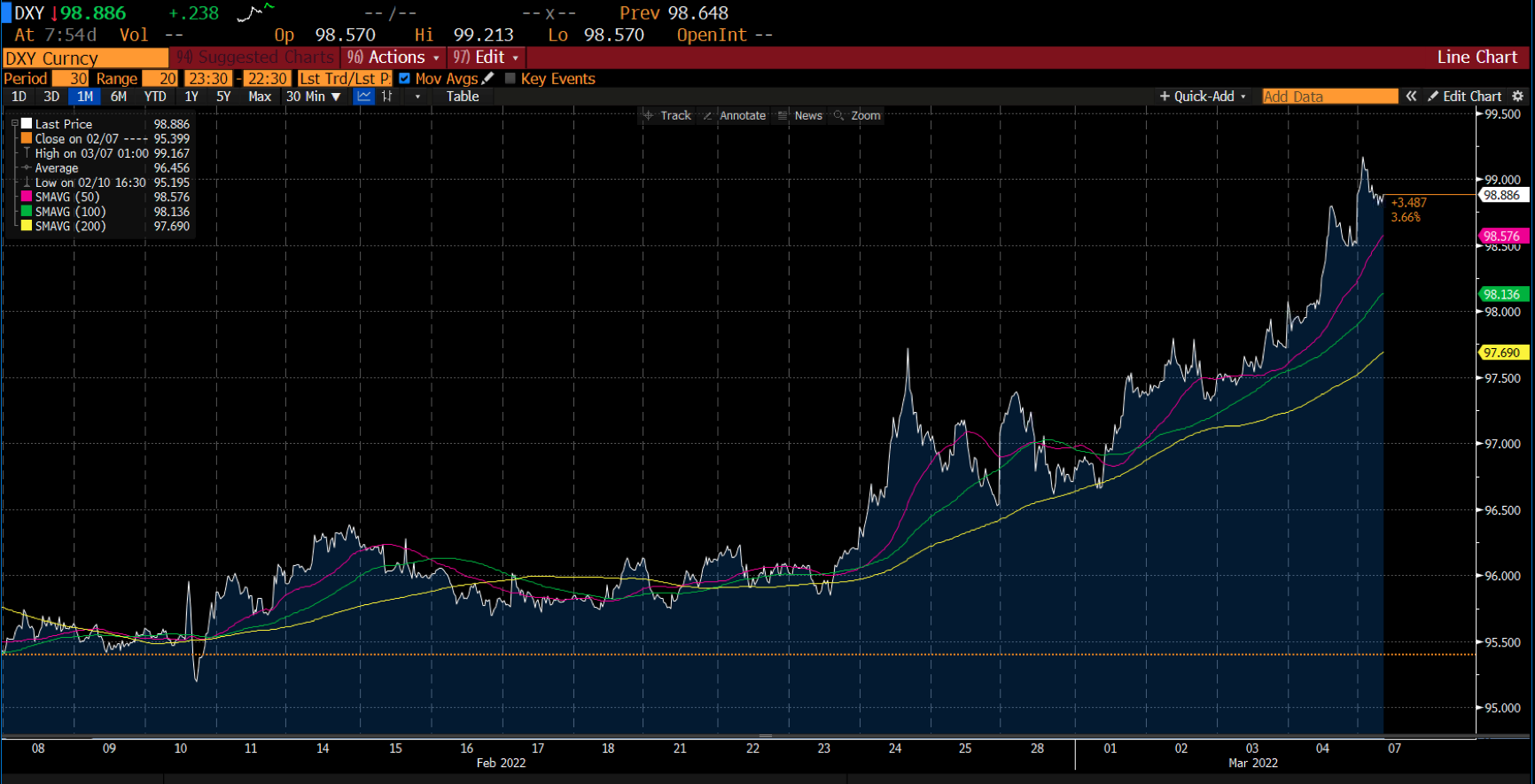

As the Ukraine-Russia conflict intensifies, the US Dollar Index (DXY) surges to $99.10, the highest level since May 2020. The quote restarted its trading this week with an upside gap, rising 0.63% intraday which resulted in new highs for the week.

Economic data from the US came in above expectations but it made no difference on market sentiment. There was a 678K increase in payroll in February, more than the expected 407K — making it the best month since July 2021. The unemployment rate dropped from 4% to 3.8% (even as the labour participation rate rose), and average hourly earnings stagnated in February against expectations of a 0.5% increase.

EUR/USD continues its four-week downtrend, hitting a fresh multi-day low as the trading week ended. Last week, this major currency pair dropped to its lowest levels since May 2020. In addition to the risk-off mood, the Fed is facing escalating pressure to lift its benchmark rates at a faster pace as inflation increases.

USD/JPY broke to the downside falling to ¥114.90, its lowest level since Wednesday’s Asian session. And GBP/USD is battling $1.3200 after hitting fresh 2022 lows at $1.3185, amid the Ukraine crisis-led risk-aversion and a firmer US dollar.

AUD/USD rallied for the third day in a row, closing the week in green. The pair faced strong resistance near $0.7369 even after the US Department of Labor reported that the US economy added more jobs than expected.

We await the US Consumer Price Index (CPI) for February this week as well as the decision of the European Central Bank on its monetary policy meeting for fresh stimulus. Close attention will also be paid to Russia-Ukraine headlines.

Commodities

Source: Bloomberg. Click to see full size

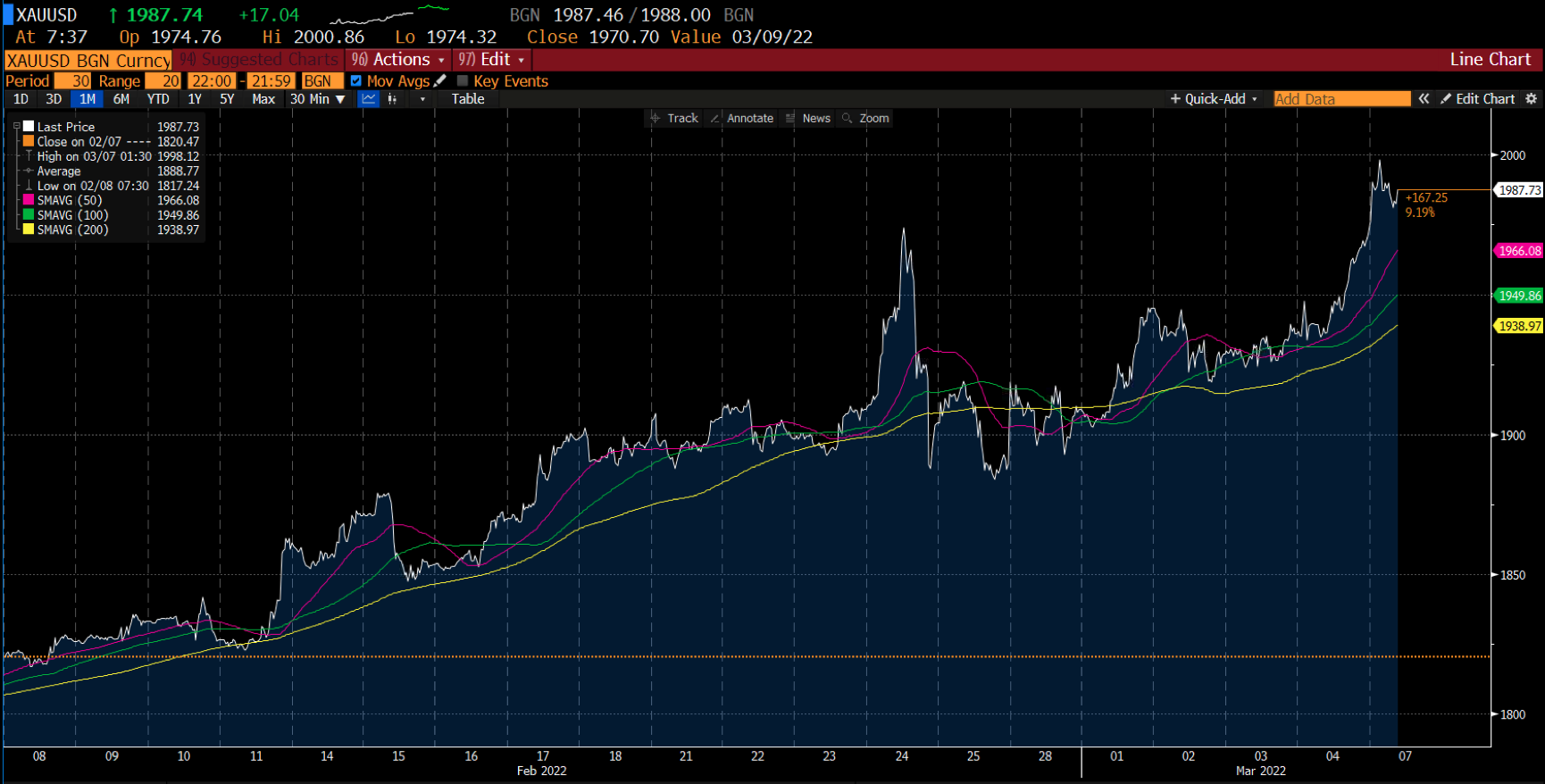

Oil prices soared last week to decade-level highs as geopolitical troubles in Ukraine and looming US sanctions pushed the energy markets higher.

The global benchmark, US West Texas Intermediate (WTI) rose $19.96, or 20.85%, to settle at $115 — its highest close since 2014. And Brent Crude gained 15.9%, closing Friday’s session above $118 a barrel.

Prices were pushed higher from the news that the United States and its allies were engaged in a “very active discussion” on a potential embargo of Russian oil and natural gas imports, according to US Secretary of State, Antony Blinken.

Russian-supplied oil to the US last year accounted for only 3% of total crude shipments that arrived to the US, making a short-term trade ban highly plausible. However, Europe is far more dependent with an estimated 30% of its oil supplies coming from Russia, so it may not follow suit.

Brent Crude could end the year at $185 if Russia’s energy supplies continue to be disrupted, according to JPMorgan Chase. They predict that without any Russian barrels, oil prices could go as high as $150 within the next three months.

Meanwhile in the metal markets, gold rose sharply amidst panic in the equity markets. The yellow metal hit $2,000 last week, its highest level since mid-2020. Last week’s rally took gold’s price back above its 50-,100-, and 200-day simple moving average, trading around $1,990 mark at the time of writing.

Cryptocurrencies

Source: Bloomberg. Click to see full size

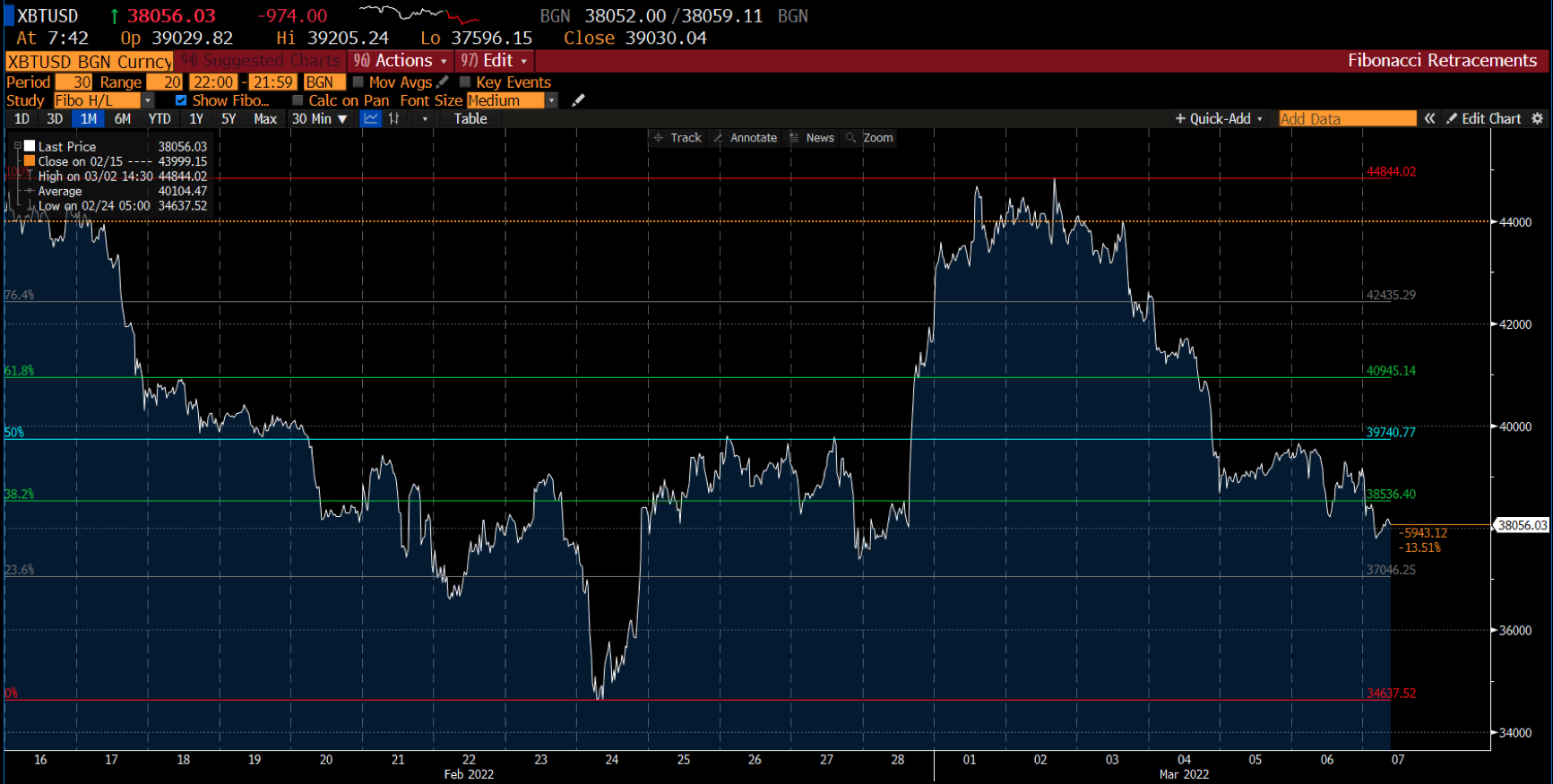

Bitcoin traded below some critical support zones last week after a late sell-off cost the cryptocurrency its key $40,000 level. After its latest run above $44,000 earlier in the week, Bitcoin failed to preserve this trend, pushing back to its average range for 2022 at around the $39,000 mark.

Bitcoin may be tested at its primary support level at around $37,050 levels at the 26.6% retracement level. Any upwards momentum would bring Bitcoin’s initial resistance level into play at around $38,540. Above this lies Bitcoin’s secondary level of resistance at $39,470, at 50% retracement.

Due to the short-term flight to safety taking over market sentiment, gold and the US dollar have profited at the expense of Bitcoin. Market commentators have ascribed the downturn of the crypto markets simply to short-term panic.

Proponents of Bitcoin are known to have called the asset “digital gold” — the idea that Bitcoin is a safe haven and store of value in times of market turmoil. This argument resurfaced as Bitcoin reached $44,000 as the war in Ukraine intensified.

But prominent market commentators have disagreed with this notion. “Crypto has aggressively sold off since it was clear the Fed were going to hike rates faster than anticipated which in turn saw stocks sell off. This is not the definition of a safe haven,” remarked Lux Thiagarajah, BCB Group’s head of trading.

What’s clear is that cryptocurrencies in general continue to be a key talking point during Russia’s invasion of Ukraine for its potential ability to evade economic sanctions. With major financial institutions being placed on a US sanctions list that prohibits business and the movement of money, this has led to a debate about whether cryptocurrencies like Bitcoin, which are decentralised in nature, could be a financial loophole that evades such restrictions.

US Indices

|

Name of the index |

Friday’s close |

*Net Change |

*Net Change (%) |

|

Dow Jones Industrial (Wall Street 30) |

33,614.80 |

-277.80 |

-0.82% |

|

Nasdaq (US Tech 100) |

13,837.83 |

-399.98 |

-2.81% |

|

S&P 500 (US 500) |

4,328.87 |

-45.07 |

-1.03% |

Source: Bloomberg

*Net change and net change % are based on the weekly closing price change from Monday to Friday.

Last week, markets were volatile but showed resilience as solid economic data helped alleviate some of the rising geopolitical concerns. However, the conflict in Ukraine is having a more significant impact on several aspects, most notably commodity prices, inflation, and interest rates.

Economic events appeared to play a secondary role in shaping sentiment, despite traders paying close attention to Federal Reserve Chair Jerome Powell’s Congressional testimony on Wednesday and Thursday. Powell stated that it was “too early to say” whether Russia’s invasion would affect the Fed’s policy in the medium term but that policymakers would “move cautiously”. Powell also stated that he was inclined to keep the federal funds rate at a quarter-point increase in March, putting to rest fears of a 50-basis-point (0.50%) increase.

Additionally, the price of US government bonds increased, causing yields to fall dramatically. The 10-year US Treasury bond yield began the week at 1.92%, dipped to as low as 1.68% on Tuesday (3 March 2022), then stabilised at 1.73% on Friday, indicating an increase in volatility.

Trade the financial markets with options and multipliers on DTrader or CFDs on Deriv X Financial account and Deriv MT5 Financial and Financial STP accounts.

Disclaimer:

Options trading, and the Deriv X platform, are not available for clients residing within the European Union or the United Kingdom.

Cryptocurrency trading is not available for clients residing within the United Kingdom.