Banking services are an essential part of our lives. We get paid, pay the bills, and swipe our bank cards at grocery stores all the time. In one way or another, almost every financial operation we do goes through a bank.

Yet, despite its vital necessity, the banking industry is confronted with some fierce competition. The emerging non-traditional banking trend is slowly taking over the market, and many believe it to be more aligned with evolving consumer needs.

The take-off point of the competition

The crisis of 2008 was one of the worst economic disasters for the entire world. Once the dust settled, it didn’t take long to find out that the market collapse was triggered by incompetent actions by the banks.

As the entire financial industry derailed, banks began actively investing in hedge funds, using their clients’ money. To raise more funds for this financial activity, they started signing off too many mortgages without conducting background checks. When the borrowers stopped paying, the artificially-created housing bubble burst, wrecking the entire industry along the way. Millions of people were affected, including those with no mortgages at all. Banks used their savings for investing with a high risk of no return and weren’t able to cover the deficit without the cash injection from the homeowners.

It was never a secret that when you keep your money in the bank, as a long-term deposit, for example, your resources are being used to fund other financial operations. However, when the crisis struck, it became apparent that there were no limitations or solid policy behind such utilisation. Consumer’s trust in bank services was broken. People were in need of safer solutions to manage their finances.

That’s when non-traditional banking started growing rapidly to fill the void. A little more than a decade later, temporary bank closures, caused by the worldwide pandemic and global lockdowns, served as a fertiliser to an already gaining popularity trend.

So what are these non-traditional banks?

Today we are presented with a wide range of alternatives to the good old traditional bank account. Real estate trust funds, fintech companies, or neobanks that operate solely online without any physical location are just some non-traditional banks examples. Even well-known tech giants like Google and Amazon provide money transfer services that exclude traditional banks entirely.

These new institutions offer lower fees, faster services, full transparency of transactions, extra services and a more wholesome customer service approach.

But despite growing popularity, it’s still questionable whether non-traditional banks are here to replace traditional banking. After all, the majority of alternative banks are still tied to regular banks due to licensing regulations.

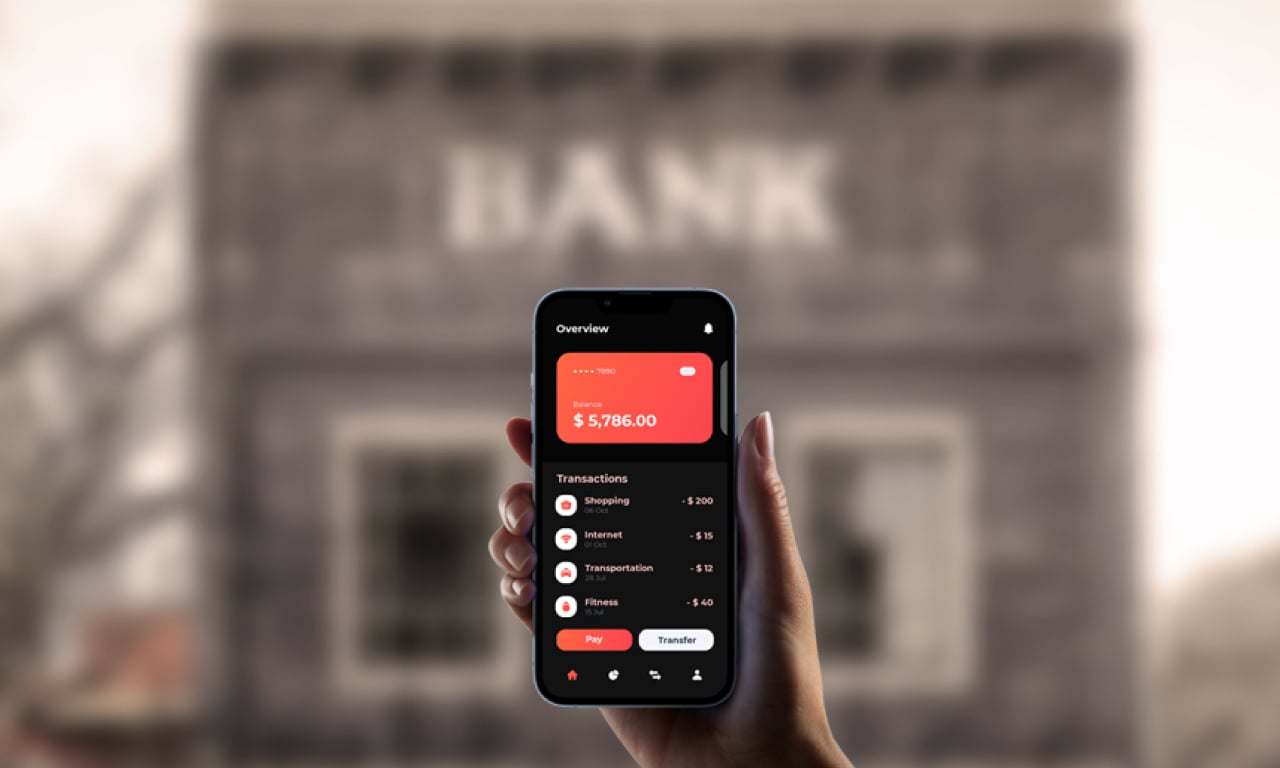

Plus, it looks like traditional banking is not going to give up easily. With the strong competition breathing down their necks, banks have no other choice but to refine their services. Interactive and user-friendly mobile apps, a growing number of extra services, and increasing accessibility reveal the determination to keep up with the evolving demand.

So who is leading in this race? In a modern, ever-changing world, it’s quite hard to identify the winner or even predict the outcome of this confrontation. But we certainly need to be ready to embrace any possible scenario. And that’s our strategy at Deriv.

How does Deriv keep up with the non-traditional banking trend?

For international fintech companies like us, it’s too early to talk about discarding traditional banking entirely. That’s why we are focused on blending both traditional and non-traditional services to provide our clients with alternatives according to their preferences.

Therefore, we offer multiple deposit and withdrawal options that include both traditional and non-traditional banking – regular bank transfers, digital or crypto wallets, and peer-to-peer solutions. Our fiat to crypto exchange is one of the latest trends Deriv has embraced to bridge the two worlds.

Regardless of services our client chooses, we keep their money completely segregated from company funds to ensure its safety. Clients are free to track the movement of their funds and to withdraw them whenever they want because they aren’t merged with the company’s funds or used for business interest.

We also strive to be as accessible and supportive to our clients as possible to make sure they are always up to date and have access to high-quality modern solutions. That’s why we are continuously working on introducing new platforms, mobile apps, products, and services to deliver a reliable and seamless on-the-go experience. And our customer support is available round the clock to help with technical difficulties or general questions.

So whether non-traditional banks will take over the industry eventually or some new trend will emerge in the nearest future, we’ve got your back.

Disclaimer:

Fiat to crypto exchange and peer-to-peer solutions are not available for clients residing within the EU.

This content is not intended for clients residing in the UK.