Everybody loves a little bit of personalisation. It’s like getting a customised t-shirt rather than a one-size-fits-all item. When compared to something off the rack, a tailor-made design will make you look and feel great.

Deriv X offers you the same feeling by putting you in control of your trading environment. Placing trades becomes much easier when you have everything exactly where you want with this highly customisable CFD trading platform.

In this blog post, we’ll go through how to place your first trade on Deriv X to help you get started.

How to place your first trade

Before getting started on Deriv X, you’ll need an account. If you don’t have a Deriv X account yet, check out this video on how to create an account.

Step 1

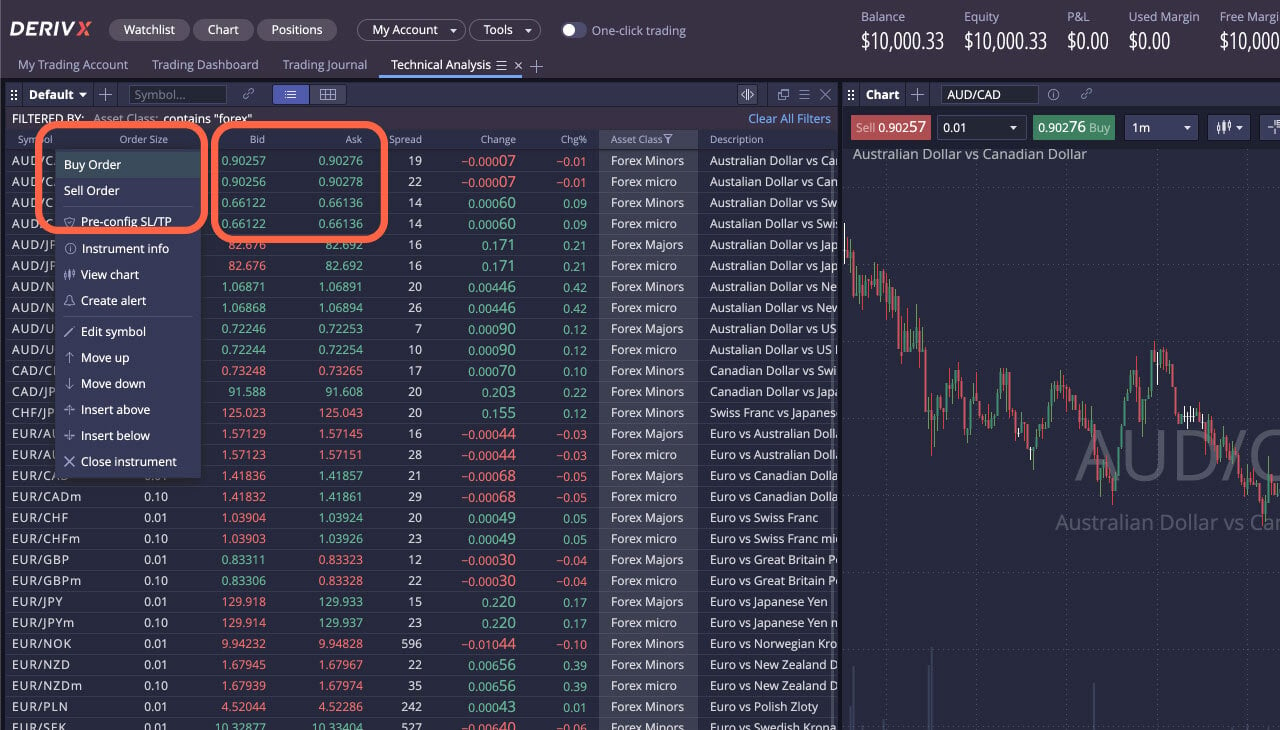

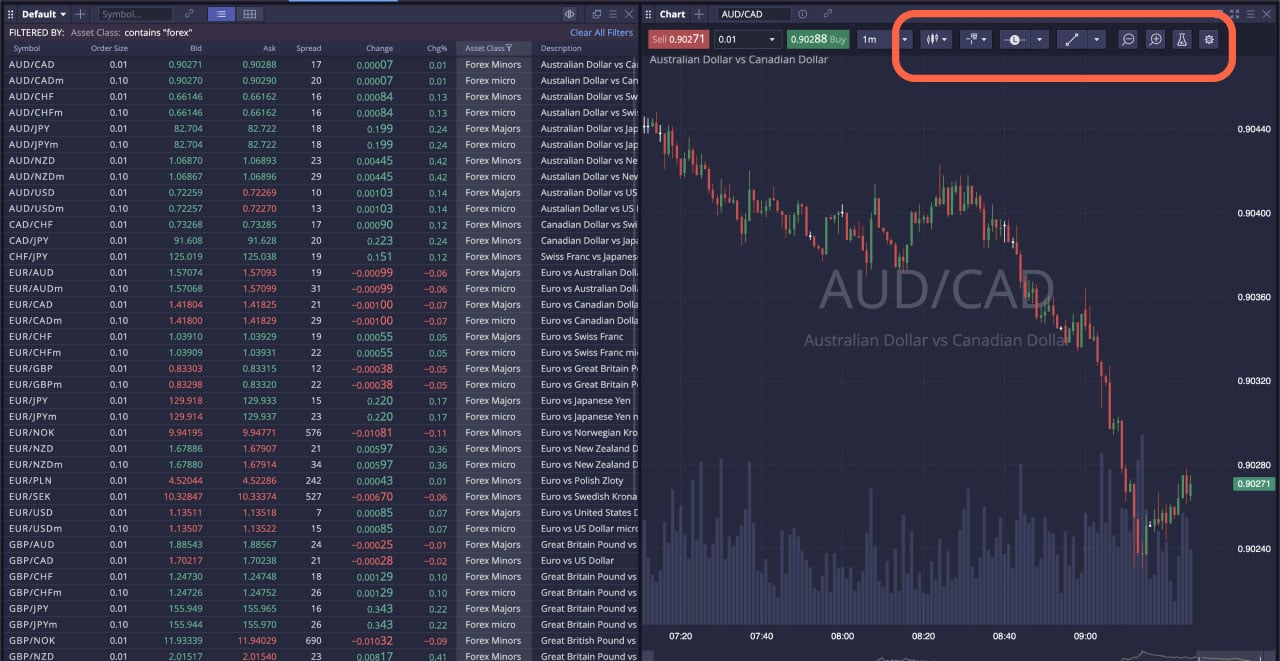

After logging-in, use the filter in the Asset Class column to view the Asset category you want to trade, and select your preferred asset from the list. You can choose assets from financial markets like forex, commodities and cryptocurrencies.

If you want to trade synthetics, click the Account tab, located in the top right corner of the platform, and select the second account listed there. Your Watchlist will switch and only display the synthetics assets.

Step 2

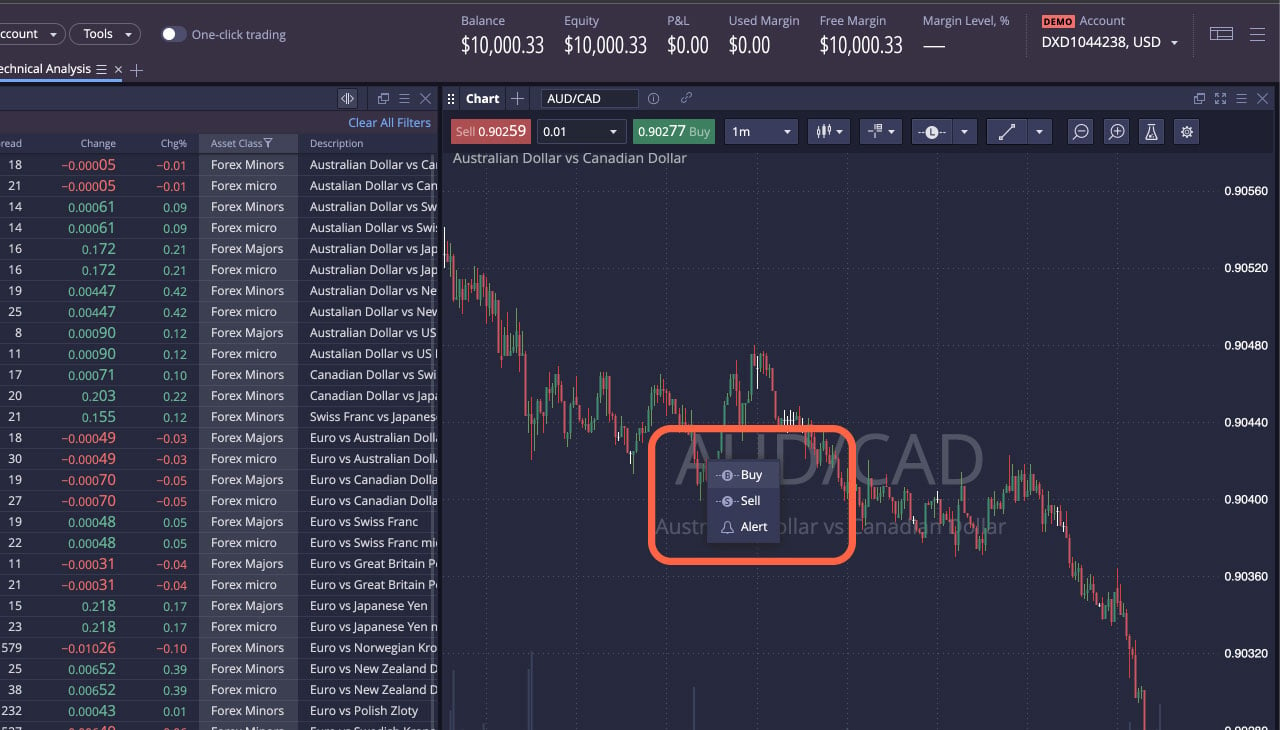

There are 3 ways to place a trade on Deriv X:

- Right-click on the asset in the watchlist, and select either Buy order or Sell order

- Click on the Bid or Ask price in the watchlist

- Right-click on the asset’s chart, and select either Buy or Sell

Step 3

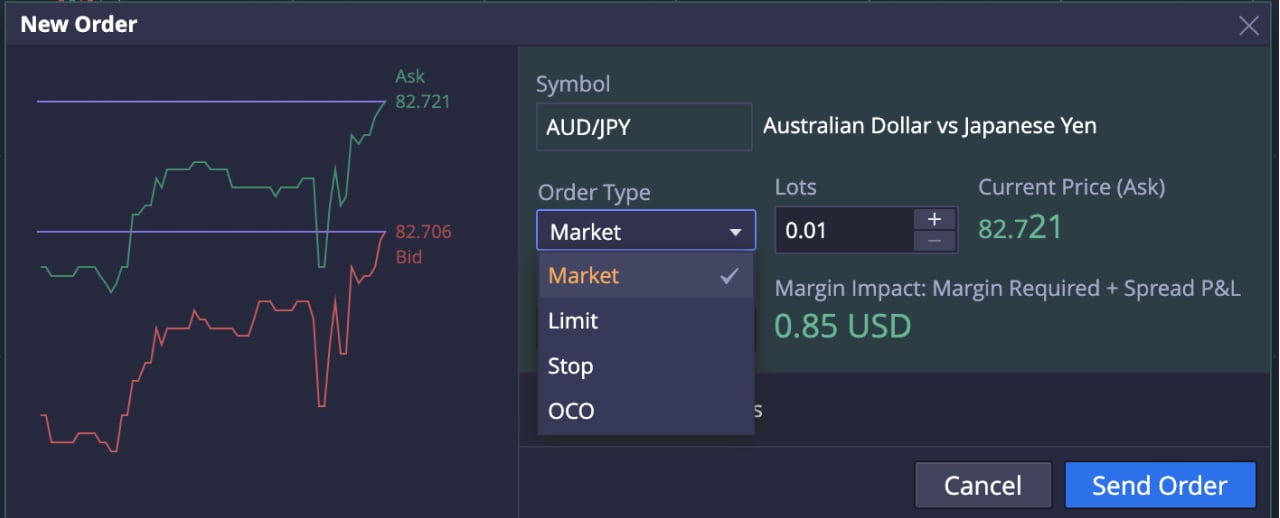

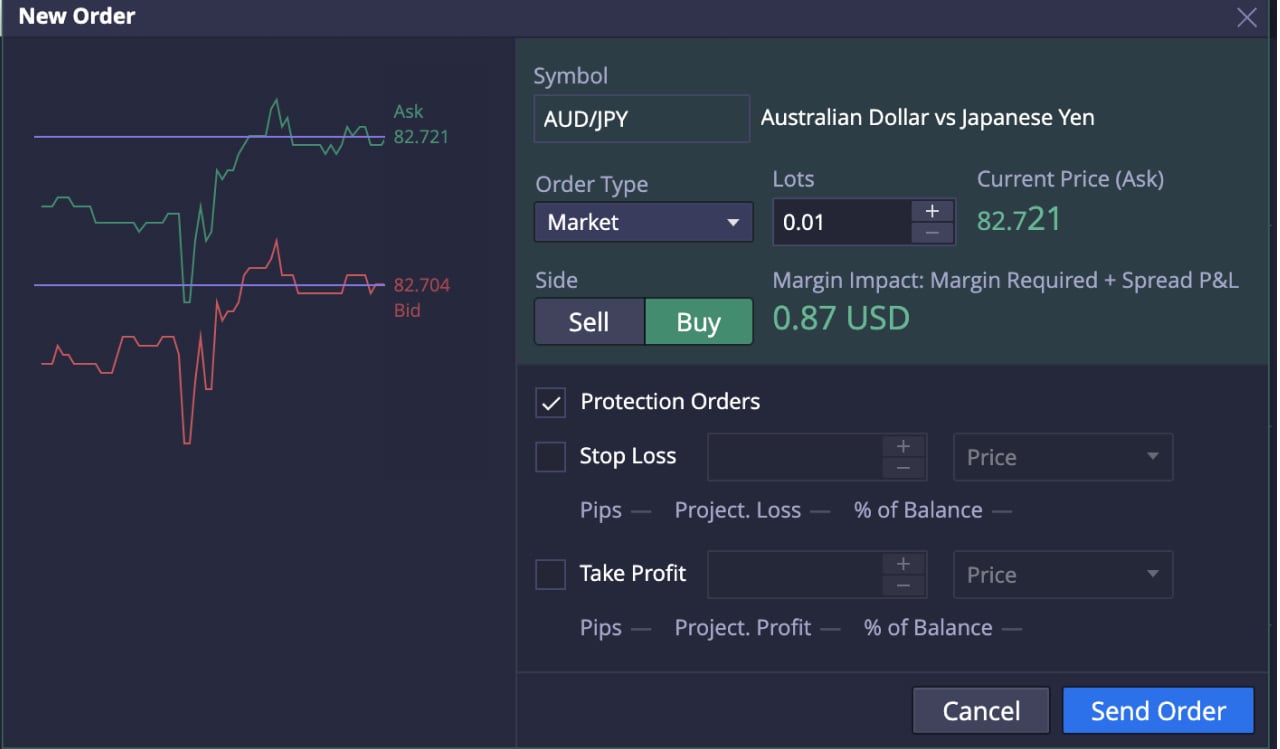

You will now see a New Order box pop-up on your screen where you need to:

- Select your order type (Market, Limit, Stop, OCO)

- Specify your lot size

- Select a buy or sell order depending on how you predict the market will move

- Set your preferred limit, if you place a Limit, Stop, or OCO order

- Set your stop loss or take profit limits by clicking Protection Orders

- Click Send Order

That’s it! You’ve successfully placed your first CFD trade on Deriv X.

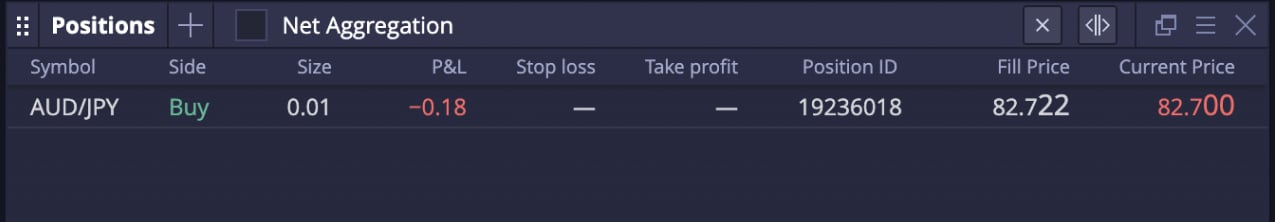

You should be able to view your new position listed in the Positions panel. Click on the position to see the details of your trade, including position ID, fill price (the price at which you opened your trade), current price, and profit or loss according to current market price.

If you want to modify your stop loss or take profit limits, double-click on the open position. To close your trade, right-click on the open position and select Close Position.

Aside from enjoying a personalised trading experience on Deriv X, you can also upgrade your ability to predict price movements by customising your chart with drawing tools and technical indicators accessible at the top of the chart window.

Ready to explore the platform and practise CFD trading with virtual funds? Log in to your Deriv X demo account right away, or read our blog on what is technical analysis in trading before placing your first CFD trade on Deriv X.

Disclaimer:

The Deriv X platform is not available for clients residing within the European Union.