Options commissions

To start earning commissions from Options trades, you need to:

- Sign up for a Partner’s Hub account to become a Deriv partner.

- Go to Open dashboard > My Referral Links.

- Choose your preferred Options commission plan. Each plan comes with a unique referral link:

- Turnover (applies to both Options and CFDs trading)

- Revenue Share (applies to Options trading only)

- Click the hamburger icon next to your chosen plan.

- Select Copy Link to share it with your clients.

Learn more about how to start earning commissions from CFDs trading.

As a Deriv partner promoting Options trading, you’ll enjoy the following benefits:

- Up to 45% commission (from Revenue Share or Turnover plan)

- Multilingual support to reach clients in different regions

- Detailed earnings reports to track your performance

- A dedicated Account Manager to guide your growth

- 24/7 live chat support for you and your clients

We have these commission plans for partners promoting Options:

- Revenue Share: Earn commissions up to 45% based on the monthly net revenue generated by your clients.

- Turnover: Earn up to 1.5% on Digital Options stakes and up to 40% of Deriv’s commission from contracts such as Multipliers, Accumulators, and others.

For partners promoting CFDs, refer to this question on CFD calculations.

Partners will earn commission from clients who trade Options on:

- Deriv platforms: Deriv Trader, SmartTrader, Deriv Bot, Deriv Nakala, and Deriv GO.

- Third-party platforms: Only via Deriv API.

For Affiliates with clients who trade CFDs, refer to Which trading platforms are part of the Deriv IB programme?

Deriv’s Revenue Share plan allows partners to earn commissions based on the monthly net revenue generated by their clients' Options trades. The commission rate varies depending on the amount of net revenue generated.

Please note that partners residing in the EU can sign up for the Revenue Share plan but can only refer clients residing outside the EU.

For monthly net revenue of Options trades:

- USD 20,000 or less: 30% commission

- Exceeding USD 20,000: 45% commission

For example:

If a client generates USD 10,000 in monthly net revenue:

- Commission: USD 10,000 x 30% = USD 3,000

If a client generates USD 25,000 in monthly net revenue:

- Commission for first USD 20,000: USD 20,000 x 30% = USD 6,000

- Commission for remaining USD 5,000: USD 5,000 x 45% = USD 2,250

- Total commission: USD 6,000 + USD 2,250 = USD 8,250

Only Multiplier Financials are excluded from Affiliate commission generation.

Digital Options: Based on the payout probability of the client's contracts. For more detailed calculations, refer to the commission structure of Digital Options.

Multipliers: 40% of commissions Deriv receives

Accumulator Options: 40% of commissions Deriv receives

Turbo Options: 40% of commissions Deriv receives

Vanilla Options: 40% of commissions Deriv receives

Lookbacks (only on SmartTrader): 0.8% of the trade stake

Note: EU-based partners can sign up for the Turnover plan but can only refer clients who reside outside the EU.

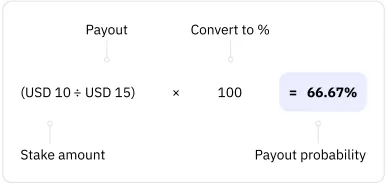

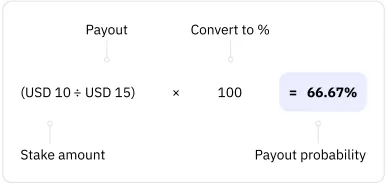

For Digital Options, the commission is based on the payout probability of the client’s contracts.

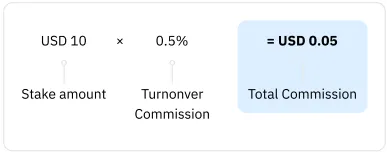

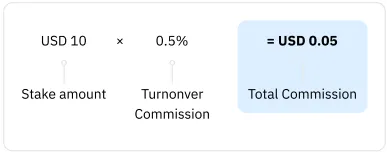

Commission = Stake amount x Turnover commission (%)

If a client trades Digital Options with a stake of USD 10 and receives a payout of USD 15:

- Payout probability

Based on the probability chart, this falls under the 0.5% commission rate

- Commission calculation

Total commission earned: USD 0.05

Commission = Client fee x 40%

Client trades multipliers with a stake of USD137 with a multiplier of 100. The client ischarged USD 5 for this trade (client fee).

Total commission earned: USD 2

Commission = Client fee x 40%

Commission = Stake amount x 0.8%

If a client trades Lookbacks with a stake of USD 10:

Total commission earned: USD 0.08

The CPA plan is for Affiliates who target clients in the EU. You earn USD 100 when a newly referred client with an EU account deposits a total of USD 100 (or its equivalent) into their Deriv account, either in a single deposit or cumulatively.

Note the following restrictions:

- It is limited to affiliates promoting to clients with a DIEL account.

- Due to regulatory restrictions, you cannot have clients residing in Portugal or Spain.

The CPA plan is available to affiliates with accounts registered under Deriv Investments (Europe) Limited (DIEL).

To check your eligibility, contact us via live chat.

Example 1

If a referred client with a DIEL account deposits USD 100 in one transaction:

Total commission earned = USD 100

Example 2

If a referred client with a DIEL account based in the EU deposits USD 50 in their first transaction:

Commission earned = USD 0

When the same client deposits USD 50 in a second transaction:

Total commission earned = USD 100

Example 3

If a referred client with a DIEL account deposits USD 200 in one transaction:

Total commission earned = USD 100

No, CPA is a one-time payment per client.

1. Commissions

- Revenue Share: From clients' revenue

- Turnover: From clients' trades on Digital Options (based on contract's payout probability) and Options (based on trade commission, up to 40%)

- CPA: From clients' deposits

2. How to Register

- Revenue Share: On the Deriv website

- Turnover: On the Deriv website

- CPA: On the Deriv website

3. Eligible Clients

- Revenue Share: Non-EU clients

- Turnover: Non-EU clients

- CPA: Clients with a EU account

4. IB

- Revenue Share: Yes

- Turnover: Yes

- CPA: No

5. Platforms

- Revenue Share: All official Deriv platforms & third-party platforms via Deriv API

- Turnover: All official Deriv platforms & third-party platforms via Deriv API

- CPA: Not applicable

6. Trading Instruments

- Revenue Share: Digital Options, Accumulator Options, Vanilla Options, Turbo Options, Multipliers on Derived Indices

- Turnover: Digital Options, Accumulator Options, Vanilla Options, Turbo Options, Multipliers

- CPA: Not applicable

How do I start earning commissions from Options trades?

To start earning commissions from Options trades, you need to:

- Sign up for a Partner’s Hub account to become a Deriv partner.

- Go to Open dashboard > My Referral Links.

- Choose your preferred Options commission plan. Each plan comes with a unique referral link:

- Turnover (applies to both Options and CFDs trading)

- Revenue Share (applies to Options trading only)

- Click the hamburger icon next to your chosen plan.

- Select Copy Link to share it with your clients.

Learn more about how to start earning commissions from CFDs trading.

What are the benefits of promoting Options trading?

As a Deriv partner promoting Options trading, you’ll enjoy the following benefits:

- Up to 45% commission (from Revenue Share or Turnover plan)

- Multilingual support to reach clients in different regions

- Detailed earnings reports to track your performance

- A dedicated Account Manager to guide your growth

- 24/7 live chat support for you and your clients

What type of commission plans do you offer for partners promoting Options?

We have these commission plans for partners promoting Options:

- Revenue Share: Earn commissions up to 45% based on the monthly net revenue generated by your clients.

- Turnover: Earn up to 1.5% on Digital Options stakes and up to 40% of Deriv’s commission from contracts such as Multipliers, Accumulators, and others.

For partners promoting CFDs, refer to this question on CFD calculations.

Which platforms can partners earn commissions from Options trading?

Partners will earn commission from clients who trade Options on:

- Deriv platforms: Deriv Trader, SmartTrader, Deriv Bot, Deriv Nakala, and Deriv GO.

- Third-party platforms: Only via Deriv API.

For Affiliates with clients who trade CFDs, refer to Which trading platforms are part of the Deriv IB programme?

How does the Revenue Share plan work for Deriv partners?

Deriv’s Revenue Share plan allows partners to earn commissions based on the monthly net revenue generated by their clients' Options trades. The commission rate varies depending on the amount of net revenue generated.

Please note that partners residing in the EU can sign up for the Revenue Share plan but can only refer clients residing outside the EU.

What are the commission rates for the Revenue Share plan?

For monthly net revenue of Options trades:

- USD 20,000 or less: 30% commission

- Exceeding USD 20,000: 45% commission

For example:

If a client generates USD 10,000 in monthly net revenue:

- Commission: USD 10,000 x 30% = USD 3,000

If a client generates USD 25,000 in monthly net revenue:

- Commission for first USD 20,000: USD 20,000 x 30% = USD 6,000

- Commission for remaining USD 5,000: USD 5,000 x 45% = USD 2,250

- Total commission: USD 6,000 + USD 2,250 = USD 8,250

Are there any products excluded from Options trade commissions?

Only Multiplier Financials are excluded from Affiliate commission generation.

What is the Turnover plan commission structure?

Digital Options: Based on the payout probability of the client's contracts. For more detailed calculations, refer to the commission structure of Digital Options.

Multipliers: 40% of commissions Deriv receives

Accumulator Options: 40% of commissions Deriv receives

Turbo Options: 40% of commissions Deriv receives

Vanilla Options: 40% of commissions Deriv receives

Lookbacks (only on SmartTrader): 0.8% of the trade stake

Note: EU-based partners can sign up for the Turnover plan but can only refer clients who reside outside the EU.

How does the commission structure work for Digital Options?

For Digital Options, the commission is based on the payout probability of the client’s contracts.

How are commissions calculated for Digital Options?

Commission = Stake amount x Turnover commission (%)

If a client trades Digital Options with a stake of USD 10 and receives a payout of USD 15:

- Payout probability

Based on the probability chart, this falls under the 0.5% commission rate

- Commission calculation

Total commission earned: USD 0.05

How are commissions calculated for Multipliers?

Commission = Client fee x 40%

Client trades multipliers with a stake of USD137 with a multiplier of 100. The client ischarged USD 5 for this trade (client fee).

Total commission earned: USD 2

How are commission calculated for Vanillas, Turbos, or Accumulators?

Commission = Client fee x 40%

How are commissions calculated for Lookbacks?

Commission = Stake amount x 0.8%

If a client trades Lookbacks with a stake of USD 10:

Total commission earned: USD 0.08

What is the CPA plan?

The CPA plan is for Affiliates who target clients in the EU. You earn USD 100 when a newly referred client with an EU account deposits a total of USD 100 (or its equivalent) into their Deriv account, either in a single deposit or cumulatively.

Note the following restrictions:

- It is limited to affiliates promoting to clients with a DIEL account.

- Due to regulatory restrictions, you cannot have clients residing in Portugal or Spain.

Who is eligible for the CPA plan?

The CPA plan is available to affiliates with accounts registered under Deriv Investments (Europe) Limited (DIEL).

To check your eligibility, contact us via live chat.

How does the CPA plan work?

Example 1

If a referred client with a DIEL account deposits USD 100 in one transaction:

Total commission earned = USD 100

Example 2

If a referred client with a DIEL account based in the EU deposits USD 50 in their first transaction:

Commission earned = USD 0

When the same client deposits USD 50 in a second transaction:

Total commission earned = USD 100

Example 3

If a referred client with a DIEL account deposits USD 200 in one transaction:

Total commission earned = USD 100

Is the CPA payment recurring?

No, CPA is a one-time payment per client.

How do the different Deriv affiliate plans compare?

1. Commissions

- Revenue Share: From clients' revenue

- Turnover: From clients' trades on Digital Options (based on contract's payout probability) and Options (based on trade commission, up to 40%)

- CPA: From clients' deposits

2. How to Register

- Revenue Share: On the Deriv website

- Turnover: On the Deriv website

- CPA: On the Deriv website

3. Eligible Clients

- Revenue Share: Non-EU clients

- Turnover: Non-EU clients

- CPA: Clients with a EU account

4. IB

- Revenue Share: Yes

- Turnover: Yes

- CPA: No

5. Platforms

- Revenue Share: All official Deriv platforms & third-party platforms via Deriv API

- Turnover: All official Deriv platforms & third-party platforms via Deriv API

- CPA: Not applicable

6. Trading Instruments

- Revenue Share: Digital Options, Accumulator Options, Vanilla Options, Turbo Options, Multipliers on Derived Indices

- Turnover: Digital Options, Accumulator Options, Vanilla Options, Turbo Options, Multipliers

- CPA: Not applicable

Still need help?

Our Customer Support team is available 24/7. Please choose your preferred contact method.