The United States’ economic growth entered positive territory after an initial estimate of its third-quarter Gross Domestic Product revealed a strong rebound, reversing the decrease from the year’s first half.

Forex

Source: Bloomberg. Click to see full size.

The EUR/USD pair went up for the second week in a row after the European Central Bank (ECB) raised interest rates by 75 bps.

Meanwhile, the United States released its preliminary estimate of Gross Domestic Product (GDP) for Q3, which showed that the economy increased at a pace of 2.6%, higher than the projected 2.4%. Following the development on the GDP front, the US dollar came under mild selling pressure, while bond yields plummeted from multi-year highs, pressuring it further.

On the other hand, GBP/USD extended its winning streak for a third consecutive week under the new British Prime Minister Rishi Sunak. The extended upswing could also be attributed to optimism about the new UK government and its new fiscal policy.

The USD/JPY continued to stay down for the week as the Bank of Japan defied other major central banks by maintaining ultra-low interest rates.

A rate hike decision by the Federal Reserve (Fed) and the Bank of England (BoE) is awaited this week, while the US non-farm payrolls (NFP) will also be closely watched.

Level up your trading strategy with the latest market news and trade CFDs on your Deriv X account.

Commodities

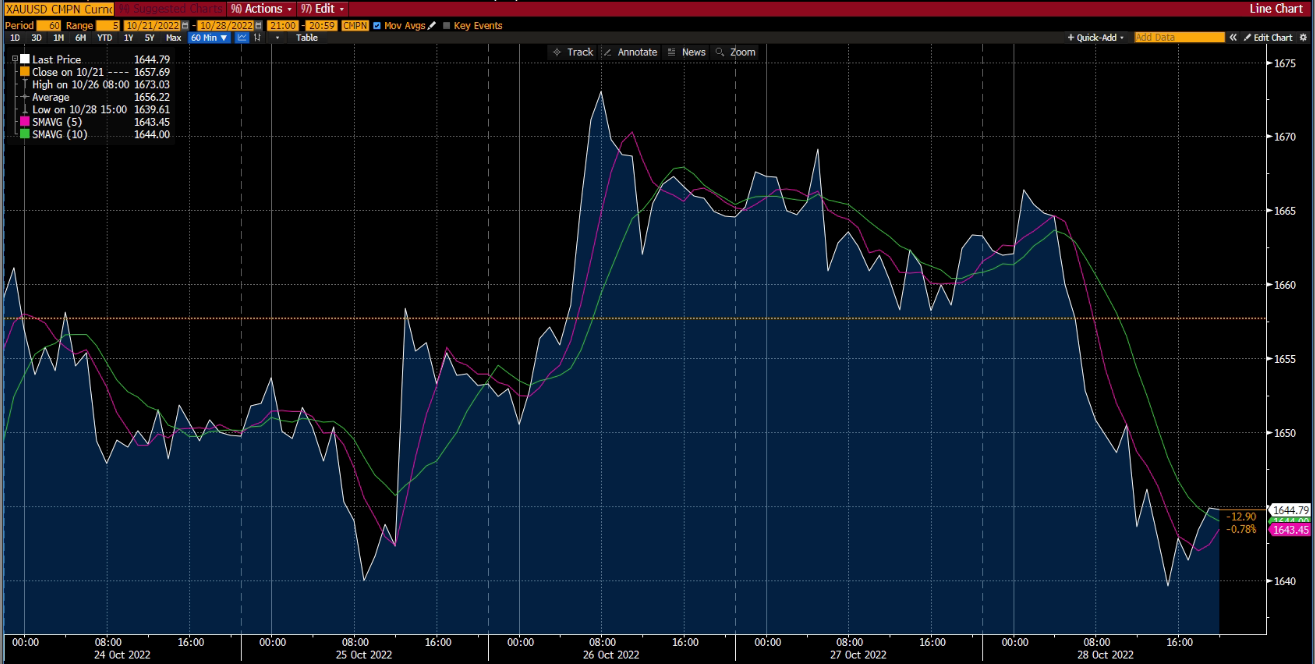

Source: Bloomberg. Click to see full size.

Gold prices fell last week despite a weaker US currency and lower US Treasury rates.

The precious metal reached a fresh multi-week high of $1,675 in the first half of the week as broad-based selling pressure surrounded the US dollar. However, XAU/USD reversed its direction after upbeat macroeconomic data from the US helped the greenback regain strength, ending the week in negative territory – below $1,650.

The decline was also impacted by expectations surrounding this week’s interest rate hike by the Federal Reserve.

Meanwhile, oil prices rose for the week, propelled higher by evidence of constrained crude supply and product markets, and prospects for a recovery in Chinese oil demand.

Oil prices ended the month higher after declining for 4 months. The Organization of Petroleum Exporting Countries (OPEC+) and its allies decided to cut oil production in November, and the European Union is threatening sanctions against Russia. This has resulted in a tighter oil supply.

Cryptocurrencies

Source: Bloomberg. Click to see full size.

Last week, cryptocurrencies traded in the green as market capitalisation breached $1 trillion for the first time in weeks.

In the first half of the week, Bitcoin rallied from the $19,200 level to the $20,900 level, contributing significantly to the market’s surge. At the end of the week, Bitcoin was trading at $20,692.84.

Ethereum followed Bitcoin’s footsteps as the popular crypto coin climbed above the $1,500 level and held up until the end of the week.

However, Dogecoin stole the limelight last week because long-time DOGE fan Elon Musk completed the acquisition of Twitter. There was a wave of positive sentiment around the meme-coin as many believe that there is a possibility of DOGE merging with this social media platform. During the week, it increased by 150%, from $0.0594 to $0.15.

This rise has caused Dogecoin to replace Cardano as the sixth-largest cryptocurrency in the world.

Take advantage of market opportunities by sharpening your trading strategy and trading the financial markets with options and multipliers on DTrader.

US stock markets

|

Name of the index |

Friday’s close |

*Net change |

*Net change (%) |

|

Dow Jones Industrial Avg (Wall Street 30) |

32,861.80 |

1,779.24 |

5.72% |

|

Nasdaq (US Tech 100) |

11,546.21 |

235.88 |

2.09% |

|

S&P 500 (US 500) |

3,901.06 |

148.31 |

3.95% |

Source: Bloomberg

*Net change and net change (%) are based on the weekly closing price change from Friday to Friday.

Dow Jones rose by more than 5% at the end of the week, making it the Dow’s most significant monthly rise since May 2022. Unfortunately, Nasdaq and S&P 500 could not maintain their uptrend momentum from the previous week.

The stock market value of Amazon plummeted by nearly $140 billion after Amazon forecasted a slowdown in holiday sales. On the other hand, Apple surged by 7.6% as the technological juggernaut exceeded top and bottom line projections in its most recent earnings report.

Following the high-profile $44 billion Twitter Inc. takeover, Elon Musk removed its Chief Executive, Chief Financial Officer, Policy Chief, and legal affairs as one of his first steps, and the shares were taken off the New York Stock Exchange.

This week’s focus will be on the US Federal Reserve (Fed) rate as financial markets anticipate a rise in interest rates by 75bps, as well as the non-farm payroll data release to determine whether the Fed will raise interest rates in the coming months.

Now that you’re up-to-date on how the financial markets performed last week, you can improve your strategy and trade CFDs on Deriv MT5.

Disclaimer:

Options trading and the Deriv X platform are unavailable for clients residing in the EU.