As financial markets embraced an improved global risk sentiment, several assets saw gains. However, traders are waiting for the Gross Domestic Product (GDP) results scheduled to be released this week, and the real question is – will markets be able to hold on to their gains if recession sets in?

Forex

Source: Bloomberg. Click to see full size.

EUR/USD ended the week at around $1.0213 while recovering from its multi-year low of $0.9951 in mid-July. The pair rose mainly due to Wall Street having an excellent week and falling US government bond yields weighing on the greenback.

Meanwhile, the Federal Reserve’s ‘blackout’ period allowed GBP/USD to recover after falling to $1.1760 – its lowest level since March 2020. Reduced bets on a 100bps rate hike combined with less hawkish commentary by Fed policymakers led to a broad correction in the US dollar. Also, the rising chances of the Bank of England raising rates by 50bps in August provided an ideal environment for GBP/USD to recover. However, the chart above shows that uncertainty about UK politics limited the currency pair’s rebound, causing the pair to end its week at around $1.200.

This week is dominated by risks associated with events happening in the US, the most important of which is the Fed policy decision. Furthermore, the UK calendar doesn’t include any high-level macro news. As a result, political events in the United Kingdom will continue to be important for GBP traders.

Level up your trading strategy with the latest market news and trade CFDs on your Deriv X Financial account.

Commodities

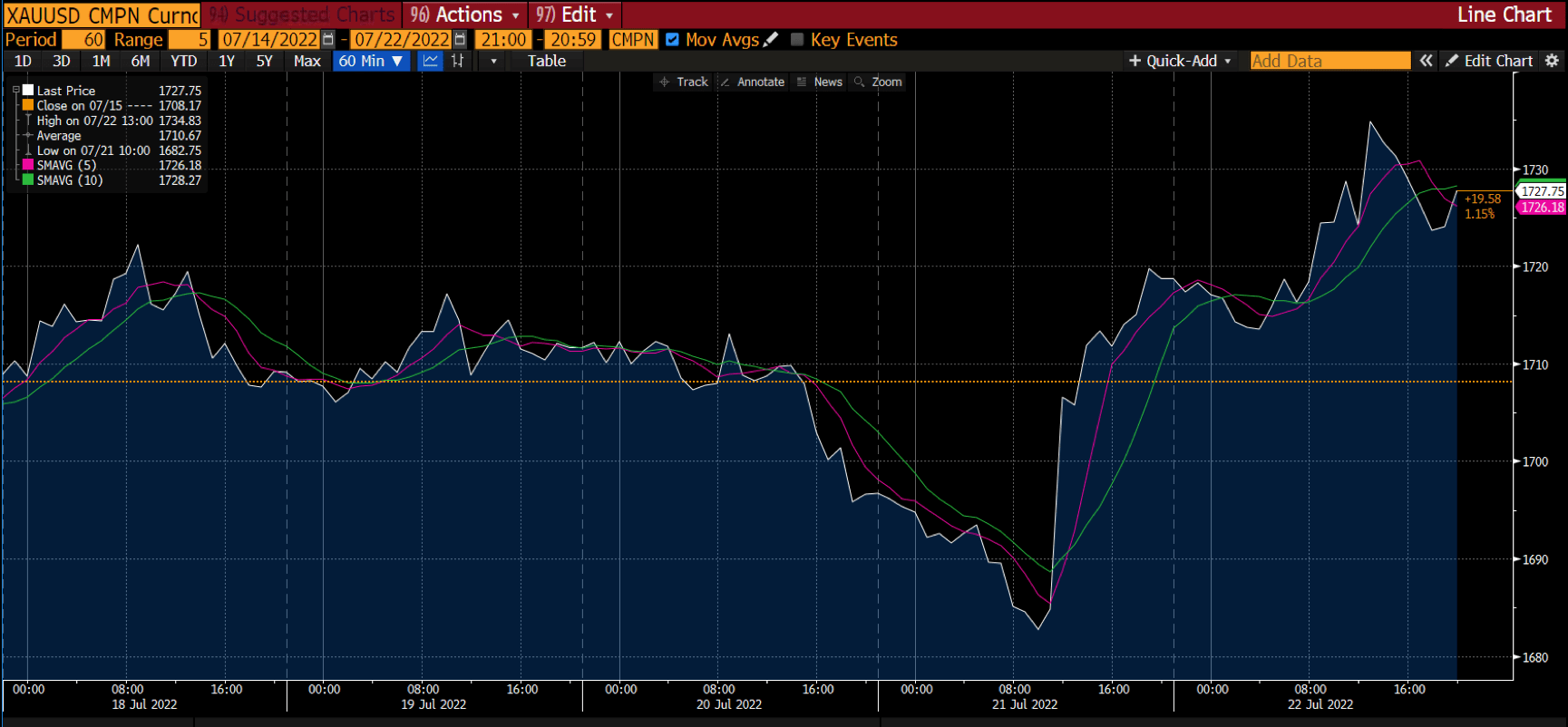

Source: Bloomberg. Click to see full size.

Gold had an excellent start to the week and recovered from its 11-month low of $1,698 before the European Central Bank increased interest rates for the first time since 2011. This dragged the metal back to below the $1,690 mark on Thursday, 21 July 2022.

Furthermore, the minutes of the Reserve Bank of Australia policy meeting, released on Tuesday, 19 July 2022, also indicated that future interest rate hikes would be necessary to bring inflation back to the target level. As a result, gold prices were further impacted.

At Friday’s close, the precious metal was trading at the $1,727.75 mark, nearly bisecting its SMA 5 and SMA 10, which were at $1,726.18 and $1,728.17, respectively.

On the other hand, the resumption of Russian gas supply via the Nord Stream 1 pipeline is improving market confidence and easing concerns about a potential recession. This improvement has caused oil prices to drop heavily despite the risk-on mood amid fears of more output and less demand.

In addition, China has issued lockdowns due to its increased Covid-19 cases. Therefore, restrictions on the movement of men and materials as well as layoffs in manufacturing activities may lead to a serious decline in aggregate demand. This would significantly impact oil prices.

Cryptocurrencies

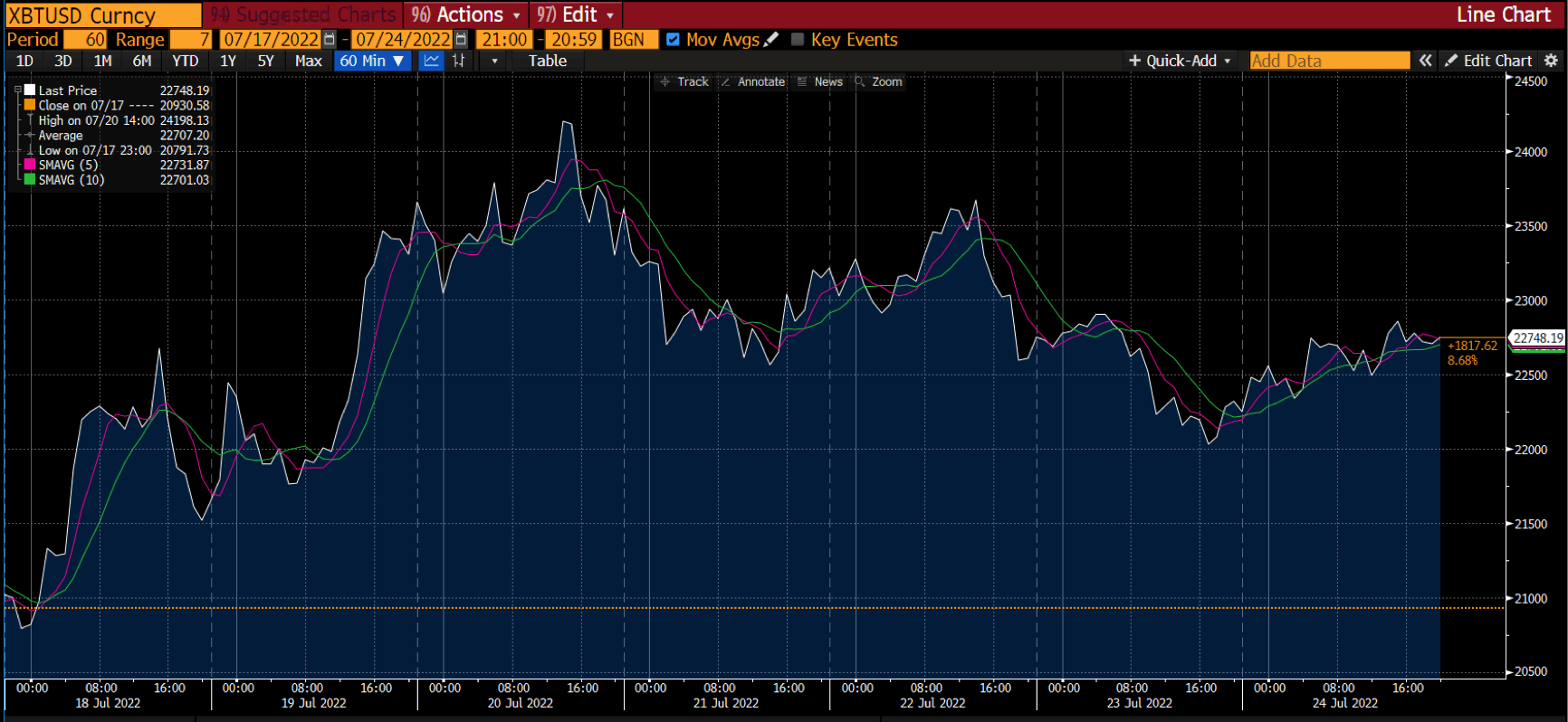

Source: Bloomberg. Click to see full size.

Although the crypto winter is far from over, the cryptocurrency market felt some warmth last week, with none of the leading crypto coins suffering significant losses. In fact, Bitcoin climbed to the $24,000 level on Wednesday, 20 July 2022, its highest since mid-June.

However, the bears returned, causing Bitcoin to return to the sub-$23,000 range towards the end of the week. At the time of writing, its price is at the $22,748.19 mark, marginally leading its SMA 5 and SMA 10 at $22,731.87 and $22,701.03, respectively.

Ethereum outperformed Bitcoin in terms of market growth and grazed the $1,600 level before returning to the mid-$1,500 level towards the end of last week. The growth can be attributed to the announcement of Ethereum Merge, the network upgrade, which seemed to have caused the rally.

Meanwhile, other cryptocurrencies such as Avalanche, Solana and Doge saw 23%, 9%, and 6% growth during the last week.

Latin American countries of Paraguay and Colombia have joined the crypto bandwagon, making announcements and releasing statements that indicate cryptocurrency regulation.

In other crypto-related news, electric car manufacturer Tesla sold 75% of its Bitcoin holdings last week, valued at nearly $936 million.

Maximise market opportunities by sharpening your trading strategy and trading the financial markets with options and multipliers on DTrader.

US stock markets

|

Name of the index |

Friday’s close |

*Net change |

*Net change (%) |

|

Dow Jones Industrial Avg (Wall Street 30) |

31,899.29 |

611.03 |

1.95% |

|

Nasdaq (US Tech 100) |

12,396.47 |

412.85 |

3.45% |

|

S&P 500 (US 500) |

3,961.63 |

98.47 |

2.55% |

Source: Bloomberg

*Net change and net change (%) are based on the weekly closing price change from Friday to Friday.

The 3 major averages posted substantial gains this week as US equity markets rebounded due to better-than-expected corporate earnings. The Dow saw a 1.95% rise, the S&P 500 experienced a 2.55% gain, and the Nasdaq climbed by 3.45%.

According to several second-quarter earnings reports, corporate profits and outlooks showed some resilience despite a slowing economy. About 21% of S&P 500 companies have reported earnings so far. Of those, nearly 70% have beaten the expectations of analysts.

This week will be highly eventful for the financial markets, with many significant companies like Microsoft, Google, Facebook, Apple, and Amazon reporting their earnings. The Federal Open Market Committee (FOMC) statement and Federal Funds Rate are scheduled to be released on Tuesday, 26 July 2022. At the same time, the nation’s central bank is expected to hike its benchmark federal funds rate by 75 basis points. Furthermore, GDP results for the quarter will be released on Wednesday, 27 July 2022, which will attract a lot of attention.

In theory, a recession is identified when the GDP of an economy falls for 2 successive quarters. It will be interesting to see how the Fed works its way out if the results are unfavourable. We are in for a volatile week.

Now that you’re up-to-date on how the financial markets performed last week, you can improve your strategy and trade CFDs on Deriv MT5 Financial and Financial STP accounts.

Disclaimer:

Options trading, Deriv X platform, and STP Financial accounts on the MT5 platform are not available for clients residing in the EU.