Even though volatility remains elevated, the financial markets’ performance in the last week offered a glimmer of hope.

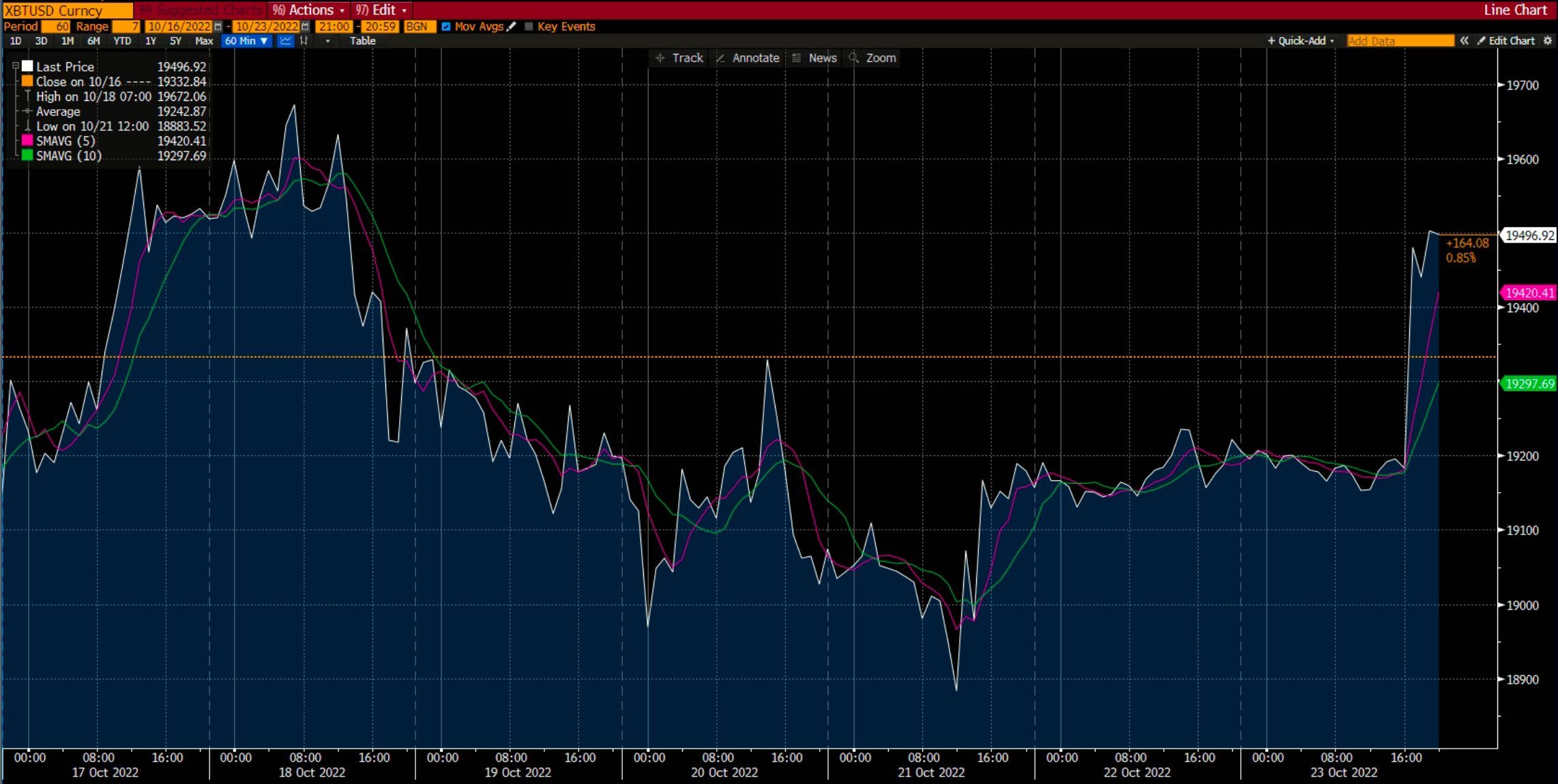

Forex

Source: Bloomberg. Click to see full size.

For the week, the GBP/USD defended its weekly gains despite the UK political debacle.

There was some calm among GBP buyers following Liz Truss’s resignation, who resigned after a turbulent and unprecedented tenure in which her economic policies roiled financial markets. However, the calmness didn’t last long because of the political uncertainty that surfaced immediately after Truss’s resignation. Although the pair rose for the week, its upside was capped by this factor and by surging US Treasury yields.

Additionally, the euro gained 1.4% against the US dollar over 5 days since late May. Federal Reserve members spoke less hawkishly on Friday, 21 October 2022, which may have contributed to the improvement in EUR/USD.

Lastly, USD/JPY surpassed the ¥150 mark for the first time since 1990. However, it did not last long as it fell back to around the ¥146 mark. The sharp drop was a clear signal to traders that the Ministry of Finance intervened to buy the Japanese yen to prevent further currency depreciation.

Level up your trading strategy with the latest market news and trade CFDs on your Deriv X account.

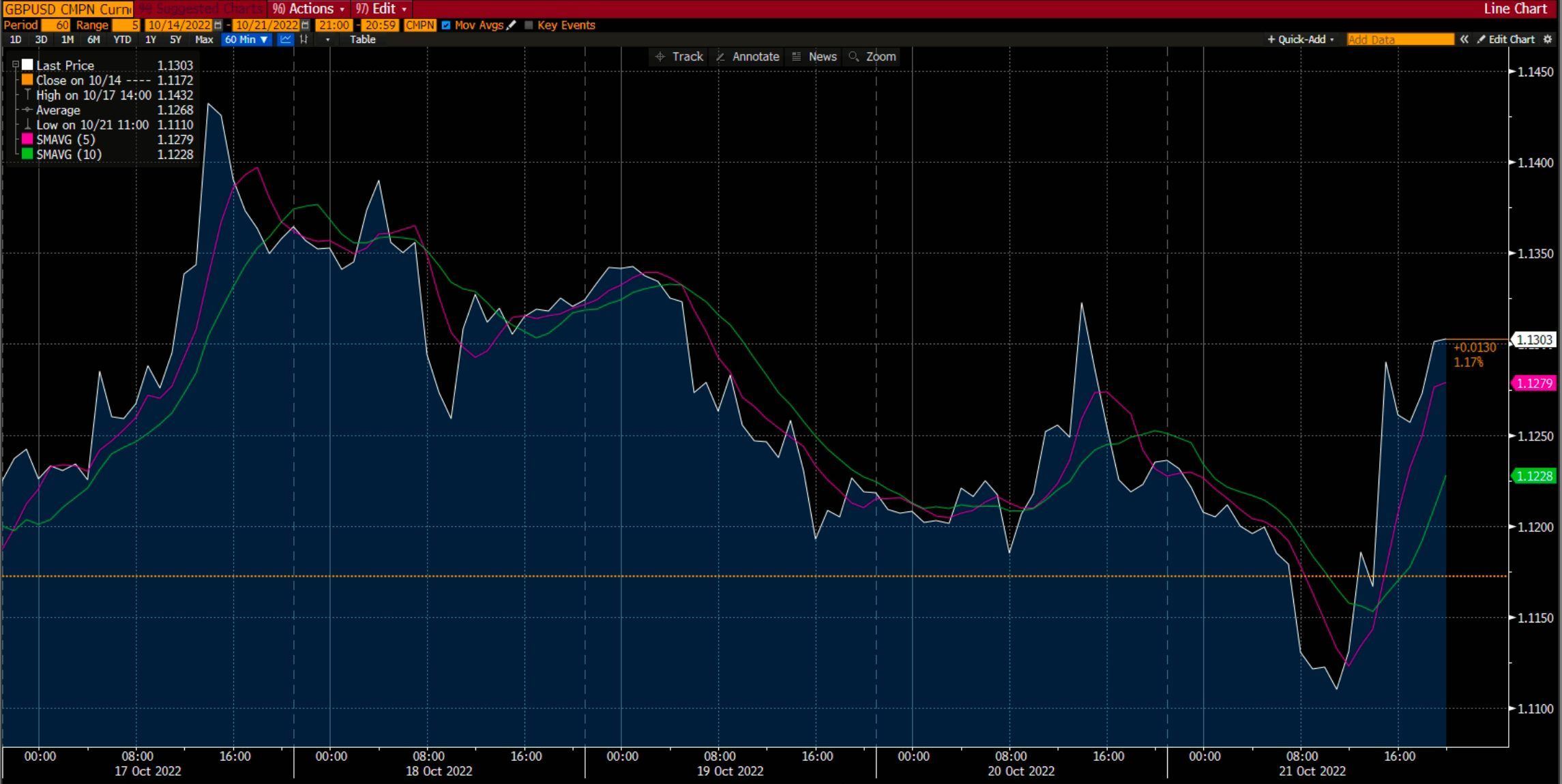

Commodities

Source: Bloomberg. Click to see full size.

There was a good chance that gold would lose for the second week in a row. However, on Friday, 21 October 2022, it bounced back based on speculation about possible Fed actions. It was pretty much a flat week for gold, with the yellow metal seeing a rise of around 0.5% for the week.

Meanwhile, silver rose quite significantly and finally breached the $18 mark, trading close to $19.40.

After a volatile week, oil prices rose following concerns over a global slowdown. Despite slowdown concerns and aggressive measures taken by central banks to tame inflation, oil has lost a third of its value since early June. As the Organization of Petroleum Exporting Countries (OPEC+) cuts output and the European Union implements sanctions on Russian flows, the market will likely face a supply uncertainty period in the next few months.

Furthermore, Xi Jinping announced on Sunday, 23 October 2022, that China would maintain its Covid Zero policy, which entails mass vaccinations and lockdowns. So now, the future of Chinese oil demand is uncertain.

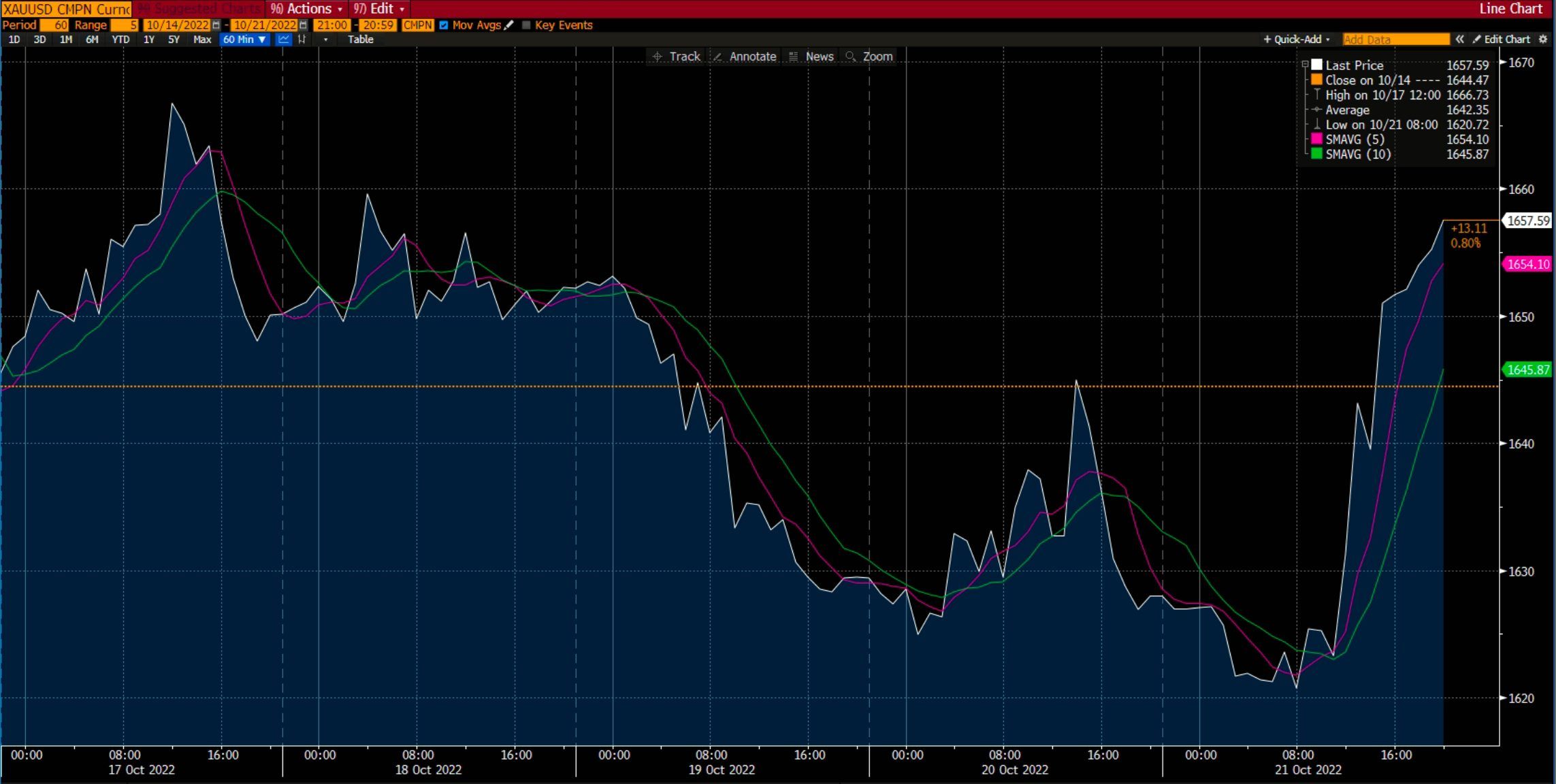

Cryptocurrencies

Source: Bloomberg. Click to see full size.

Cryptocurrency values remained relatively unchanged as the market experienced another flat week. The total crypto market capitalisation is hovering around the $920 billion mark.

Bitcoin, the world’s largest cryptocurrency by market capitalisation, is currently trading at around $19,500.

In the meantime, Ethereum recovered from the previous week’s losses to trade at $1,330 once again. However, on Thursday, 20 October 2022, its value fell to $1,282.14.

Popular blockchain oracle network, Chainlink, announced that its services were adopted by major blockchains such as Ethereum, Polygon, Avalanche, and BNB Chain. Despite traders’ accumulation of LINK (Chainlink’s native cryptocurrency), its price has been relatively stable over the past month.

In other news, BNY Mellon, America’s oldest bank and the world’s largest custodian bank, launched a cryptocurrency custody service in response to increased customer demand. The digital service allows clients, traditional funds’ managers, and institutional investors to hold Ether and Bitcoin with the same security offered on standard assets.

Take advantage of market opportunities by sharpening your trading strategy and trading the financial markets with options and multipliers on DTrader.

US stock markets

|

Name of the index |

Friday’s close |

*Net change |

*Net change (%) |

|

Dow Jones Industrial Avg (Wall Street 30) |

31,082.56 |

1,447.73 |

4.89% |

|

Nasdaq (US Tech 100) |

11,310.33 |

618.27 |

5.78% |

|

S&P 500 (US 500) |

3,752.75 |

169.68 |

4.74% |

Source: Bloomberg

*Net change and net change (%) are based on the weekly closing price change from Friday to Friday.

As the week ended, the indices increased by more than 4%, their largest Friday-to-Friday percentage increase since June.

During the recent earnings season, traders scrutinised the newest financial statements from corporations, looking for indications of stress from high inflation, rising borrowing prices, and adverse economic conditions.

Meanwhile, advertisers continued to reduce marketing spending due to macroeconomic difficulties. Shares of Facebook-owned Meta and Twitter fell by 1.2% and 4.9%, respectively.

Housing data also showed significant deterioration. The impact of increasing interest rates has been most sharply felt in interest-rate-sensitive sectors of the economy, with housing being perhaps the most affected.

Traders were heartened on Friday, 21 October 2022, by rumours that the Federal Reserve was starting to moderate interest rate hikes. Following a volatile week of trading, stocks concluded the week on a bullish note.

Now that you’re up-to-date on how the financial markets performed last week, you can improve your strategy and trade CFDs on Deriv MT5.

Disclaimer:

Options trading and the Deriv X platform are unavailable for clients residing in the EU.