Markets in the United States were down for the week, unable to maintain the upward momentum that followed last week’s favourable Consumer Price Index (CPI) data. Meanwhile, hawkish remarks by US Federal Reserve officials over the last few days have prolonged the economic uncertainty.

Forex

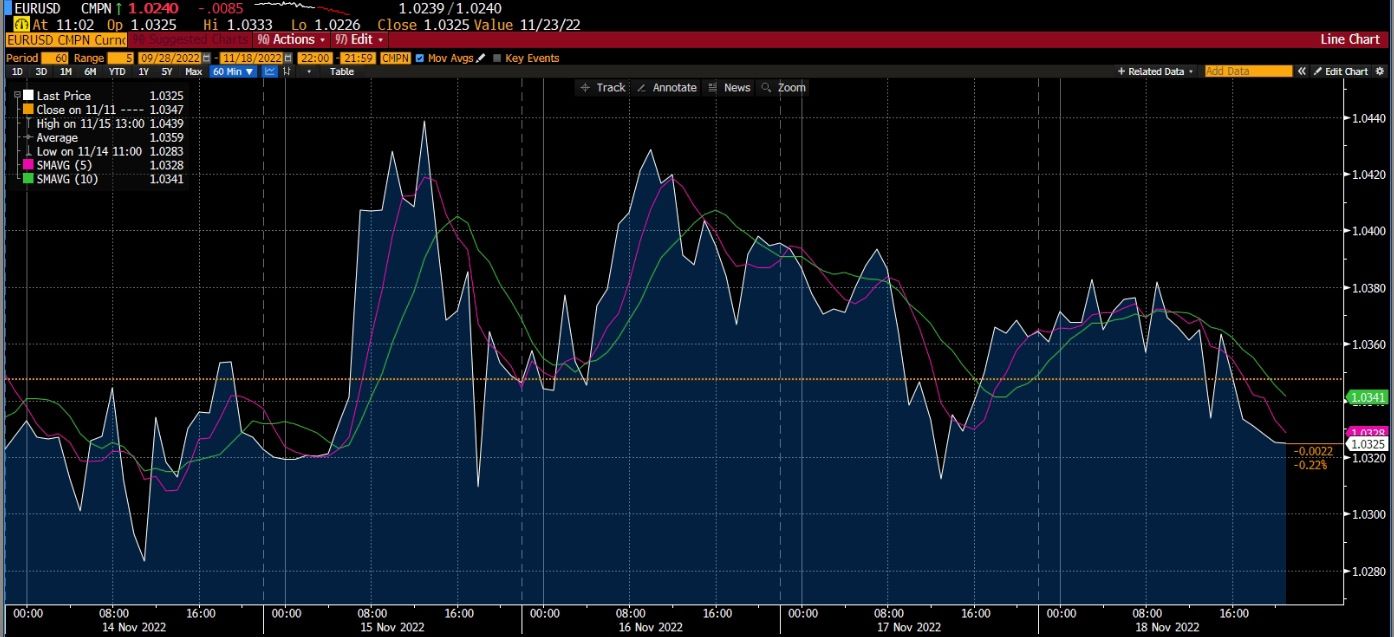

Source: Bloomberg. Click to see full size.

Last week, EUR/USD fell back after showing signs of gaining traction as indicators of global inflationary pressures continued strong. Growing tensions between Russia and the West, and worries of fresh supply-chain difficulties — which appeared to be resolved over the course of the week — also contributed to the fall of the currency pair.

Central banks are dropping signals ahead of their monetary policy meetings in mid-December. The European Central Bank (ECB) President Christine Lagarde stated that it will continue to raise rates, adding that it may need to restrict economic activity to tame inflation. Meanwhile, the US Federal Reserve took an aggressive stance much earlier than the ECB and is moving closer to restrictive rates, which are expected to bring inflation even lower.

On the other hand, despite a lack of bullish impetus from the much-anticipated autumn budget of the United Kingdom, GBP/USD buyers remained unstoppable for the second week in a row, helping the pair maintain its upward momentum.

Thanksgiving and Black Friday will make it a holiday-shortened week, which shall include the S&P Global providing preliminary November Purchasing Managers’ Index (PMI) estimates for the European Union, the United Kingdom, and the United States. The Federal Open Market Committee (FOMC) meeting minutes will also be published this week.

Level up your trading strategy with the latest market news and trade CFDs on your Deriv X account.

Commodities

Source: Bloomberg. Click to see full size.

Gold began the new week under moderate negative pressure, but it was able to recoup traction before staging a downward correction near the end of the week. For the week, spot silver prices shed roughly 3.7%.

The minutes of the Federal Reserve’s October policy meeting, which is scheduled for November 23, as well as Purchasing Managers’ Index (PMI) surveys might have an impact on the US dollar’s (USD) valuation and movement this week.

According to the Federal Reserve’s latest policy statement, policymakers will make decisions regarding rate hikes based on “cumulative tightening, policy lags, and economic and financial developments”. While his comment led some to expect a less aggressive Fed policy tightening moving forward, FOMC Chairman Jerome Powell pointed out that the central bank is focused on achieving the terminal rate and he expected it to be revised higher.

During the week, oil prices also dropped as concerns over weakening Chinese fuel demand outweighed worries that tighter EU sanctions on Russian crude exports (happening next month) could result in lower supply.

Cryptocurrencies

Source: Bloomberg. Click to see full size.

Cryptocurrencies have taken a massive hit following the catastrophic meltdown at FTX — which was one of the largest crypto exchanges before its unraveling — last week, thereby marking November 2022 as one of the worst months in the cryptocurrency history. The global crypto market cap now stands under USD 800 billion.

After hitting an all-time peak of around USD 69,000 nearly a year ago, Bitcoin, the world’s leading cryptocurrency, is now nearly 75% down from its record high. It was trading at USD 16,252.50 at the time of writing.

Ethereum, on the other hand, is currently trading below USD 1,150, registering a fall of around 8% over the past week.

A majority of cryptocurrency investors appear to have lost faith in exchanges and centralised platforms due to the implosion at FTX. Massive outflows from these platforms show the evident loss of trust, with over USD 3.7 billion worth of Bitcoin being withdrawn from exchanges along with other digital currencies.

In an effort to reduce the negative impact of FTX’s collapse, Binance — the world’s largest cryptocurrency exchange — is setting up a fund to help potentially strong projects experiencing liquidity challenges.

Take advantage of market opportunities by sharpening your trading strategy and trading the financial markets with options and multipliers on DTrader.

US stock markets

|

Name of the index |

Friday’s close | *Net change | *Net change (%) |

| Dow Jones Industrial Avg (Wall Street 30) | 3,965.34 | -27.59 | -0.69% |

| Nasdaq (US Tech 100) | 11,677.02 | -139.99 | -1.18% |

| S&P 500 (US 500) | 33,745.69 | -2.17 | -0.01% |

Source: Bloomberg

*Net change and net change (%) are based on the weekly closing price change from Friday to Friday.

Most of the major indices lost a portion of the strong gains they recorded last week — when they posted their best day since 2020 — and closed modestly lower.

The S&P 500 dropped 0.69% during the course of the week whereas Nasdaq shed 1.18%, owing to the Fed’s statements that indicated further aggressive policy tightening. The Dow Jones Industrial Average remained relatively flat for the week.

This week, the markets will look to rebound from last week’s losses and it could be fueled by the outcome of the Fed’s November policy-setting meeting. Furthermore, a report from the central bank’s meeting earlier this month is set for release on Wednesday. It could give direction to the markets.

Additionally, the third-quarter earnings head into the final stages as the earnings calendar for the coming week looks sparse.

Traders must keep in mind that the holiday season starts this week and US stock markets will be closed Thursday, 24 November 2022, due to the Thanksgiving holiday. Furthermore, trading will end early on 25 November 2022 on account of Black Friday as markets shut at 1pm E.T.

Now that you’re up-to-date on how the financial markets performed last week, you can improve your strategy and trade CFDs on Deriv MT5.

Disclaimer:

Options trading and the Deriv X platform are unavailable for clients residing in the EU.