The holiday-shortened trading week was impacted by the most recent Federal Reserve (Fed) meeting and several economic data, raising concerns among traders about the potential steps to combat inflation.

Forex

Source: Bloomberg. Click to see full size

EUR/USD fell to a 20-year low on Friday, 8 July 2022, before finishing the week at around $1.019. This fall was a result of financial markets being gripped by panic as recession fears persisted and inflationary pressures rose, further intensified by Russia’s energy crisis.

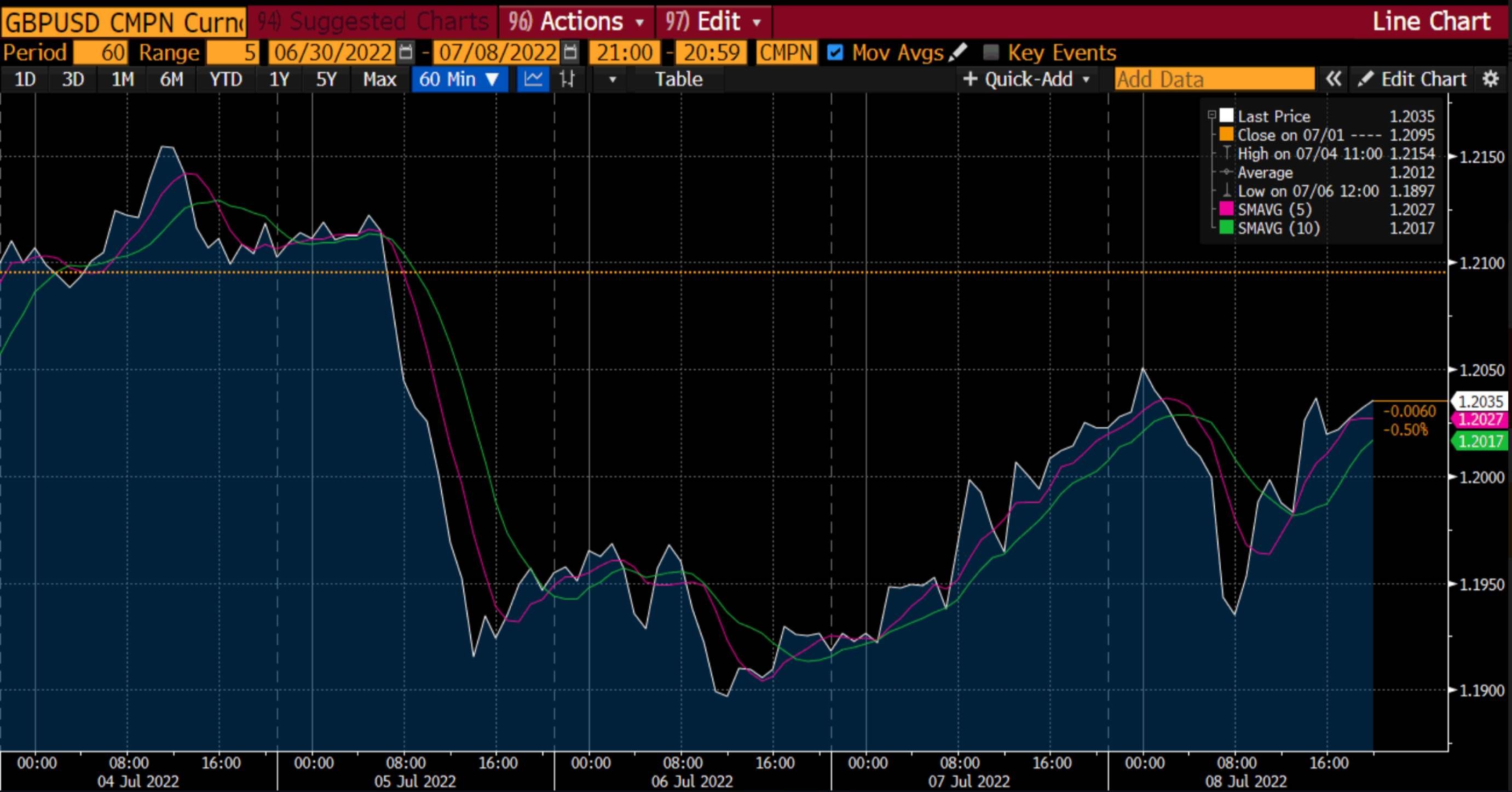

For the second consecutive week, the British pound declined against the US dollar, bringing prices to their lowest since March 2020. Boris Johnson was at the centre of a political storm that contributed to the pair’s weakness, which was also influenced by recession fears and Brexit concerns. The resignation of Mr Johnson on Thursday, 7 July 2022, removed some political uncertainty, allowing prices to recover before the weekend. The chart above shows that the pair was priced just above the 5 and 10 SMA’s, ending its week at around $1.2035.

Although the USD/JPY pair continued to rise, it did not break through its 24-year high of ¥137.00. The US June payrolls eased recession fears, causing the USD/JPY to rise. Furthermore, the inaction of the Bank of Japan (BoJ) towards its ultra-loose monetary policy and Shinzo Abe’s assassination have hindered the yen’s value and weakened the Japanese economy.

This week will be important for currencies since the US and the UK will release June inflation figures and UK GDP data.

Level up your trading strategy with the latest market news and trade CFDs on your Deriv X Financial account.

Commodities

Source: Bloomberg. Click to see full size

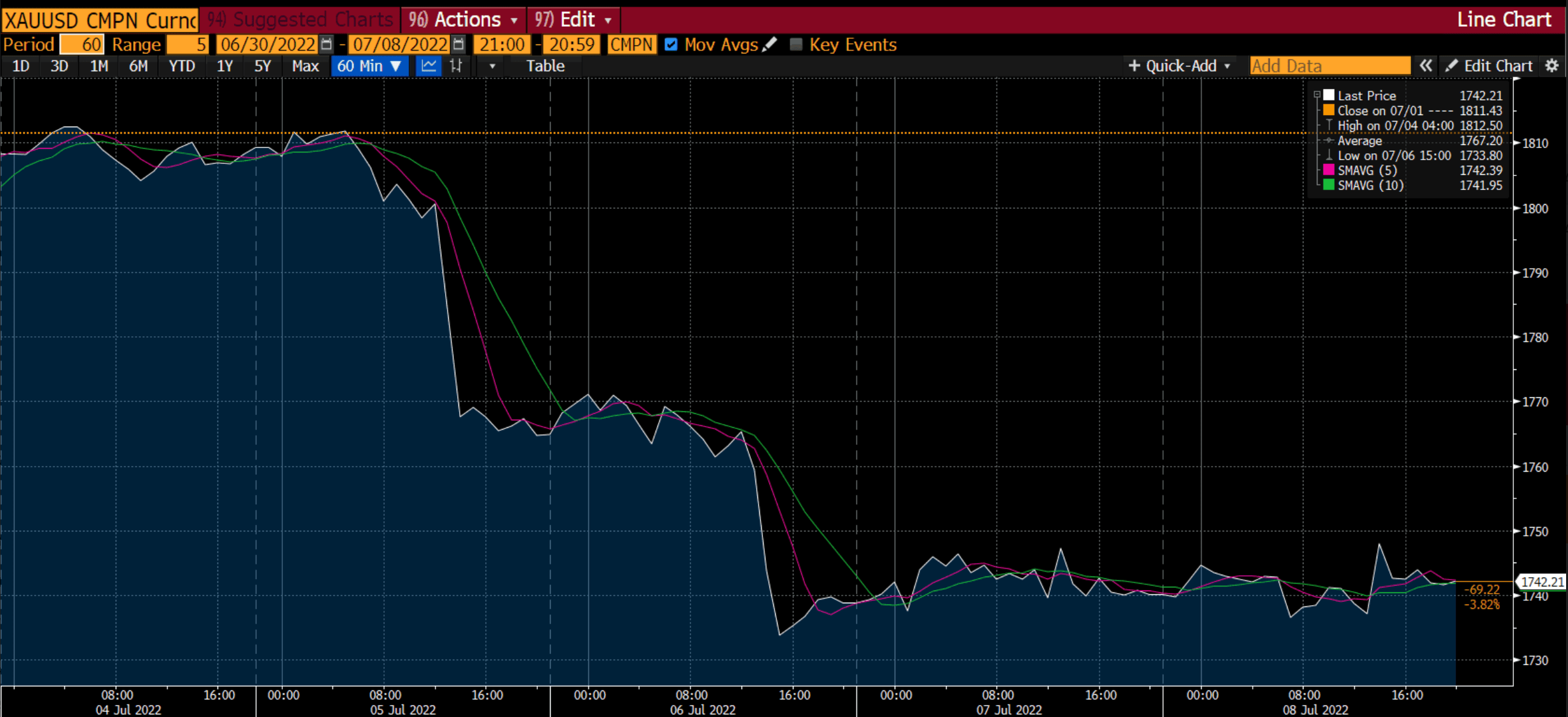

The yellow metal started the week around $1,810 and plunged to the $1,740 level – its lowest since September 2021. Fears of a global recession seemed to have affected traders’ confidence, causing gold prices to fall. Moreover, the Federal Reserve’s constant talk of raising interest rates to curb soaring inflation was a significant deterrent. In fact, Fed Chair Jerome Powell stated that the US central bank remains committed to bringing inflation under control and that the US economy is prepared to withstand tighter policy.

On Friday, 8 July 2022, gold went up by 0.40% due to a weaker US dollar and a mixed sentiment. However, it was down by 3.53% for the week. The chart shows the drastic drop and highlights that gold ended the week between a thin resistance and support level.

Meanwhile, oil prices rose by 2% on Friday, 8 July 2022, as the market remained concerned about whether the jobs sector is strong and the possibility of the Fed raising rates aggressively. However, oil posted a weekly decline of roughly 3.4% in what was a volatile week for commodities in general. Furthermore, worries over a potential recession pulled prices down for the week and led to oil prices touching their 12-week low mid-week.

Cryptocurrencies

Source: Bloomberg. Click to see full size

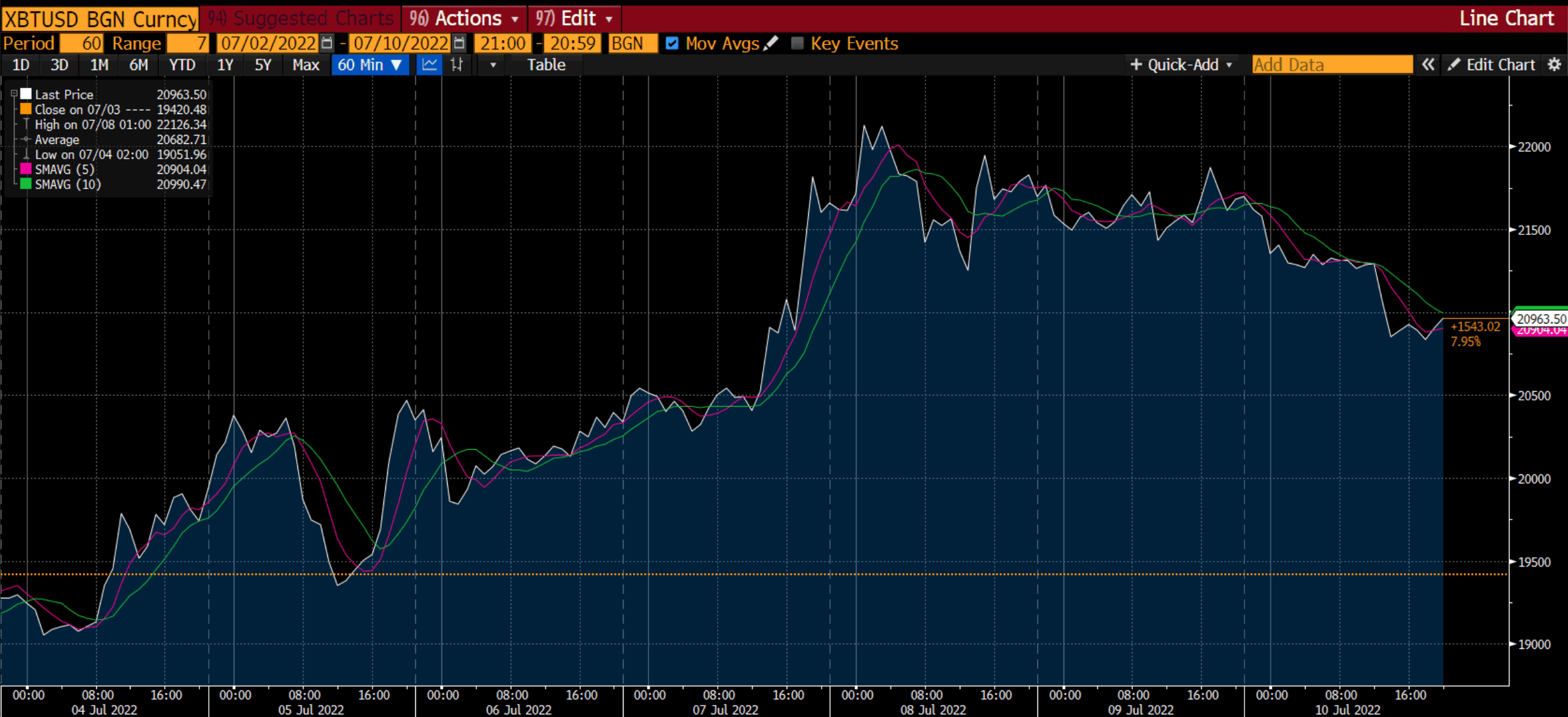

Last week, most of the top cryptocurrencies (by market capitalisation) increased in value, making it a great week for traders.

With both traditional and crypto markets reacting positively to the United States Federal Reserve’s reassurance that recession fears are exaggerated, Bitcoin reclaimed the $22,000 level for the first time since mid-June. As seen in the chart above, the price went above the $22,000 mark on Friday, 8 July 2022 and maintained its upward momentum since the start of the week.

Ethereum, the second-largest cryptocurrency by market cap, also increased by around 9% in the last 7 days. Meanwhile, Polygon surged upwards by 19%, Avalanche climbed by over 10%, and Solana increased by nearly 7% for the week.

Furthermore, Dogecoin (DOGE) rose after Elon Musk’s The Boring Company, a construction and infrastructure company, announced that it would accept DOGE as a payment currency. DOGE has surpassed Polkadot to become the tenth-largest cryptocurrency, with a market cap of around $9.37 billion. Over the last 7 days, the cryptocurrency has gained by approximately 7%.

Maximise market opportunities by sharpening your trading strategy and trading the financial markets with options and multipliers on Deriv Trader.

US Stocks market

|

Name of the index |

Friday’s close |

*Net Change |

*Net Change (%) |

|

Dow Jones Industrial (Wall Street 30) |

31,338.15 |

370.33 |

1.20% |

|

Nasdaq (US Tech 100) |

12,125.69 |

345.79 |

2.94% |

|

S&P 500 (US 500) |

3,899.38 |

67.99 |

1.77% |

Source: Bloomberg

*Net change and net change % are based on the weekly closing price change from Monday to Friday.

All 3 major averages finished the week in green. The stock market recovered much of the previous week’s losses, hoping that the Federal Reserve would control inflation without causing the economy to slump.

Nasdaq rose for 5 consecutive days for the first time this year. Furthermore, last week’s gains lifted the S&P 500 Index out of bear market territory, and it is now down by only 19.1% from its peak in January. Meanwhile, Friday’s payrolls report from the Labor Department revealed that employers added 3,72,000 nonfarm jobs in June, exceeding consensus expectations of around 2,70,000. Although the jobs report was positive for the economy, many traders expect the Federal Reserve to fight inflation with rate hikes in the coming months aggressively.

However, Twitter lost more than 5% on Friday, 8 July 2022, and ranked among the worst performers in the S&P 500 due to reports that Elon Musk might withdraw his takeover offer.

The corporate earnings season will start next week, with JPMorgan Chase, Morgan Stanley, Wells Fargo, and Citigroup set to report their second-quarter earnings. Moreover, June’s Consumer Price Index (CPI) will also be a key focus for traders and will be available this Wednesday, 13 July 2022.

Now that you’re up-to-date on how the financial markets performed last week, you can improve your strategy and trade CFDs on Deriv MT5 Financial and Financial STP accounts.

Disclaimer:

Options trading, Deriv X platform, and STP Financial accounts on the MT5 platform are not available for clients residing in the EU.